Lessons from Game of Thrones: Investing with a Wide Moat

Which is a better investment, Riverrun or Winterfell?

The castle is situated at the end of the point of land where the Tumblestone flows into the Red Fork of the Trident. The rivers form two sides of a triangle, and when danger threatens, the Tullys open their sluice gates upstream to create a wide moat on the third side …

A Game of Thrones, George R.R. Martin

In A Game of Thrones Jaime Lannister’s army defeats the Tully forces in the Riverlands and capture the heir - but they are unable to take the castle Riverrun. The wide moat stops them. Jaime doesn’t do as well in his next battle in the Whispering Woods and is taken prisoner by the Starks. Soon after he has his hand chopped off. It doesn’t turn out well for the Starks either. Their castle, Winterfell doesn’t have a moat and they lose it the first time it is attacked.

When you play the game of thrones you win or you die. There is no middle ground. Playing the game of money is not as dangerous but you still want to protect yourself. Like the Tullys you want to have a wide moat between your estate and any marauders who can take away your wealth.

Investing with a wide moat is investing in companies with structural barriers that protect profits and defend against competition. An example is American Express whose wide moat has been built up over many years by assembling a base of big-spending cardholders by offering exceptional rewards and services. These affluent customers are attractive to merchants, who willingly pay higher discount fees to American Express. In turn, high discount fees fund the company's rewards programs, making the company's offerings more appealing to cardholders and completing a virtuous circle. American Express' closed-loop network is its wide moat.

The wide moat metaphor for investing was created by Warren Buffet when explaining his investment philosophy. Morningstar® has adopted this concept in its equity research and assigns Economic Moat™ ratings to companies. The companies with the strongest structural barriers are described as having ‘wide moats’. Morningstar also assigns ‘narrow moat’ and ‘no moat’ ratings.

Morningstar also values each company and combines the 20 best value US wide moat companies into the Morningstar Wide Moat Focus Index ™. The result is a concentrated, high conviction portfolio of the 20 most attractively priced US companies that have long-term competitive advantages.

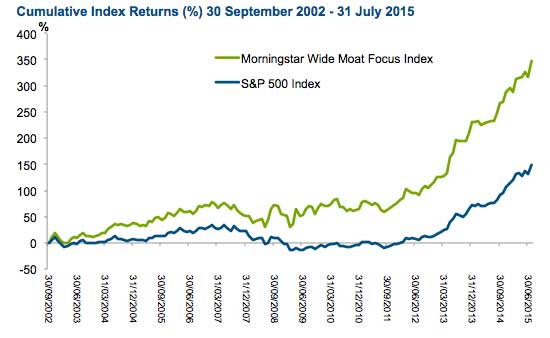

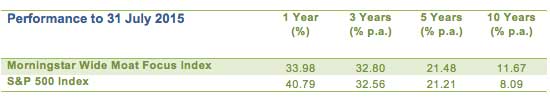

This index has outperformed the broader US market over the long term.

Source: Morningstar; FactSet. Performance is in Australian dollars.

Performance data quoted represents past performance. Past performance is not a guarantee of future results. Index performance is not illustrative of fund performance. Prior to April 24, 2012, Market Vectors Morningstar Wide Moat ETF had no operating history. Indices are unmanaged and do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in a fund. Indices are not securities in which investments can be made.

Australian investors can now invest in this portfolio in a single trade on ASX through the Market Vectors Morningstar Wide Moat ETF under the code MOAT. MOAT has traded on the New York Stock Exchange since 24 April 2012.

Your investments should be like Riverrun, able to withstand attacks from competitors because they have wide moats. You don’t want to invest in Winterfell only to have the Ironmen take it away from you.

MOAT may suit investors looking to include US equities in their portfolio allocation.

For more information on MOAT click here.

Published: 09 August 2018

IMPORTANT NOTICE: Issued by Market Vectors Investments Limited ABN 22 146 596 116 AFSL 416755 (‘MVIL’). MVIL is a wholly owned subsidiary of Van Eck Associates Corporation based in New York, United States (‘US’) (‘Van Eck Global’). Market Vectors ETF Trust ARBN 604 339 808 (‘MVET’) is the issuer of shares in the Market Vectors Morningstar Wide Moat ETF (‘US Fund’). MVET and the US Fund are regulated by US laws which differ from Australian laws. Trading in the US Fund’s shares on ASX will be settled by CHESS Depositary Interests (‘CDIs’) which are also issued by MVET. MVET is organised in the State of Delaware, US. Liability of investors is limited. Van Eck Global serves as the investment adviser to the US Fund.

This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation nor needs. Investing in international markets has specific risks which are in addition to the typical risks associated with investing in the Australian market. Investors must be willing to accept a high degree of volatility in the performance of the US Fund. Before making an investment decision in relation to the US Fund you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.marketvectors.com.au or by calling 1300 MV ETFs (1300 68 3837).

Past performance is not a reliable indicator of current or future performance. No member of the Van Eck Global group of companies or MVET guarantees the repayment of capital, the performance, or any particular rate of return from the US Fund.

Investment in the US Fund may be subject to risks which include, among others, fluctuations in value due to market and economic conditions or factors relating to specific issuers. Medium capitalisation companies may be subject to elevated risks. The US Fund’s assets may be concentrated in a particular sector and may be subject to more risk than investments in a diverse group of sectors.

The Morningstar® Wide Moat Focus Index™ was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the US Fund and bears no liability with respect to the US Fund or any security. Morningstar®, Morningstar Wide Moat Focus Index™ and Economic Moat™ are trademarks of Morningstar, Inc. and have been licensed for use by Van Eck Global.

Market Vectors® and Van Eck® are registered trademarks of Van Eck Global.

© 2015 Van Eck Global. All rights reserved.