The importance of valuing private equity earnestly

The value of any asset is based on the price someone is willing to pay for it right now. You can see the value of your shares on ASX, as sellers transact with other buyers. You can confidently expect to be able to sell your shares at a similar price. This price transparency, on listed exchanges, does not transpose to assets that do not trade on exchange. Examples of these unlisted assets include private equity. The ‘value’ of these assets has been the subject of debate recently, if only there were listed alternatives.

Amid volatility in share markets, and a gloomy economic outlook, investors continue to seek strong returns, and many, including Australia’s largest institutions, are turning to alternative investments such as unlisted private equity.

An increasing amount of Australia’s $3.4 trillion superannuation pool is now going into private equity. A 2020 forecast by consulting firm BCG predicted Australian super funds would lift their private equity investments from $80 billion to $185 billion by 2025. This estimate is conservative, judging by recent moves in the sector. Data from the Australian Prudential Regulation Authority (APRA) shows $30 billion flowed into private equity in the year to December 2021, as equity market returns softened and fixed income returns stayed low.

Super fund managers are attracted to private equity as it provides important diversification benefits. It also has the potential to generate strong returns over the long term.

Private equity

Put simply, private equity is the ownership or interest in a corporate entity that is not publicly listed. There are different types of private equity investment. It can involve taking a stake in a growing business, making direct loans to business, or it can be taking control of a company either through outright purchase or through obtaining a controlling equity interest (buyout). Private equity provides capital to nurture expansion, new products or restructuring with the goal of unlocking greater value for investors.

The difficulty of access

Traditionally, direct investments in private companies and in private equity funds require:

- large capital outlays,

- long lockup periods, and

- investors taking a concentrated, illiquid exposure to a small number of private companies – which are often leveraged.

It is that last point that has been the subject to debate recently. The two most important points to remember about liquidity are:

- Its definition – a liquid investment can be readily acquired and converted to cash.

- The impact on price - a liquid investment can be bought or sold at a fair value without a significant premium or discount to its fair value. An illiquid investment may need to be sold at a discount to be readily converted to cash.

The illiquidity premium of private equity

By investing in private equity, large superannuation funds are potentially being ‘rewarded’ for illiquidity. They are locking up their investment for a long period of time, in the hope that their private equity investment comes to fruition. The illiquidity premium is the additional returns an investor can capture from locking their money up for a longer duration than if it was sitting in cash or public markets.

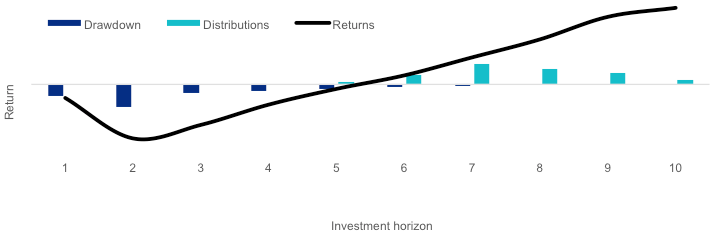

The J-curve illustrates this.

Chart 1: The private equity J-Curve

Source: VanEck. For illustrative purposes only.

You can see in the chart above, investors, while making large investments (drawdowns) in private equity typically endure losses during the early years of the investment as the business establishes (or reestablishes) itself. At this stage you would say the investment is illiquid, it’s unlikely an investor could sell their stake at a fair valuation, if at all.

Hopefully the business matures, it then requires less capital. Cash flows increase and eventually it starts to return income to investors represented above as distributions. Over this time, the value of the private equity investment also increases. The return line is sloping upwards. By year 10, the investment may be more liquid, in other words, someone might be willing to pay close to fair value for the asset.

This doesn't mean there are not ways to exit a position in the private markets at any time, but investors often can’t get out quickly, and will need to sell via a secondary market to a buyer willing to buy their asset. This is in contrast to listed securities that can be easily bought and sold.

According to the Financial Times, in the US, pension funds were among those that sold US$33 billion worth of stakes in private funds in the first six months of 2022. According to Jeffries, that’s an increase from US$19 billion over the same period in 2021, and, the investments were typically sold below their face value.

Furthermore, stakes in venture capital funds were sold at 71 per cent of their most recent valuation, as rising interest rates and fears of a recession have curbed investors’ willingness to back often unprofitable start-ups.

It is evident that investing in private equity, while potentially rewarding, is risky and the recent market volatility has bought this to the fore for Australia’s largest superannuation funds.

Risks of private equity investing

The increasing allocation by large super funds into unlisted private equity assets is problematic for two main reasons:

- Price disclosure and valuation, there is no price visibility for members of the fund over the value of private equity assets held. Valuations are subjective and infrequent.

- Liquidity risks for those funds making high allocations to illiquid assets.

Price disclosure and valuations

The first problem with allocations to unlisted private equity is that prices are not easily observable, valuations are opaque, subjective and infrequent. The lack of market prices can result in opaque valuations, which can misstate investment or fund values. As a result, members may never know the value of unlisted assets in their super funds. For example, overvaluing a private equity investment could potentially have an overstated impact on investment returns.

The venture capital sector of private equity has been in the news of late, with discussion about the valuations of Australian start-up Canva. Many large Australian super funds have benefited from the company’s meteoric rise from a small IT firm in Perth to a multibillion-dollar enterprise. However, recently the company’s valuations have taken a hit. The AFR has reported Canva valuations are down by as much as 60 per cent in the secondary market this year. This has led several financial advisors to question whether super funds which hold significant stakes in the business have revalued all of their overweight unlisted assets to reflect current public market valuations.

Another example mentioned in the Financial Times is Klarna, a Swedish buy-now-pay-later firm which some super funds directly or indirectly hold. After being valued in 2021 at $46 billion, a 2022 $800 million funding round valued Klarna at 6.7 billion (An 85 per cent fall). As the underwhelming initial public offerings of Uber and WeWork show, the case is not isolated. While Klarna has suffered an 85 per cent slide in value over a year, global share markets, by comparison have declined by 15 to 20 per cent.

The Australian Prudential Regulation Authority (APRA) undertook an unlisted asset valuation thematic review in 2021 which found Superannuation Fund’s revaluation frameworks need improvement. The findings included that board engagement was often limited, and, some trustees relied overly on external parties. The regulator has called upon super fund trustees to improve the frequency and methodology used in unlisted valuations.

Listed private equity

Listed private equity companies, that trade publicly on exchanges around the world, gain their exposure to private equity either:

- directly, that is the company invests directly in private equity from its own balance sheet;

- indirectly, by investing into private equity funds; or

- they are the private equity managers themselves.

Listed private equity can provide investors with similar exposure to the benefits of unlisted investments in a more transparent, lower cost, and accessible way.

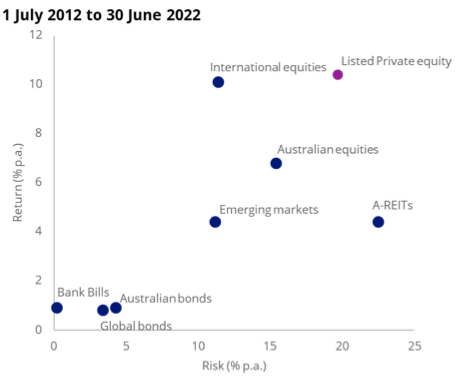

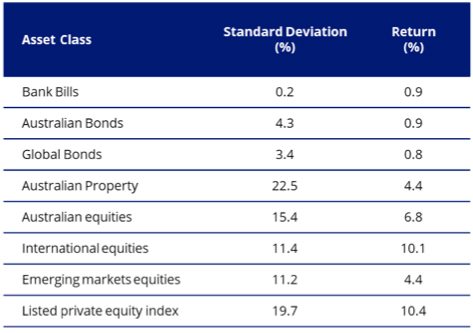

The LPX50 index, which includes the largest and most liquid 50 private equity companies giving investors exposure to venture, growth and buy-out opportunities, you can see from the chart below, is higher risk, as measured by standard deviation of returns, but it has provided the highest return compared to other asset classes.

Source: Morningstar Direct, Ten year risk-reward. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Indices used Bank Bills – Bloomberg AusBond Bank Bill Index, Global Bonds – Barclays Global Aggregate Bond Index A$ Hedged, Australian Bonds – Bloomberg AusBond Composite 0+ years, Australian Property – S&P/ASX 200 A-REITs Index, International Equities – MSCI World ex Australia Index , Australian Equities – S&P/ASX 200 Accumulation Index, Emerging markets equities – MSCI Emerging Markets Index, Listed private equity – LPX50 Index.

The VanEck Global Listed Private Equity ETF (GPEQ) tracks the LPX50 Index. GPEQ provides immediate access to a highly diversified private equity portfolio of more than 3,300 private equity direct investments and 350 private funds.

GPEQ also aims to mitigate the effect of early year losses, noted in the J-Curve above, because the underlying portfolio comprises of a range of existing investments that are at differencing stages of maturity.

Traditionally only the largest institutions have had the resources to build a diversified portfolio of private equity funds. Now you can to. And it has the benefit of liquidity, being listed on ASX.

Related Insights

Published: 19 August 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

LPX and LPX50 are registered trademarks of LPX AG, Zurich, Switzerland. The LPX50 Index is owned and published by LPX AG. Any commercial use of the LPX trademarks and/or LPX indices without a valid license agreement is not permitted. Financial instruments based on the index are in no way sponsored, endorsed, sold or promoted by LPX AG and/or its licensors and neither LPX AG nor its licensors shall have any liability with respect thereto.