The rise of Australia’s technology titans

Technology companies are growing in Australia and becoming a larger part of the overall market. Back in 2014 the MVIS Australia Equal Weight Index included only one stock classified as information technology, namely Computershare. As of 22 June 2020 there are now six information technology companies in the Index.

Back in 2014 the MVIS Australia Equal Weight Index included only one stock classified as information technology, namely Computershare. It remained this way until March 2018 when Link Administration was added. These were the only information technology companies of sufficient size to enter the index.

As of 22 June 2020 there are now six information technology companies in the Index.

In 2014 information technology made up a little over 1% of the Index. It now accounts for 7.5% of the Index, which is more than double the 3.25% weighting in the S&P/ASX 200 index. The equal weight nature of the MVIS Australia Equal Weight Index is providing an overweight position to the growing Australian tech sector.

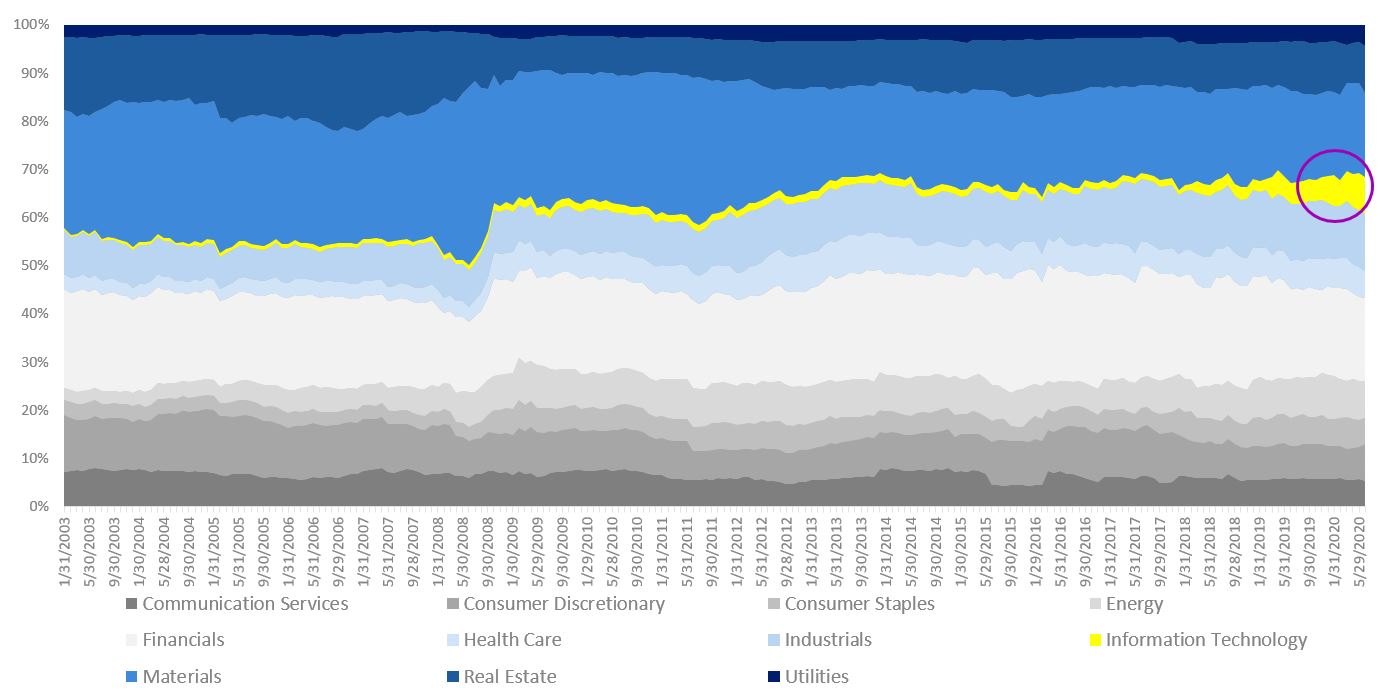

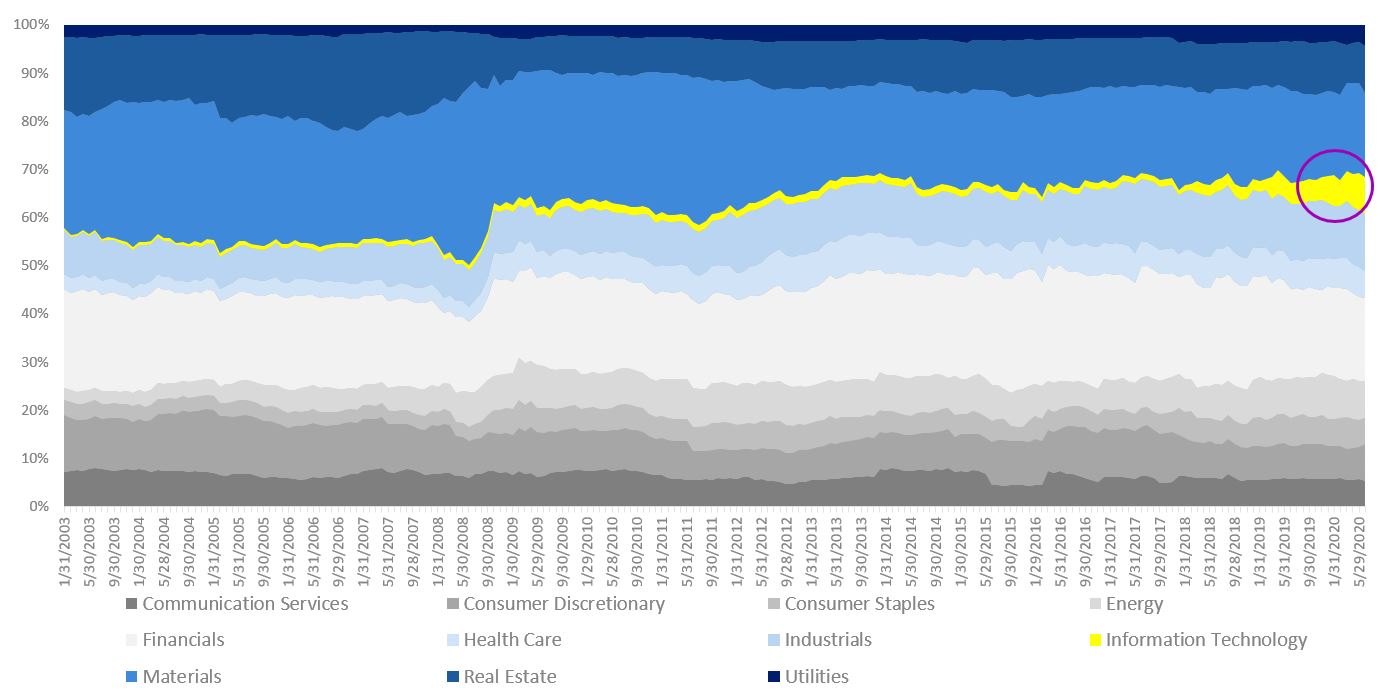

The chart below shows the change in the sector composition of the MVIS Australia Equal Weight Index over time.

To access these growth opportunities, an Australian portfolio that tracks an equal weight index has a higher allocation to technology than a market capitalisation index.

As of 22 June 2020 there are now six information technology companies in the Index.

|

Company |

Date Included |

|

Computershare |

Prior to 2014 |

|

Link Administration |

Mar-18 |

|

Afterpay Touch |

Mar-19 |

|

Altium |

Mar-19 |

|

Wisetech Global |

Dec-19 |

|

NextDC |

Jun-20 |

|

Appen |

Jun-20 |

In 2014 information technology made up a little over 1% of the Index. It now accounts for 7.5% of the Index, which is more than double the 3.25% weighting in the S&P/ASX 200 index. The equal weight nature of the MVIS Australia Equal Weight Index is providing an overweight position to the growing Australian tech sector.

The chart below shows the change in the sector composition of the MVIS Australia Equal Weight Index over time.

To access these growth opportunities, an Australian portfolio that tracks an equal weight index has a higher allocation to technology than a market capitalisation index.

Published: 24 June 2020

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors Australian Equal Weight ETF (‘Fund’). This information contains general advice only about financial products and is not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. The PDS details the key risks. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

MVIS Australia Equal Weight Index (‘MVIS Index’) is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany (‘MVIS’). MVIS is a related entity of VanEck. MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVIS Index. Solactive uses its best efforts to ensure that the MVIS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVIS Index to third parties.

Education

ETFs Explained

About Smart Beta

International Investing

Emerging Markets

Quality Investing

Moat Investing

Investing for Income

Property Investing

Investing in Infrastructure

Gold Investing

Expert Insights

ViewPoint Quarterly

ESG Investing

Investing in Healthcare

Video Gaming & Esports

Investing In Clean Energy