Getting ready for the car(bon) race

As many countries around the world are getting serious about global warming, investors are in a unique position to benefit from the transformation.

Initiatives by governments around the world to decarbonise has created an opportunity.

In Australia, following a number of climate related disasters in recent years, one topic dominated the Federal election in 2022: And with the recent change in Australia’s federal government, there has also been a legislated shift in the nation’s position on climate change.

Australia’s parliament has passed Labor’s climate change legislation. The new law pledges to cut carbon emissions by 43 per cent by 2030, with a goal of net zero by 2050. The recent moves in Australia, mirror a broader shift in global climate policy, but we have still shied away from pricing carbon.

One of the ways some governments are achieving their goals is via a carbon price. Many economists agree that introducing a carbon price is the single most effective way for countries to reduce carbon emissions.

While climate change policies in Australia and around the world may differ, more than 190 countries are unified in their commitment to The Paris Agreement, limiting global warming to 2 degrees by 2050. With carbon emissions responsible for the lion’s share of global warming, the focus is on decarbonisation.

According to research from S&P Global, government policies seeking to transition economies to net-zero emissions are likely to increase globally, amid the urgency of mitigating climate change impacts. These are likely to include some form of carbon pricing regulations.

Many economists argue that carbon pricing policies are one of the most efficient policy levers to encourage reductions of Greenhouse Gas (GHG) emissions.

From an economic perspective, they provide direct incentives for households and firms to account for the environmental cost of carbon emissions.

An example of such legislation is the recent passage of the Inflation Reduction Act in the US. The bill pledges to inject US$369 billion into the US clean energy economy, the largest investment in the nation’s history to slow the pace of climate change. The bill increases the tax credit for permanent carbon removal from US$50 to US$180 per ton. With the legislation, companies have room to develop environmentally sustainable technologies at lower costs, and work towards gigaton scale removal of carbon.

Initiatives by governments around the world to decarbonise has created an opportunity for savvy investors.

The World Bank says, increasingly, investors who are looking to buy and hold credits in anticipation of future price increases are entering the market.

Other investors are accessing carbon markets to diversify their portfolios given the low correlations between the past returns of the carbon price and traditional assets such as equities and bonds.

Recent years have also seen offerings of exchange-traded funds that invest in emissions allowances, providing a vehicle for retail investors and even individuals interested in environmental and social governance to participate in a market that may not have been previously accessible to them.

VanEck is bringing this opportunity to Australian investors via its Global Carbon Credits ETF (Synthetic) (ASX: XCO2) which will soon be available on ASX. XCO2 tracks the price of carbon across four global emission trading schemes (ETSs). The fund will be Australia’s first listed fund of its kind, and invests in futures linked to the price of carbon credits.

The schemes considered for XCO2 include four of the world’s most established carbon credits markets: the EU Emissions Trading Scheme, UK Emissions Trading Scheme, California’s Western Climate Initiative and the Regional Greenhouse Gas Initiative of North Eastern US states such as Connecticut, New York, New Jersey, Maine and Massachusetts.

The decarbonisation of the world is happening and markets are deep and liquid

Globally in 2021, the top three carbon futures markets grew 165 per cent by trading volume and traded US$683 billion worth of futures contracts by market value.

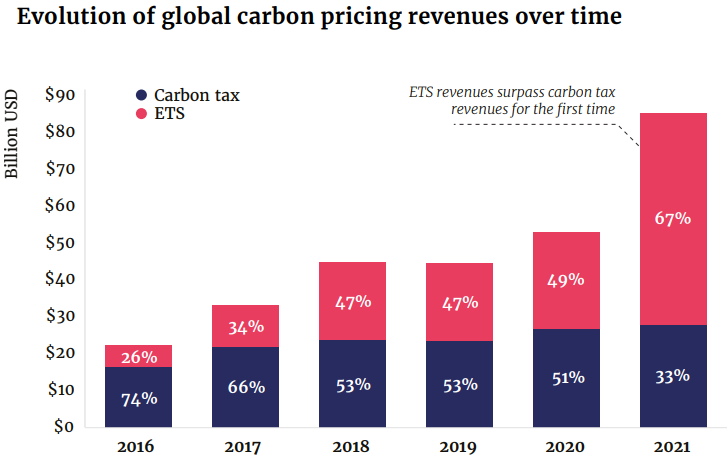

Meanwhile, carbon pricing revenues increased sharply in 2021, driven largely by higher carbon prices, as revenues generated by emissions trading schemes surpassed revenue generated by carbon taxes for the first time. Global carbon pricing revenue collected in 2021 was approximately US$84 billion, representing an increase of over US$31 billion compared to 2020, according to the World bank.

Source: World Bank

The World Bank says for the first time, the total value of the Voluntary Carbon Market exceeded more than US$1 billion in November 2021, a quadrupling in value from 2020. The market has further grown to around US$2 billion as at August 2022, according to Ecosystem Marketplace. This rapid increase in value reflects both rising prices and rising demand from corporate buyers leading to higher transacted volumes.

“At the same time corporate interest in using credits to meet climate goals, along with traders and investors hoping to turn a profit on continued price increases, has supported increased market value and liquidity.” The World Bank.

The growth in net zero targets has accelerated rapidly over the past years

Corporations can voluntarily buy carbon credits to contribute toward meeting their climate targets, to compensate for emissions, or to remove unabated emissions. The United Nations (UNFCCC’s) Race to Zero initiative where companies can pledge to eliminate their carbon emissions by 2050, now reports 5,235 companies have made a commitment of this type, and pledges by Global Fortune 500 companies grew 17 per cent between 2020 and the end of 2021.

There has also been progress at a sector level, notably the International Air Transport Association which recently announced a voluntary net zero target for the aviation sector by 2050. Under current plans, 19 per cent of the target will be met with carbon credits.

Growth opportunities exist as more countries move toward carbon markets and the transition to net zero, and existing carbon markets continue to evolve in order to incentivise changes in production and consumption patterns toward decarbonisation.

While XCO2 will track the price of carbon in four carbon futures markets initially, there is no reason that more markets will not be added down the track.

Key Risks

There are risks associated with an investment in XCO2. These include but are not limited to market risk, concentration risk, regulatory risk, futures strategy risk, currency risk and index tracking risk. See the PDS for more details.

Related Insights

Published: 29 September 2022

Important information:

This information is prepared in good faith by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of units in VanEck ETF’s traded on the ASX. Units in XCO2 are not currently available. XCO2 has been registered by ASIC and is subject to ASX and final regulatory approval. The PDS is available at VanEck. The Target Market Determination will be available at vaneck.com.au.

You should consider whether or not any VanEck fund is appropriate for you. Investing in ETF’s has risks, including possible loss of capital invested. See the relevant PDS for details. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.