Delta surge supports Quality

The COVID-19 delta surge, particularly in the US, has dampened the economic outlook.

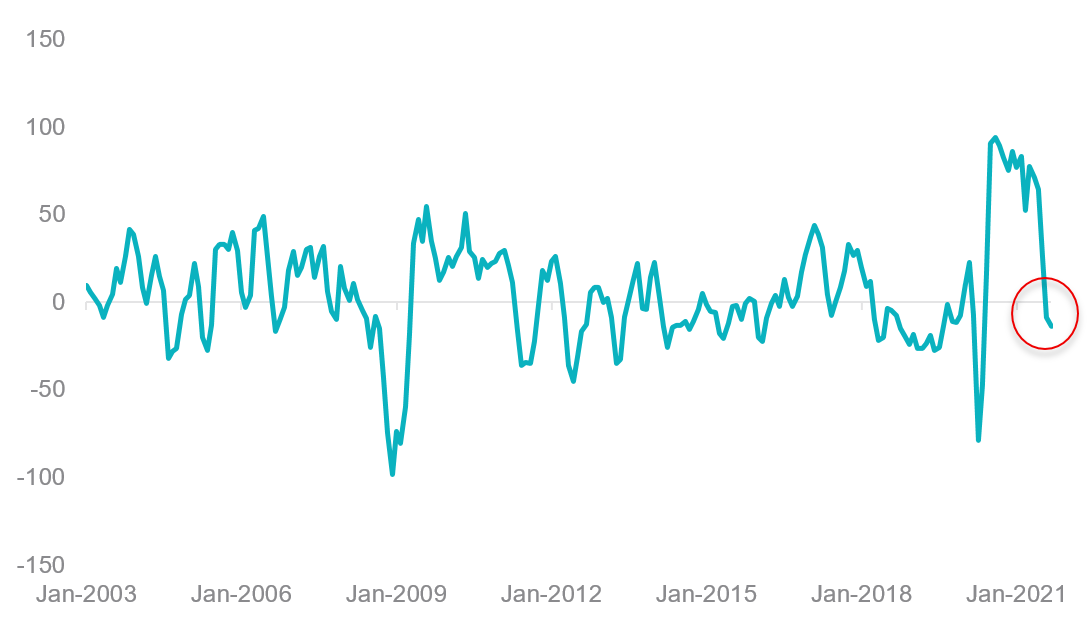

The Citi US economic surprise index (chart 1) which measures economic figure releases against economists’ expectations is negative for the first time since March 2020, raising questions about the US and global recovery (chart 2).

Chart 1 - Citi US Economic Surprise Index

Source: Citigroup, Bloomberg. January 2003 to August 2021.

US non-farm payroll and inflation (CPI) prints in August for example were both below forecasts.

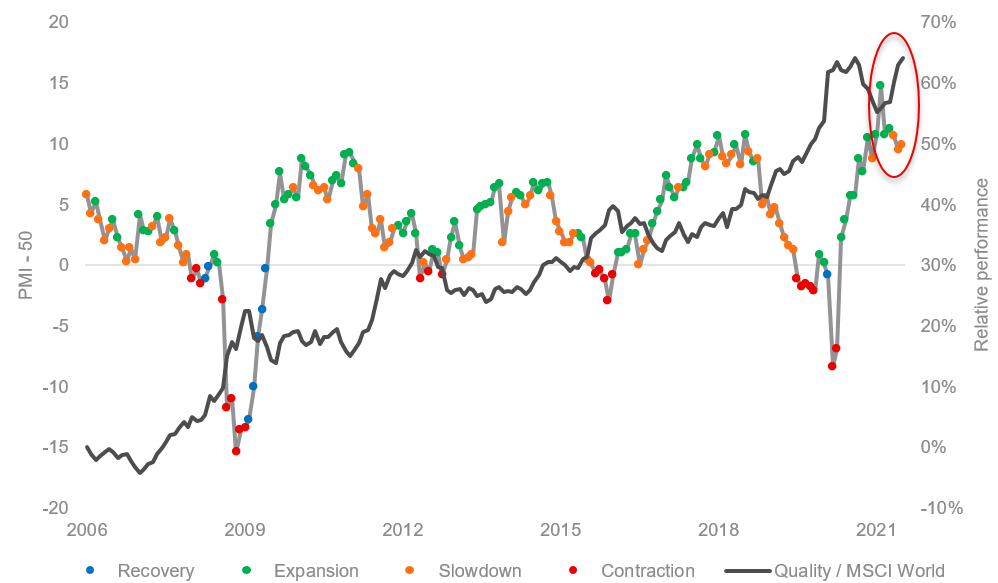

US Manufacturing activity has also slowed represented by the US Institute of Supply Management (ISM) Manufacturing PMI Index. The PMI measures the change in production levels across the US economy from month-to-month.

Chart 2 – US ISM Manufacturing PMI Index

Source: ISM, Bloomberg. PMI above 50 indicates activity has expanded and visa versa.

If the global economic recovery continues to falter it could benefit quality companies, as they tend to offer investors protection during weaker economic environments and heightened market volatility. According to MSCI, world leading index provider, quality companies are those with: high return on equity (ROE), stable year-on-year earnings growth and low financial leverage.

Quality stocks have outperformed over the past 6 months as US manufacturing activity has slowed.

Chart 3 – US ISM Manufacturing PMI Index and MSCI World Quality versus MSCI World performance

Source: ISM, Bloomberg, November 1997 to August 2021. Economic phase is a function on the current value of PMI-50 and the three-month change in PMI.

VanEck offers three ASX listed international quality equity ETF strategies:

- VanEck MSCI International Quality ETF (ASX: QUAL)

- VanEck MSCI International Quality ETF (ASX: QHAL)

- VanEck MSCI International Small Companies Quality ETF (ASX: QSML)

Published: 23 September 2021

QUAL, QHAL, QSML invest in international markets. An investment in QUAL, QHAL or QSML has specific and heightened risks that are in addition to the typical risks associated with investing in the Australian market. These include currency risks from foreign exchange fluctuations, ASX trading time differences and changes in foreign laws and regulations including taxation.

QUAL, QHAL and QSML are indexed to a MSCI index. The ETFs are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to QUAL, QHAL, QSML or the MSCI Index. The PDSs contain a more detailed description of the limited relationship MSCI has with VanEck and the ETFs.