Smart Beta entering mainstream

Globally, smart beta is one of the fastest growing investment strategies in the asset management industry. In Australia smart beta ETFs are also gaining traction. The results of VanEck’s fourth annual smart beta survey, the largest of its kind in the world, indicates that the growth is going to continue.

In 2012, there were five smart beta ETFs listed on the ASX with $250 million invested. They predominately focused on income by targeting dividend strategies.

Today that figure is $8 billion. This is a compound annual growth rate of 54%. There are now over 45 smart beta ETFs across a range of asset classes and strategies including factor based, ESG and alternate indexing such as equal weight.

Now in its fourth year, VanEck's smart beta survey was conducted in July and August 2019 among Australian financial professionals. We believe the survey is the largest of its kind. This year, 221 financial professionals working in an advisory capacity in Australia responded.

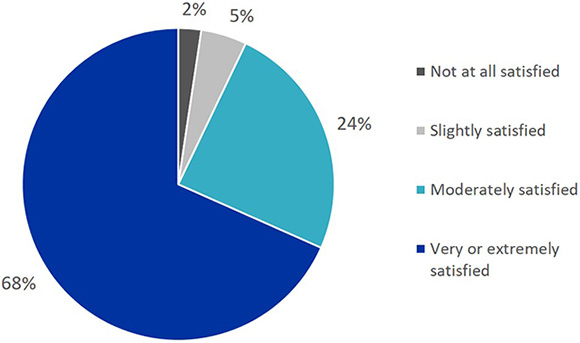

The majority of advisers (66%) use smart beta strategies to replace actively managed funds and most (68%) are very or extremely satisfied with their investments. For those not using smart beta strategies, 65% of financial professionals plan to increase their smart beta allocation in the next 12 months. This highlights that the movement towards smart beta ETFs - which deliver targeted investment outcomes through rules-based investing – is taking hold of the Australian investment market and becoming mainstream.

Performance the key draw

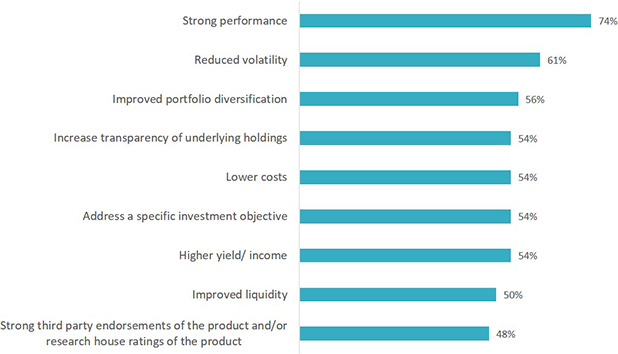

Relatively strong performance is the number one motivating factor for financial professionals using smart beta strategies in portfolio construction. Investors and their advisers are realising that actively funds often underperform their benchmarks, so investors are shifting to smart beta to seek targeted performance outcomes for much lower fees. Other motivating reasons to use smart beta include reduced volatility, improved portfolio diversification and increased transparency as the chart below shows.

How motivating would each of these reasons be to start using smart beta?

Source: VanEck Fourth Annual Smart Beta Survey, August 2019

Awareness of smart beta strategies has increased considerably since the survey began, with 93% of respondents familiar with smart beta, an increase from 81% in 2016.

Many financial professionals (46%) are now using smart beta strategies in client's portfolios according to the survey, compared to only a third (37%) in 2016. Most financial professionals use smart beta ETFs for Australian equity (79%) and international equity (78%) exposure. The most popular smart beta strategies are equal or alternative weighted strategies (58%), single factor quality strategies (45%), multi-factor combinations (41%) and dividend, income or yield weighted strategies (24%).

The survey also reveals very high levels of satisfaction among smart beta users, with seven out of 10 (73%) people using smart beta strategies very satisfied or extremely satisfied with their smart beta investments.

How happy are you with your smart beta investments?

Source: VanEck Fourth Annual Smart Beta Survey, August 2019

The persistent underperformance of active managers is backed by research from S&P Dow Jones Indices. The SPIVA Australia Scorecard recently found that over the one-year period ending June 2019, 93.2% of Australian large-cap equity funds underperformed the S&P/ASX 200 index. The Scorecard has observed consistent underperformance for the majority of Australian active funds in most categories over the longer periods (5-, 10-, and 15-year periods).

Those are staggering numbers and explain why active managers are losing market share to smart beta strategies. A recent VanEck white paper, When are fees too high? A study of Australian equities management, found most Australian active manager will be forced out of existence by disruptive smart beta investment strategies, which offer the same or better outcomes for lower cost.

The white paper found that most Australian equity funds should be charging fees between 0.35% p.a. and 0.50% p.a. as most of their performance can be explained by factors, the same factors used in smart beta strategies. Unless their performance improves, active managers are likely to keep losing market share to smart beta ETFs.

To help investors capitalise on the benefits of smart beta ETFs we have developed a range of free educational materials.

We invite you to have a look around and learn about the advantages smart beta strategies can offer your portfolios.

Learn more about smart beta or view additional results from our smart beta survey.

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck) as the responsible entity and issuer of the VanEck Vectors Australian domiciled exchange traded funds (‘Funds’). This information contains general advice only about financial products and is not personal advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to a fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37. The Funds are subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from any Fund

Published: 06 September 2019