Facing the new investing world armed like The Future Fund

You may think that Australia’s largest institutional investor, The Future Fund has a broader investment opportunity than everyday Australian investors. At the recent AFR Forum, Alpha Live, Future Fund CEO Raphael Arndt stated that this was, “mostly not true.”

We agree, and we think ETFs are a great way for investors to address the new market reality facing investors, as identified by the Future Fund. ETFs allow investors to access alternative approaches and exposures in the new world, just as institutional investors are.

In December last year, The Future Fund published a position paper titled, The Death of Traditional Portfolio Construction?

The paper stated that “Traditional approaches have delivered strongly, but it is doubtful they are fit for purpose in the future.

“As the outlook for the traditional beta has declined and the toolkit for defending portfolio returns has shrunk, institutional investors need to reconsider what they invest in, where they invest, and how they make decisions.”

By traditional beta, the Future Fund is referring to bonds and equities. In other words, The Future Fund is saying that institutional investors need to consider approaches beyond these asset classes.

We would argue this extends beyond institutional investors, and ETFs allow investors of all types to take advantage of portfolio diversification.

The Death of Traditional Portfolio Construction? considered the investment environment at the end of 2022 and determined, “Given where the world is today investors are likely to need to work harder and employ different combinations of strategies than they have in the past.

“The structural tailwinds driving market returns are fading and headwinds are challenging investors’ ability to achieve their return objectives, while levels of risk and volatility are higher.”

The Future Fund outlined 7 key issues investors need to consider.

- Alpha is more important than ever – Alpha, or outperformance, is difficult. A pure traditional beta approach, according to The Future Fund, could increase the risk of large negative returns in the short-to-medium-term, with history suggesting such periods can extend across a decade.

- More regional differentiation - With higher geopolitical risks, investors may have a greater preference for domestic exposures and a higher hurdle for investing in emerging markets, but The Future Fund warns against such apprehension but also warns to be wary of capital controls and confiscation risk in certain countries.

- More correlation caution - As higher inflation and volatility are weighing on traditional defensive asset classes, The Future Fund thinks investors will need to search for alternative forms of defence. They suggest differentiated hedging and alternatives as well as those assets with a higher pass-through of domestic inflation.

- Higher inflation levels and volatility – The Future Fund thinks commodities could play a greater role in institutional portfolios because these types of exposures may be useful for portfolio resilience, even if they generate low absolute returns.

- A more dynamic approach – Dynamic positioning is likely to supplant set-and-forget approaches, according to the Future Fund.

- Foreign currency may no longer be defensive – The Future Fund warns that Australian investors need to look at the world through a currency lens. It cites that the demand for Australia’s commodities in a stagflationary world, where the need for global investment is profound, particularly to tackle climate change, will provide a tailwind to the Australian current account. This should benefit the Australian dollar but should also reduce confidence in the traditional defensive nature of holding foreign currency exposure.

- Decarbonisation/energy transition – In a world with increasing conflicts, and with resources locked in different regions, the transition challenge remains urgent, but it is now less coordinated and more expensive. Investors need to consider this.

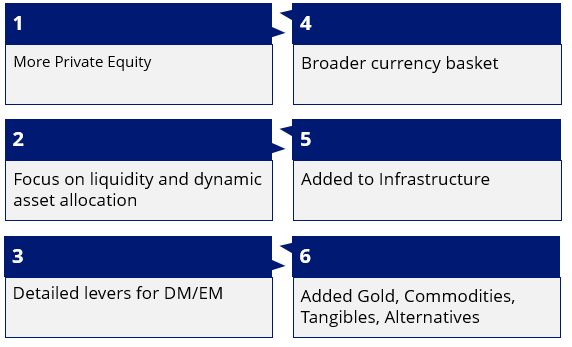

The Death of Traditional Portfolio Construction? includes a table outlining newer levers across The Future Fund’s portfolios they are using to help make it more resilient in the face of these converging key issues investors need to consider. The six levers activated are:

Source: Future Fund

Opportunities across these levers exist on ASX.

VanEck offers investments across private equity (GPEQ), infrastructure (IFRA) and gold (NUGG).

It would be remiss of us not to mention decarbonisation and energy transition and how investors on ASX have institutional grade tools in consideration of this issue such as VanEck’s Global Clean Energy ETF (CLNE) and its Carbon Credits ETF (XCO2).

Of course, the Future Fund still maintains exposure to traditional asset classes through equities and bonds.

In terms of its asset allocation, each year, as required by the Future Fund Act 2006, an Annual Performance Statement is prepared. Past reports are available at www.transparency.gov.au. A review of the reports indicates that “in asset classes where manager skill is less evident (such as listed equities), we have been transitioning the portfolio to a cheaper, more passive approach.”

But the Future Fund does not take any ‘passive’ approach. They are smarter.

Earlier annual reports give interested readers an idea of what these “cheaper, more passive” approaches could be. According to the 2018/19 annual report the passive approach The Future Fund is taking “… systematically harvests equity risk premia through exposure to factors.”

But what does this mean? Simply, the Future Fund is using factor-based investing. So too, already, are lots of Australian investors, they just don’t refer to it as “harvesting risk premia”, or maybe they do.

Factors are identifiable, persistent drivers of risk and return over time. Factor-based investing can be implemented via rules-based, transparent indices. Passive funds, like ETFs, track indices, so it can be surmised that The Future Fund’s cheaper passive approach is tracking factor-based indices and there are ETFs that track factor-based indices too.

Most traditional index providers have had the foresight to create factor-based indices in anticipation of increasing demand for low-cost passive investing alternatives.

MSCI, for example, has created a range of factor-based indices that aim to isolate factors. And there is little wonder The Future Fund invests in these types of strategies. Over the past 25 years, according to MSCI, “Over time, individual factors have delivered outperformance relative to the market.”1That is, factors have risen more than the market, as represented by the MSCI World ex Australia Index which is the benchmark index for international equities.

One example of MSCI’s factor-based indices is its Quality Index series. These target international companies with a high return on equity (ROE), low leverage and stable earnings. These are fundamentals famous investor Benjamin Graham suggested investors should not ignore in his book “The Intelligent Investor” and, we would argue, are key components for many active managers’ processes.

Graham is known as the ‘Father of Value Investing’, and MSCI has also created an Enhanced Value Index Series too. These target companies with high-value scores based on price-to-book value, price-to-forward earnings and enterprise value-to-cash flow from operations.

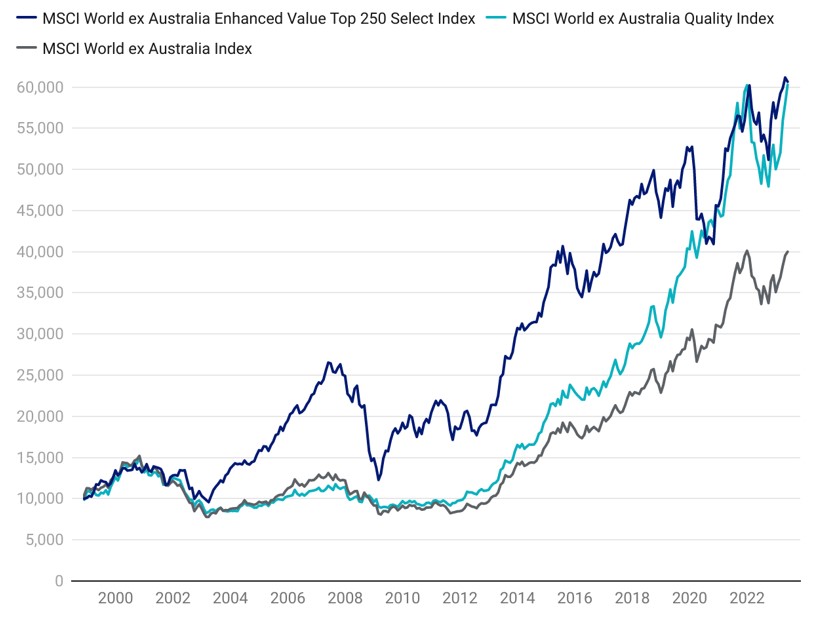

The chart below compares the long-term returns of MSCI’s quality and enhanced value indices compared to the market benchmark, MSCI World ex Australia Index. You can see, consistent with MSCI’s findings, these factors have delivered outperformance relative to the market over time. Before the GFC, economies were recovering and expanding during this time enhanced value outperformed. During the contraction and sluggish growth (slowdown) following the GFC and the COVID-19 lockdowns, quality came to the fore. Both have outperformed over the very long term. This could be the ‘alpha’ The Future Fund states is more important than ever.

Chart 1: Hypothetical growth of 10,000: MSCI World ex Australia Index, MSCI World ex Australia Quality Index and MSCI World ex Australia Enhanced Value Top 250 Select Index

Source: Morningstar Direct, from 30 November 1998 (VLUE Index base date) to 31 May 2023. Past performance is not a reliable indicator of future performance. The above graph is a comparison of the performance of the MSCI World ex Australia Quality Index, the MSCI World ex Australia Enhanced Value Top 250 Select Index and the MSCI World ex Australia Index, based to 10,000 from 30 November 1998. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude fees and costs associated with investing in VLUE or QUAL. You cannot invest in an index. QUAL’s Index base date is calculated at 30 November 1994. QUAL’s Index performance prior to its launch on 15 October 2014 is simulated. VLUE’s Index base date is calculated at 30 November 1998. VLUE’s Index performance prior to its launch on 15 February 2021 is simulated. The MSCI World ex Australia Index (“MSCI World ex Aus”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of developed market large- and mid-cap companies, weighted by market capitalisation. QUAL and VLUE’s index have fewer companies and different country and industry allocations than MSCI World ex Aus.

You can see why The Future Fund is using factor-based approaches for equities.

Like its newer levers, these types of approaches are not just for institutional investors. VanEck’s QUAL and VLUE ETFs track the indices noted above. Australian investors have access to these ETFs on ASX, as they do with many of the asset classes/portfolio levers The Future Fund invests.

ASX investors can invest like The Future Fund.

As always, we recommend you speak to a financial adviser who is best placed to determine which ETF is right for you.

Related Insights

Published: 18 June 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.