China’s silver foxes

China’s incredible economic transformation is epitomised by the rapid growth in its middle class. By 2030, it is estimated that 58% of Chinese households will be considered “mass affluent” or above. That is, households with a disposable monthly income of 18,000 yuan (A$3709) or more. This growing, cashed-up middle class is also ageing. By 2030 there will be about 250 million people over age 651 in China and they will live longer than their parents. The overall life expectancy in China has steadily increased from 43.5 years in 1950 to 77.5 years in 2020. This demographic transition brings its challenges, but also significant opportunities in sectors such as healthcare and consumer goods.

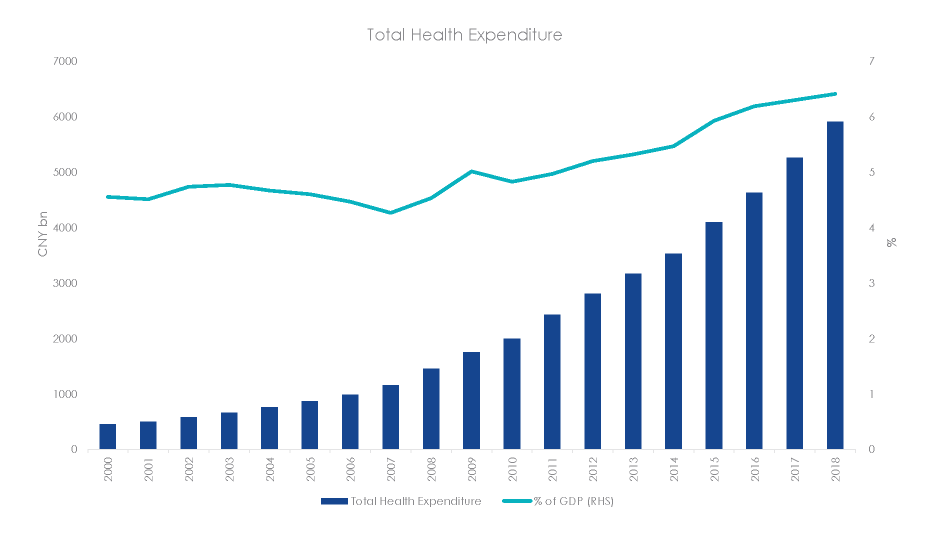

Investments and resources in healthcare and aged care are essential, particularly since the COVID-19 outbreak. The total healthcare expenditure in China grew at a compound annual growth rate of 15.3% p.a in 2010-2018, exceeding the nominal GDP growth of 13.1% p.a. This growth trajectory is likely to increase as people demand better quality healthcare services, have higher disposable income, and consumption patterns change.

Source: Bloomberg and National Bureau of Statistics.

There is also a boom in segments driven by the older generations, including food and clothing, medicines and supplements. Healthcare and consumer staples are two of the four segments that make up China’s “new economy”. The other two segments are technology and consumer discretionary. Chinese silver foxes generally have a greater tendency to save money. With the improved standards of living, they also have the real spending power. According to data from iMedia Research, the market scale of China's silver economy exceeded 3.7 trillion yuan (about A$760 billion) in 2018 and will reach 5.7 trillion yuan by 20212.

Investors wanting access to China’s booming healthcare sector and its “new economy” can do so via an ETF that tracks the CSI MarketGrader China New Economy Index.

1 https://www.mckinsey.com/featured-insights/china/china-and-the-world-inside-the-dynamics-of-a-changing-relationship

2 http://www.xinhuanet.com/english/2019-05/31/c_138106428.htm

Published: 16 July 2020

The PDS details the key risks. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from any Fund.

An investment in the Fund is subject to various risks that may have the effect of reducing the value of the Funds, resulting in a loss of capital invested and a lack of income from the Fund. Chinese securities have heightened risks compared to investing in the Australian market. These risks include currency risks from foreign exchange fluctuations, ASX trading time differences, foreign laws and regulations including taxation, potential difficulties in enforcing contractual obligations, changes in government policy, expropriation, economic conditions including international trade barriers, restrictions on foreign ownership, securities trading restrictions, restrictions on repatriation and restrictions on currency conversion. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the Fund.