Not all real estate is the same

Diversification is important when investing in Australian real estate investment trusts (A-REITs). Different subsectors of the A-REIT market perform differently. This has been particularly borne out since March this year when COVID-19 hit.

Before we delve into the detail, let’s take a look at the main A-REIT subsectors.

Retail – typically refers to shopping centres, in both capital cities and regional areas. It also includes freestanding shops like Bunnings.

Office – as the name indicates these A-REITs own properties used as offices and include CBD office towers as well as suburban and regional office parks.

Industrial – includes warehouses, manufacturing buildings, industrial parks and multi-use buildings.

Residential – includes the development and ownership of land and apartments. There are no major A-REITs in Australia that are dedicated to residential. However A-REITs like Mirvac derive a large proportion of their income from residential.

Diversified A-REITs – as the name suggests diversified A-REITs own and manage a mix of property types; they do business in two of more of the A-REIT subsectors.

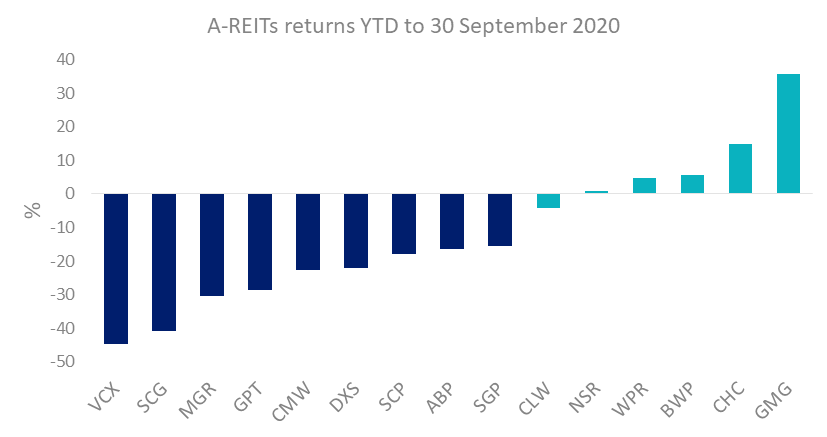

The graph below shows the returns of 15 A-REITs this year. There has been an exceptionally wide dispersion of returns between the subsectors.

Source: Bloomberg, as of 30 September 2020.

Retail was one of the hardest hit sectors by COVID-19, with rent collections for shopping centres down for the six months to 30 June ranging from 65% to 90%. In addition, rents are expected to drop by 20% as a result of increasing vacancy rates, retailers reducing their footprint and minimal new long term leases.

Vicinity Centres (ASX code: VCX) is one of Australia's largest REITs and focused on ownership, management and development of shopping centres and outlets. VCX was the poorest performer, losing 45% in value over the period.

On the other hand, Goodman Group (ASX code: GMG), which is a vertically integrated, internally-managed global property group specialising in industrial property ownership, funds management, and property development, achieved stellar performance of 36%. Industrial property was a bright spot being the key beneficiary of the shift to e-commerce as supply chains adapt and logistics operators adjust to changing consumer behaviour. E-commerce penetration for grocery is expected to reach 10% by 2024 (currently 3%) and ex grocery to 17% (9% in FY19).

In this current environment, it is more difficult than ever to determine which REIT subsector is going to perform the best, with a lot riding on when a COVID-19 vaccine will end the lockdowns and restrictions. This is why it is more important than ever to be diversified.

One way to access the A-REIT sector in a diversified way is via an ETF. However most ETFs are dominated by the largest A-REITS which is why ‘capping’ may provide a better diversified exposure to the sector. The MVIS Australia AREIT Index caps stocks at 10%.

VanEck Australian Property ETF (ASX code: MVA) tracks the MVIS Australia A-REIT Index and is a simple way to gain a diversified exposure to the all the A-REIT sub sectors in Australia including retail, office, industrial, residential and specialised sectors.

Related Insights

Published: 22 October 2020

An investment in MVA carries risks associated with: financial markets generally, individual company management, industry sectors, fund operations and tracking an index. See the PDS for details.

MVIS Australia A-REITs Index (‘MVIS Index’) is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany (‘MVIS’). MVIS is a related entity of VanEck. MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVIS Index. Solactive uses its best efforts to ensure that the MVIS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVIS Index to third parties.