Three new ETFs: To hedge or not to hedge international equities?

The choice to hedge your currency exposure in international equities is an important one. Here are three factors to consider in your decision.

In terms of international equity investing, to date, VanEck has only offered an Australian dollar hedged exposure for the VanEck MSCI International Quality ETF (QUAL). The hedged version has the ASX ticker (QHAL).

To provide more flexibility and choice for investors we are listing Australian dollar hedged versions of our popular MSCI International Small Companies Quality (QSML), MSCI International Value (VLUE) and Morningstar Wide Moat (MOAT) ETFs. These ETFs will have the following ASX tickers:

- VanEck MSCI International Small Companies Quality (AUD Hedged) ETF – QHSM

- VanEck MSCI International Value (AUD Hedged) ETF – HVLU

- VanEck Morningstar Wide Moat (AUD Hedged) ETF – MHOT

The decision to hedge your currency exposure is an important one as movements in the Australian dollar can either erode or add value to your investment.

As a baseline, investors that think the Australian dollar is likely to increase should currency hedge and those that are bearish should remain unhedged. To form a decision, investors should consider the following points.

Investment time horizon

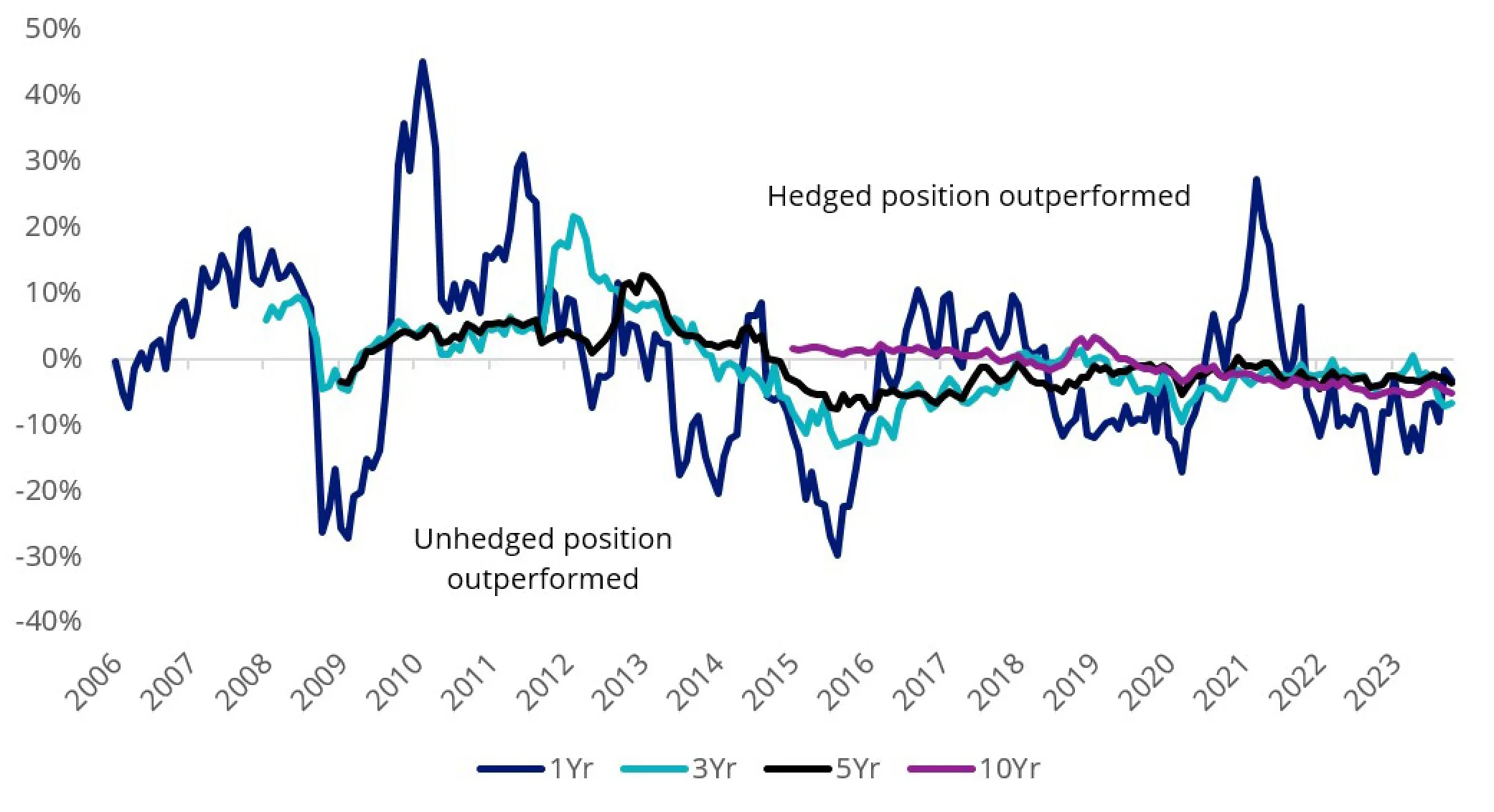

Investment return differences between currency hedged and unhedged equity exposure is more volatile over shorter periods. It may be tempting to try to influence returns by timing the exposure to a currency but there is material downside risk over the short term if the outcome is different to expected. Over the long term, differences between currency hedged and unhedged returns diminish. The graph below illustrates differences between AUD currency hedged and unhedged annualised returns for US exposure represented by S&P 500 over various periods.

Figure 1 – Rolling S&P 500 AUD hedged less unhedged annualised returns

Source: Bloomberg. Past performance is not indicative of future results.

Timing the entry and exit point

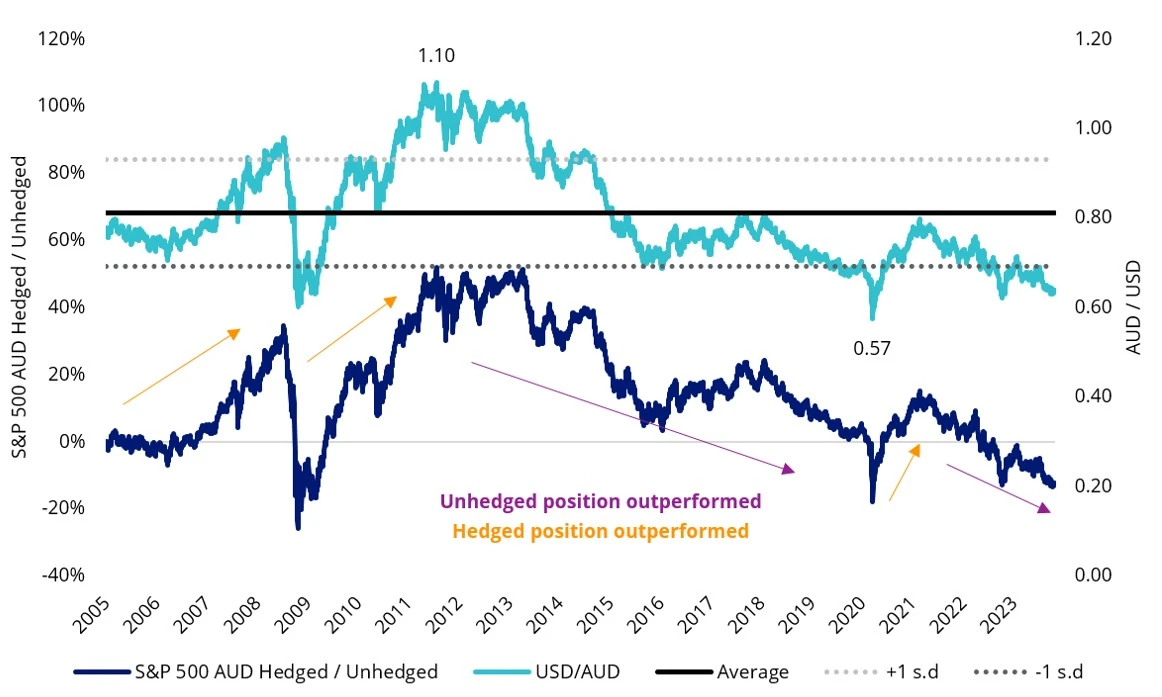

The Australian dollar has fluctuated between 0.57 and 1.10 US dollars over the last 15 years. When deciding whether to currency hedge or not it is important to consider where you think the Australian dollar is valued now relative to your end investment time. If you think the Australian dollar is at the lower bound, you should consider an Australian dollar hedged exposure. Alternatively, if you think the Australian dollar is upper bound, you should consider an unhedged exposure. If you think the Australian dollar will be valued at a similar level to your end investment date, you should be indifferent to taking a hedged or unhedged currency position. Below is an illustration of how AUD/USD currency movements have influenced S&P 500 AUD hedged and unhedged returns.

Figure 2 – S&P 500 AUD hedged versus unhedged cumulative performance and USD/AUD

Source: Bloomberg. Past performance is not indicative of future results.

Diversification benefits

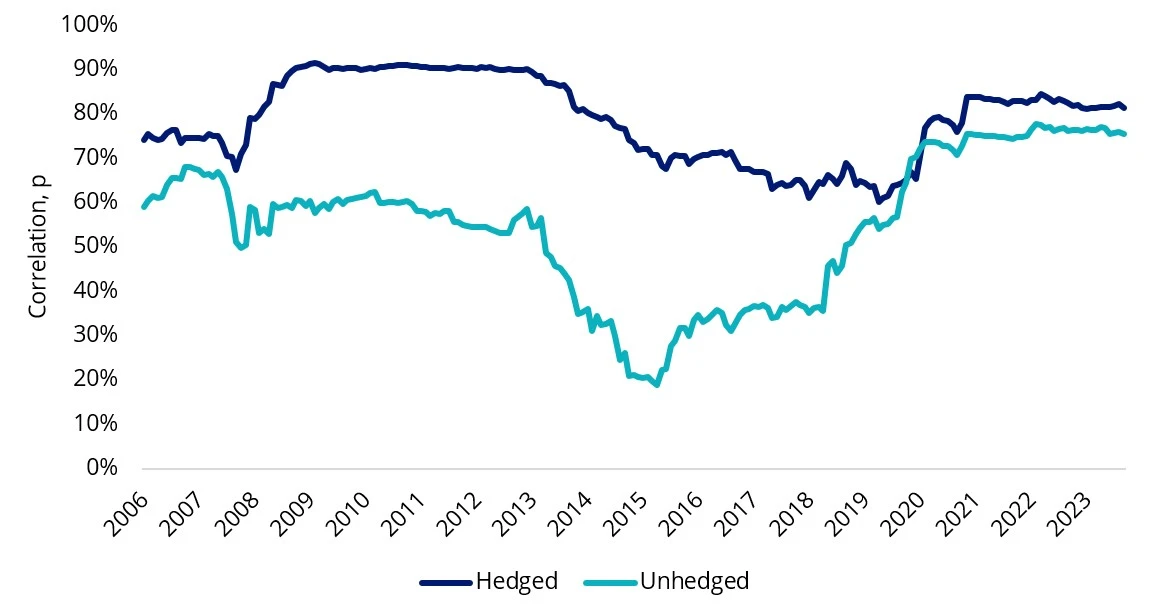

Unhedged currency international equity exposure has historically provided more diversification benefits, illustrated by having a lower correlation to Australian equity returns compared to international currency hedged exposure, however this difference has narrowed since 2019. Below is a comparison of AUD hedged and unhedged international equity correlations to Australian equity returns represented by MSCI World and ASX 200 respectively.

Figure 3 – 60 month rolling MSCI World ex Australia AUD hedged versus unhedged to ASX 200 correlation

Source: Bloomberg

And finally…

Ultimately, much like investing in equities, timing currency exposure is difficult to assess. We always recommend speaking with your financial advisor or broker to determine if currency hedging is appropriate for your circumstances.

Key risks:

An investment in the ETFs carry risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, currency hedging, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index.

Last Updated On: 09 November 2023

Important information:

Issued by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’). This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if a fund is appropriate for your circumstances. PDSs are available here. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.