Highlights at COP28

The 2023 United Nations Climate Change Conference or as it is known, COP28, was held recently. Here we provide a summary of what we observed.

The 2023 United Nations Climate Change Conference or as it is known, COP28, ran from 30 November until 12 December 2023 in Dubai. Here we provide a summary of what we observed.

The 2023 United Nations Climate Change Conference (COP28) ran from 30 November 2023 until 12 December 2023 in Dubai. This annual climate event gathers governments around the world to commit on policies to limit global temperature rises and adapt to impacts associated with climate change. Some of the declarations this year included sustainable agriculture, resilient food systems and climate action, global climate finance network and climate health funding.

The core of COP28 was the Global Stocktake (GST), where 195 countries were assessed and given the “report card” on their initial pledges to cut emissions by 2025 since the Paris Agreement.

We already know that the current BAU trajectory is not enough, though significant progress has been made in terms of cutting greenhouse gas (GHG) emissions.

The latest Emissions Gap Report 2023 suggests that GHG emissions in 2030 were projected to increase by 16 per cent at the time the of Paris agreement’s adoption in 2015. It looks to be on track to only increase 3 per cent. While that is a gain, the forecast 2030 emission still must fall by 28 per cent to achieve the Paris Agreement 2°C pathway or 42 per cent for the 1.5°C pathway. So, while there has been progress, there needs to be more.

While the debate regarding phasing out fossil fuels remains up in the air, there has been a historic agreement to “operationalise” a Loss and Damage Fund, following its establishment in the previous COP meeting in Egypt. The fund aims to provide financial assistance to nations most vulnerable to the effects from climate change.

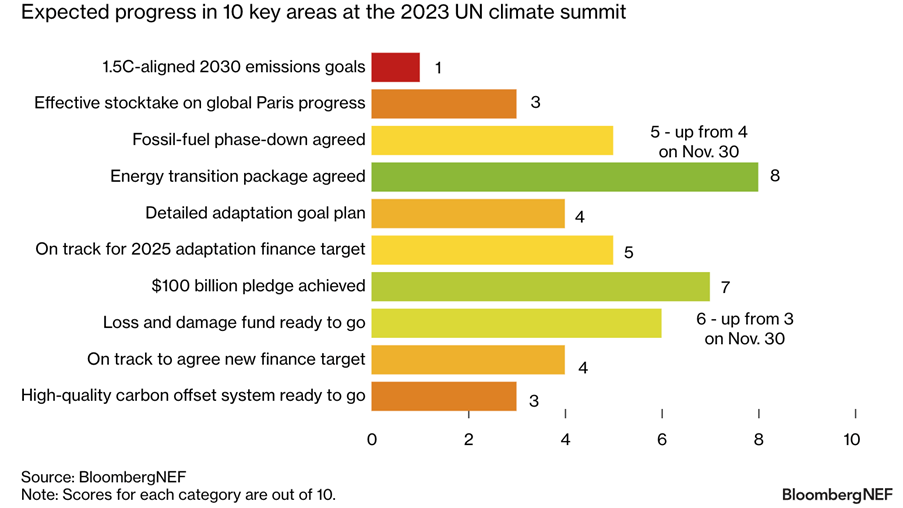

COP28 expectations rise, but still only hit 4.2 Out of 10

Another highlight from the high-level dialogue between the COP28 Presidency and the International Energy Agency (IEA) is the five pillars necessary for 1.5°C-aligned energy transition, the first one being tripling global renewable energy generation capacity by 2030. The IEA data shows that this is achievable, given that the annual capacity additions have more than doubled from 2015 to 2022, rising on average by about 11% per year. Solar PV and wind power are leading the way, with resilient technology supply chains in place, cost-effective system integration of solar PV and wind in place. To further increase renewable capacity, more nations need to also take on renewable initiatives.

One disappointing outcome at COP 28 is the irreconcilable difference on Article 6 – proposals intended to allow countries to raise climate ambition and implement national action plans more affordably using a new carbon crediting mechanism by UN. In addition, it would promote cooperation among countries and other groups to conduct and benefit from emission reduction activities.

In summary, the outcome of COP28 is that the direction is okay, but we’re not where we need to be.

Published: 15 December 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

ESG (Environmental, Social, and Governance) investing is receiving an increasing amount of attention from investors. The problem for ASX investors is that it is difficult to know how ‘green’ their investment is. You may have heard the term “greenwashing”, which was coined in the 1980s to describe outrageous corporate claims. Four decades later the phrase is having a renaissance, now used to describe mislabelled managed funds. Here we provide some insightful analysis of our popular of VanEck MSCI International Sustainable Equity ETF (ESGI) which tracks an innovative index that, in addition to screening out companies, also targets the leading ESG performers in each sector.