REIT rents rebound

Rent collections for real estate investment trusts (REITs) in the US improved in July, according to the latest survey by Nareit (National Association of Real Estate Investment Trusts) which is the worldwide representative voice for REITs.

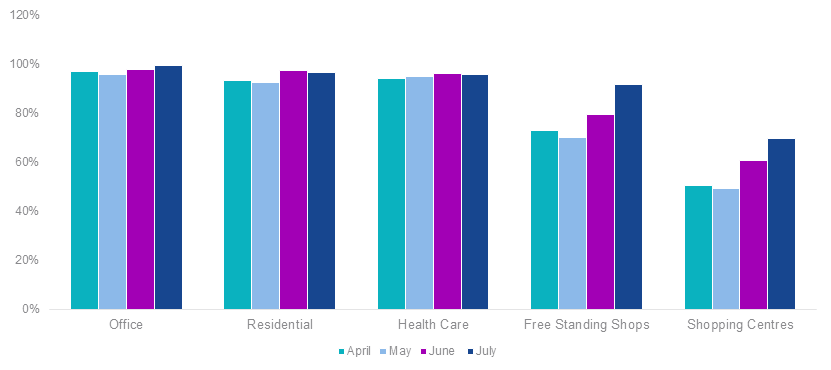

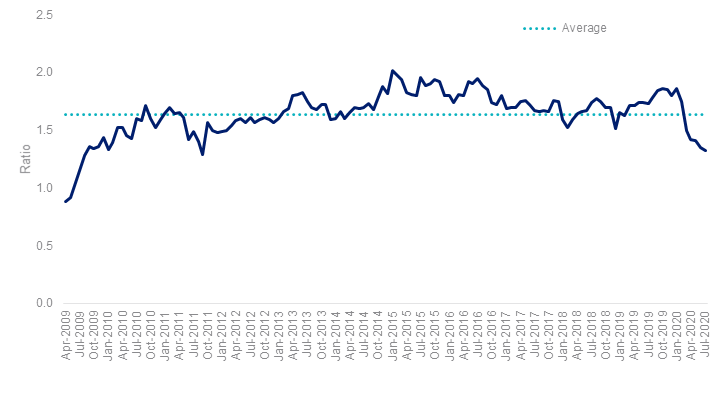

Rent collections for Real Estate Investment Trusts (REITs) in the US improved in July, according to the latest survey by Nareit (National Association of Real Estate Investment Trusts) which is the worldwide representative voice for REITs. The fourth edition of its monthly survey showed a material improvement for the US retail subsector while industrial, office, residential and health care subsectors reported rent collections above 95% of pre-COVID levels.

Figure 1. Share of Typical Rent Received by US REITs: April – July 2020

Source: Nareit

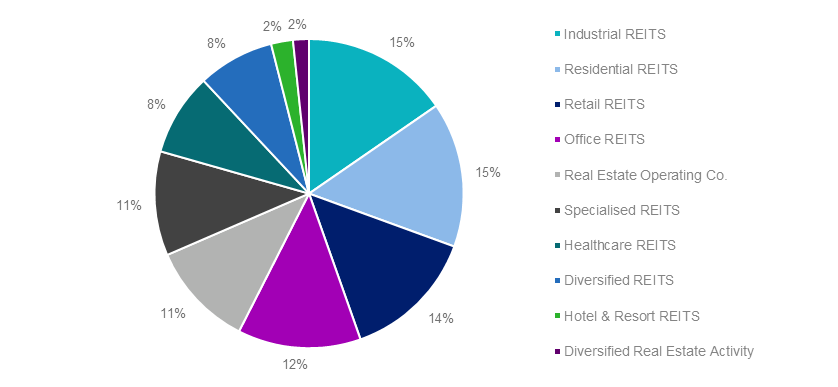

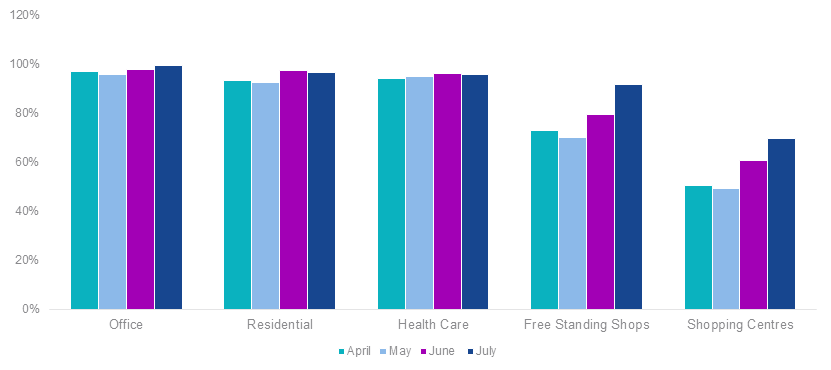

FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged (REIT Index) provides exposure to a balanced and diverse range of international REIT subsectors including heath care and specialised REITs such as data centres, which are not available in Australia.

Figure 2. REIT Index Subsector Breakdown

Source: FTSE, VanEck, 31 July 2020

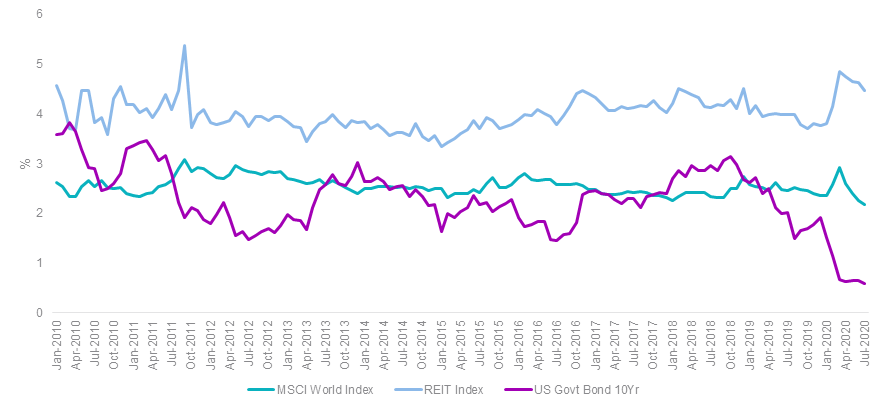

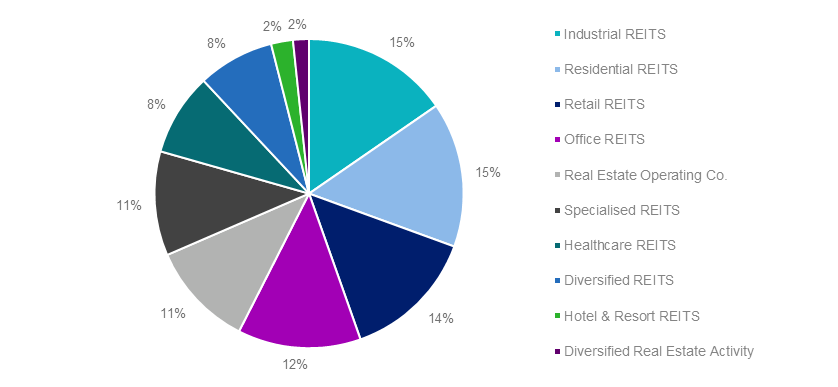

Global REITs as represented by the REIT Index have maintained a 12-month trailing dividend yield above 3.5% since 2010 despite a backdrop of falling global interest rates and bond yields – see figure 3 below. REITs are also considered ‘bond proxies’ as they provide a reliable income stream from rents to investors. This contrasts to dividends from shares, which can be volatile, suspended and/or payout ratios reduced, which has been more prevalent during the COVID-19 economic fallout.

Figure 3. 12 Month Trailing Dividend Yield & Government Bond Yield

Source: Bloomberg. Trailing dividend yield is not a guarantee of future dividends paid by the Fund. Past performance is not a reliable indicator of future performance.

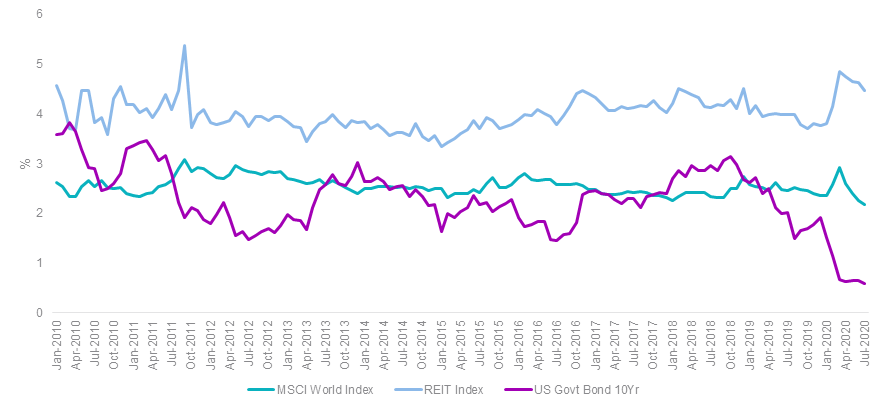

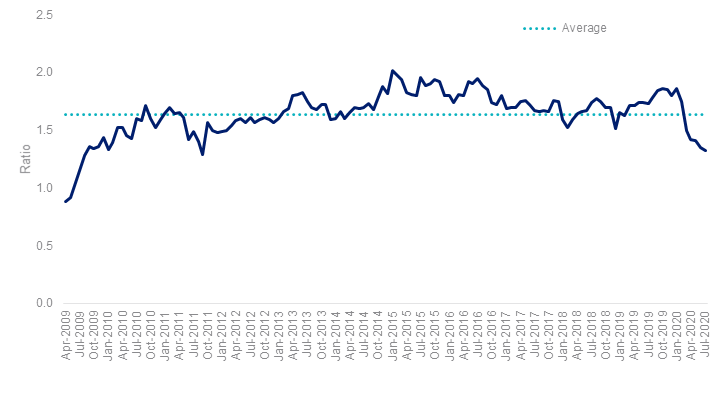

Price to Net Tangible Assets (NTA) ratio, which is typically the market’s perception of future earnings potential and performance for the REIT index is trading below the 11 year average. This may present an opportunity for investors.

Figure 4. REIT Index Price to NTA

Source: FTSE

Figure 1. Share of Typical Rent Received by US REITs: April – July 2020

Source: Nareit

FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged (REIT Index) provides exposure to a balanced and diverse range of international REIT subsectors including heath care and specialised REITs such as data centres, which are not available in Australia.

Figure 2. REIT Index Subsector Breakdown

Source: FTSE, VanEck, 31 July 2020

Global REITs as represented by the REIT Index have maintained a 12-month trailing dividend yield above 3.5% since 2010 despite a backdrop of falling global interest rates and bond yields – see figure 3 below. REITs are also considered ‘bond proxies’ as they provide a reliable income stream from rents to investors. This contrasts to dividends from shares, which can be volatile, suspended and/or payout ratios reduced, which has been more prevalent during the COVID-19 economic fallout.

Figure 3. 12 Month Trailing Dividend Yield & Government Bond Yield

Source: Bloomberg. Trailing dividend yield is not a guarantee of future dividends paid by the Fund. Past performance is not a reliable indicator of future performance.

Price to Net Tangible Assets (NTA) ratio, which is typically the market’s perception of future earnings potential and performance for the REIT index is trading below the 11 year average. This may present an opportunity for investors.

Figure 4. REIT Index Price to NTA

Source: FTSE

Published: 11 August 2020

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors FTSE International Property (Hedged) ETF (‘Fund’). This information contains general advice only about financial products and is not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. The PDS details the key risks. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

The Fund is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited or the London Stock Exchange Group companies (‘LSEG’) (together the ‘Licensor Parties’) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged (‘Index’) upon which the Fund is based, (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Index to VanEck or to its clients. The Index is calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Index or (b) under any obligation to advise any person of any error therein. All rights in the Index vest in FTSE. “FTSE®” is a trademark of LSEG and is used by FTSE and VanEck under license.

Education

ETFs Explained

About Smart Beta

International Investing

Emerging Markets

Quality Investing

Moat Investing

Investing for Income

Property Investing

Investing in Infrastructure

Gold Investing

Expert Insights

ViewPoint Quarterly

ESG Investing

Investing in Healthcare

Video Gaming & Esports

Investing In Clean Energy