The true cost of investing

Fees and costs have always been a hot topic when it comes to investing and it’s getting hotter as we approach 1 October 2017. This is the date ASIC’s regulatory guidance on fees and costs disclosures (RG 97) comes into full effect.

Many fund managers are worried about the changes as it will require them to quantify the full costs of managing investments. For some the true costs will be significantly higher than they are currently disclosing to investors. RG 97 intends to ensure full transparency and comparability between products. Understanding the total cost of investing will benefit consumers. Here we give them a head start.

From 1 October 2017, ASIC’s RG 97 requires all managed investment and superannuation product issuers to provide more detailed disclosure about fees and costs.

It’s important to note that this is not about new costs. RG 97 is about costs investors are already incurring but don’t know about. ASIC is implementing the new requirements because the disclosure obligations that have existed under the Corporations Act Regulations for over 10 years have failed to achieve their goals of transparent and comparable costs disclosure. This means for over 10 years investors have been making decisions based on incomplete information.

The changes are designed to create a more level playing field by giving customers more meaningful comparisons between products through greater transparency.

These changes will impact almost all categories of fees and costs.

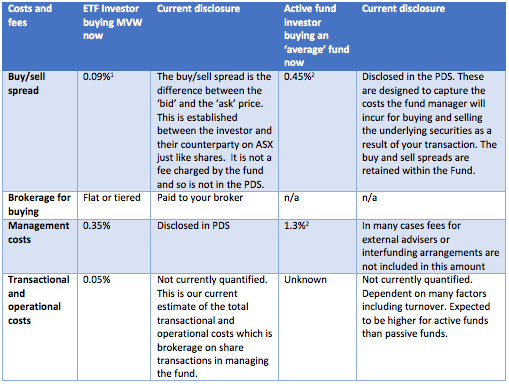

Actively managed unlisted funds and ETFs generally have different costs so the impact of these changes will be different. The following table sets out a hypothetical example of current investments costs incurred for an Australian equity investor in an ETF versus an unlisted managed fund and how they are currently disclosed:

1 – Source: ASX Investment Products Monthly Updated, March 2017

2 – Source Morningstar, VanEck. As at 31 March 2017. Average calculated from primary funds within Australian Equity Large Blend, Australian Equity Large Value and Australian Equity Large Growth funds. The Buy/Sell spread is the difference between the entry price and the exit price

What is immediately clear from the above is that the management costs and the buy/sell spreads active unlisted funds charge are higher than a comparable ETF. This is important as money lost to fees compounds over time. In other words, you don't just lose the tiny amount of fees you pay—you also lose all the growth that money might have had for years into the future.

ETFs are passive funds and much has already been written about their lower management costs compared to active unlisted funds. To date, comparisons have been based on incomplete information. From 1 October RG 97 will further highlight the difference in fees and ETFs will become even more popular.

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors Australian Equal Weight ETF (‘Fund’). This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

Published: 09 August 2018