Altering carbon

Among the policies voters considered most important during the recent Federal election, climate change, along with the cost of living, aged care and health were top of the list, according to Australian National University.

While climate change policies in Australia and around the world may differ, more than 190 countries unified to commitment to The Paris Agreement, limiting global warming to 2 degrees by 2050. With carbon emissions responsible for the lion’s share of global warming, the focus is on decarbonisation.

One of the ways some governments are achieving their goals is via a carbon price. Many economists agree that introducing a carbon price is the single most effective way for countries to reduce carbon emissions.

This has created an opportunity for savvy investors.

Carbon pricing is a climate policy approach used around the world with the goal of altering the level of carbon dioxide (CO2) in the atmosphere. Increasing levels of CO2 in the Earth’s atmosphere is the leading cause of the imbalance that is causing the Earth’s temperature to rise, and governments are responding.

Carbon pricing requires companies and other entities to pay for the CO2 they release into the atmosphere. There are two main forms of carbon pricing:

- Carbon taxes; and

- Cap-and-trade programs.

A carbon tax is a charge placed on greenhouse gas pollution, mainly from the burning of fossil fuels. This is implemented by placing a surcharge on carbon-based fuels, such as coal and oil, as well as other industrial processes that result in CO2 being emitted into the atmosphere. The tax is in effect the carbon price. In this instance, the government sets it and generally, the price increases over time.

According to the David Suzuki Foundation, “A carbon tax puts a monetary price on the real costs imposed on our economy, our communities and our planet by greenhouse gas emissions and the global warming they cause. A shift by households, businesses and industry to cleaner technologies increases the demand for energy-efficient products and helps spur innovation and investment in green solutions.”

In other words, a carbon tax makes polluting more expensive and clean energy more affordable following innovation and investment in greens solutions. Sweden has had a carbon tax in place since 1991.

A cap-and-trade program is designed to limit, or cap, the amount of CO2 a company can emit. Those that exceed the limit are required to buy carbon ‘credits’ that are equivalent to CO2 excess emissions. The carbon credits, also known as emissions allowances, are official permits that allow a company to produce a certain amount of carbon emissions. These can be traded if the full allowance is not used, hence the ‘trade’ part of ‘cap-and-trade’.

A cap-and-trade program (also known as an Emissions Trading Scheme or ETS) has the same goal as a carbon tax by changing the costs, incentivising changes in production and consumption patterns toward decarbonisation. By limiting the supply of carbon credits, the government is putting a cap on total emissions. One of the advantages of the cap-and-trade scheme is that the cap on emissions can be sector specific, they can change depending on expected economic growth or environmental targets, and it provides certainty around emission reductions.

Carbon credits are either:

- auctioned by the government and then traded, or

- given free to regulated firms who can then trade them.

These primary and secondary market sales and purchases result in a market price for carbon. In other words, there is a market setting the carbon price.

Since the early 1990s, a cap-and-trade system has been in operation in the US to reduce the emissions of sulphur dioxide and nitrous oxide. In terms of targeting CO2 and greenhouse gases, the European Union implemented a cap-and-trade system in 2005 and today it is the largest cap-and-trade system operating.

Right now, a carbon price covers roughly 20% to 25% of greenhouse gases that the world produces. There are 68 different carbon pricing instruments, being different variations of taxes and cap-and-trade schemes.

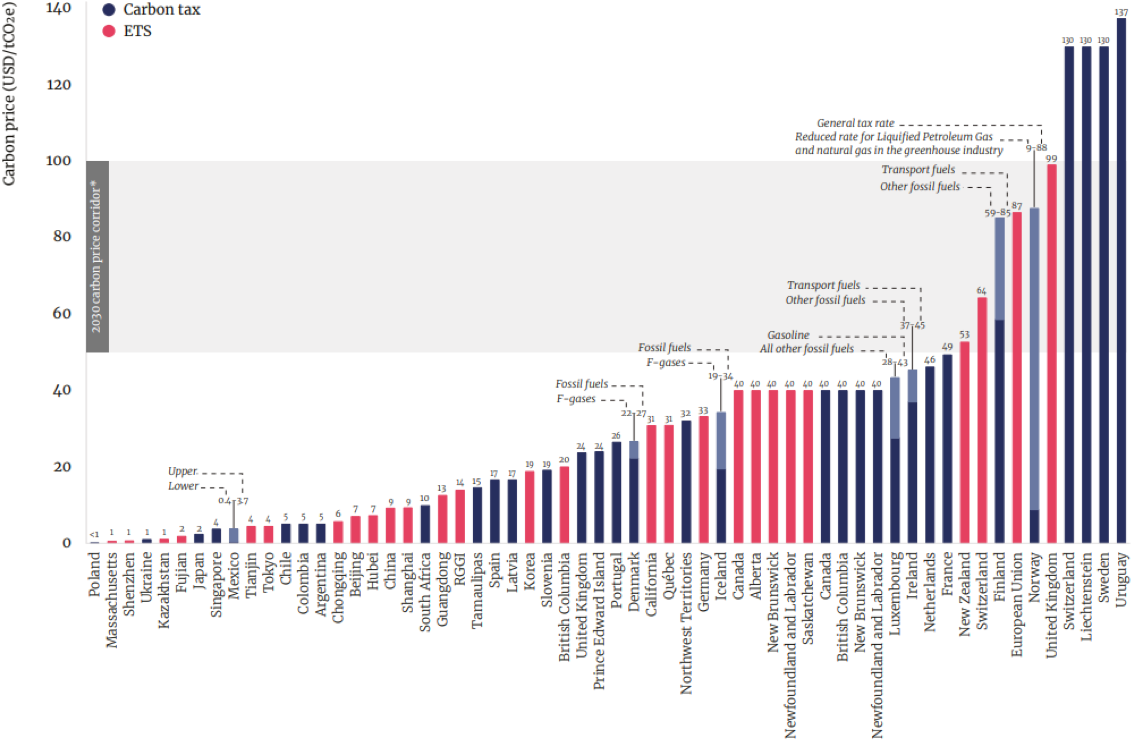

Carbon price by country

Source: The World Bank, State of Carbon Trends of Carbon Pricing in 2022. *The 2030 carbon price corridor is based on the recommendations in the report of the High-Level Commission on Carbon Prices. **Several jurisdictions apply different carbon tax rates to different sectors or fuels. In these cases, we have indicated the range of tax rates applied, with the dark blue shading showing the lower rate and the combined dark blue and light blue shading representing the higher rate.

To meet the 2-degree temperature goal of the Paris Agreement, the carbon price needs to be between US$50 to US$100/tCO2e by 2030. Currently only around 4% of global emissions are covered by a carbon price at and above this range.

Therefore, there is a need for higher carbon prices for the world to achieve its Paris Agreement goals.

Some of the cap-and-trade schemes are large, liquid markets. In the four most actively traded carbon markets there were US$689.9 billion worth of futures traded in 2021. This represented a 164% increase from the year before.

The four most actively traded carbon futures markets in the world are:

- European Union Emissions Trading Scheme (EU ETS), which started in 2005;

- Western Climate Initiative (California Cap and Trade Program), which started in 2013;

- Regional Greenhouse Gas Initiative (RGGI covering many North Eastern US states), which was established in 2009; and

- UK Emissions Trading Scheme (UK ETS), which was created in 2021.

Together these markets represent some of the largest regional economies in the world.

VanEck recently announced that, subject to ASX and final regulatory approvals, it would soon offer investors the ability to access the global carbon market opportunity via the VanEck Global Carbon Credits ETF (Synthetic) (ASX: XCO2). XCO2 will track the ICE Global Carbon Futures Index which is an index made up of carbon pricing from the four futures markets noted above.

This is an Australian first and an innovative way for Australian investors to potentially benefit from changes to the price of carbon.

There are short-term drivers that affect the price of carbon, including:

- Changes in current and expected future scarcity of allowances;

- Variations in general economic conditions, eg GDP;

- Revisions to the rules of the systems (including those governing offsets and market stability mechanisms);

- Interactions with other climate and energy policies.

As noted above, over the long-term, there is a requirement for the price of CO2 to rise so that economies around the world are best placed to achieve their Paris Agreement goals.

Register your interest for the upcoming launch of XCO2

Related Insights

Published: 27 May 2022

Important information:

This information is prepared in good faith by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of units in VanEck ETF’s traded on the ASX.

Units in XCO2 are not currently available. XCO2 has been registered by ASIC and VanEck has lodged an application with ASX for units in the fund to be admitted to trading status on ASX. The PDS has been lodged with ASIC and will be available at vaneck.com.au after the exposure period. The Target Market Determination will be available at vaneck.com.au.

You should consider whether or not any VanEck fund is appropriate for you. Investing in ETF’s has risks, including possible loss of capital invested. See the relevant PDS for details.

No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.

This information is believed to be accurate at the time of compilation but is subject to change. VanEck does not represent or warrant the quality, accuracy, reliability, timeliness or completeness of the information. To the extent permitted by law, VanEck does not accept any liability (whether arising in contract, tort, negligence or otherwise) for any error or omission in the information or for any loss or damage (whether direct, indirect, consequential or otherwise) suffered by any recipient of the information, acting in reliance on it.

View Index provider disclaimers. Index providers for VanEck funds do not sponsor, endorse or promote the funds.

© 2022 Van Eck Associates Corporation. All rights reserved