The waves of a pandemic: Lessons from the past

Infamous Hawaiian surf break, Jaws, recently hosted extraordinary waves, estimated to be up to 60 feet (18.3 meters) in size. The gigantic North West swell was triggered by near-perfect synergy in the North Pacific. Crowds gathered on Hawaii’s North Shore as big wave surfers took on the monstrous wall of water. These days, it seems investors are a bit like these big wave surfers, fearlessly riding the COVID waves, most recently buoyed by the vaccine rollout. But history shows wave warnings should still be in effect.

The Eddie Aikau Big Wave International is an annual surf event named for Hawaiian legend Eddie Aikau, who would brave big waves in his role as the North Shore’s first lifeguard. He was also a champion surfer. The contest is unique in that waves must reach a minimum height before the competition can start. As a result the tournament has only been held nine times since its 1985/86 inception. Had it not been for the COVID-19 virus, the contest would have been held this past few weeks as record swells hit Hawaii’s North Shore. It seems there was a wave that was too big for the Eddie Aikau contest, the COVID-19 wave.

For the past 12 months epidemiologists, doctors, statisticians and politicians have been presenting wave-like images showing the growth, the flattening and the regrowth of infections and deaths from COVID-19.

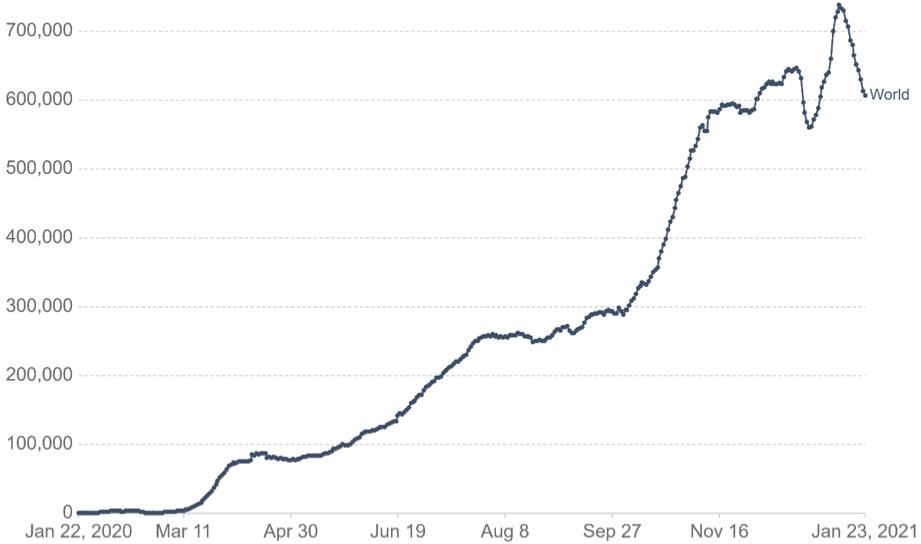

Chart 1: Daily new confirmed COVID-19 cases worldwide

Rolling 7-day average. The number of confirmed cases is lower than the number of actual cases; the main reason for that is limited testing.

Source: Our World in Data, John Hopkins University CSSE COVID-19 Data – 24 January 2021.

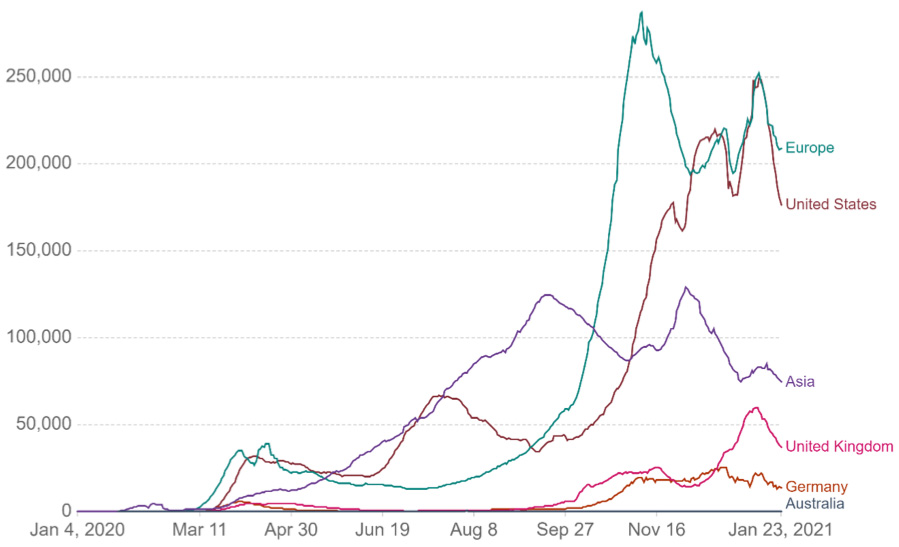

Chart 2: Daily new confirmed COVID-19 cases select regions and countries

Rolling 7-day average. The number of confirmed cases is lower than the number of actual cases; the main reason for that is limited testing.

Source: Our World in Data, John Hopkins University CSSE COVID-19 Data – 24 January 2021.

By the middle of the 2020 it seemed the great wave had crested. In the US, by July the evidence was the worst of new cases, hospitalisations, incubations and deaths were behind us. In Britain too, it seemed April was the peak in terms or mortality.

In his opinion piece for the Boston Globe in July historian Niall Ferguson cited, then Vice President Mike Pence’s optimism “We truly do believe, as we move forward, with responsibly beginning to reopen the economy in state after state around the country, that by early June, we could be at a place where this coronavirus epidemic is largely in the past. Americans are going to be able to enjoy a good summer.”

Mr Ferguson’s next line was prescient, “Hang-on, not so fast.”

Since then we have seen deaths and cases climb, a new mutant strain and the Merkel Mega Lock-down. How did this historian know?

“In history, all great pandemics have come in waves, including the Black Death of bubonic and pneumonic plague in the 14th century and smallpox in the 18th century. The first recorded plague outbreak – in 5th century BC Athens – had three waves in 430 BC, 429 BC and 427 to 26 BC,” Ferguson says. He goes on to cite instances when the second waves are worse than the first, including the Spanish Flu in 1918 to 19.

More recently an influenza pandemic hit Hong Kong in mid-April in 1957. A second wave surfaced in 1958, but there were also further spikes of mortality in early 1960 and early 1963. This was despite a vaccine being developed prior to the disease reaching US shores in 1958. The virus, dubbed the “Asian flu,” killed an estimated 70,000 to 116,000 Americans and one to four million people worldwide, but experts suggest it would have killed many more if not for the vaccine.

Optimistic investors have embraced the COVID-19 vaccine roll-out, but we think a wave warning should still be in effect. It is important to remember that the COVID-19 pandemic was a deflationary shock of the highest order, demand for everything collapsed virtually overnight.

Although fiscal and monetary policy was deployed on an unprecedented scale, a scale not seen since World War 2, investors must be cognisant that this deflationary shock is a key difference between a pandemic recovery and recovery after a war. In war, production does not slow down, in the pandemic, production stopped. Therefore as we recover now there is no offsetting demand for labour and resources.

While a resurgent virus and more lockdowns remain a possibility, it is all unlikely to inspire people to go out, book holidays, go shopping or go to the movies.

Waves never come by themselves, and while there will always be a peak, swells can continue for some time. On Saturday 16th January 2021, Hawaii’s North Shore was pounded with the biggest swell experienced in many years. Waves at the famous ‘Jaws’ break were estimated to be 60 feet that day. The next day, as a result of the same weather system, waves were still being measured at over 25 feet. The same is true of past pandemics, they tend not to just go away, often coming in many waves.

That is why transparency is key. Transparency helps us prepare. We are getting this, for the most part, from our leaders. Daily conferences and updates help us manage the short term of our daily lives.

Likewise you should also have transparency in your investments so you can better manage your long term goals. Exchange Traded Funds (ETFs) provide investors with a high level of transparency. Typically, an ETF’s list of securities (ie the stocks or assets that make up the ETF) are listed on the ETF provider’s website. For example, the portfolios of securities held in VanEck’s ETFs are published on our website and updated on a daily basis. That way investors know exactly what they hold as they approach subsequent waves, there is no murkiness about what has been held or what is being sold or bought.

Investors should be able to approach the next wave with as much knowledge as possible, not heading into it with opaque promises about repositioning. Successful long-term investors survive big swells by sticking to investment principles that have withstood the tests of time. For portfolios, this may include better diversification. For equities, investing in profitable companies with strong balance sheets and stable earnings has historically given resilience to portfolios.

The point is, as the history of pandemics illustrates, until we reach herd immunity and vaccine distribution is effective, we should be watchful for the threat of subsequent waves and look through short-term noise to concentrate on long-term goals.

Related Insights

Published: 29 January 2021

Issued by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’). This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if a fund is appropriate for your circumstances. The PDS is available here.