You may be missing out on smoother cash flow

Managed funds allow financial advice to be implemented with great efficiency. They are a fundamental tool for wealth creation. The only negative aspect of dealing with managed funds has been the incomprehensible tax laws that have governed them. The Government recently modernised these tax laws, enabling a key improvement for you and your clients - but you could be missing out.

The Government recently modernised tax laws governing managed funds, enabling a key improvement for clients, but you and your clients may be missing out on this benefit.

The new tax laws don’t change the amount of tax that investors in managed funds pay. There still needs to be a complicated calculation so that investors get the proper value from franking credits and capital gains tax (CGT) discounts and so non-residents don’t get charged too much withholding tax.

What should have changed though, for you and your clients, is the amount of cash that the fund pays to its investors.

Many of you have experienced that disappointing feeling of looking at a statement and seeing that an equity fund had paid only a very small amount of cash. For an adviser, there is almost nothing worse than the client meeting in which they remind you that they said they needed a certain cash flow from their portfolio for living expenses.

These uncomfortable meetings should now be a thing of the past.

The old tax laws forced funds to pay an amount equal to the amount being taxed. The amount being taxed is volatile from period to period, especially with CGT. So under the old tax laws the cash payments from the fund were always volatile. There were sometimes very low amounts and sometimes very high amounts. There could be a run of very low amounts followed by a run of very high amounts.

This made planning difficult and hurt the experience for many investors.

One of the benefits of the Government’s modernisation of these tax laws is that the cash flow no longer has to be this volatile.

At VanEck, we have listened to the feedback we have received over the years and in the first financial year under the new laws we have adopted the new approach. The payments from our funds under the new laws have been much more regular than they would have been under the old laws.

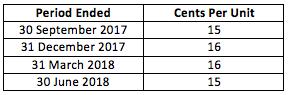

A good example is VanEck Vectors Australian Corporate Bond Plus ETF. The quarterly payments for the financial year were as follows:

This wouldn’t have been possible under the old tax laws.

In the past advisers may have been driven to use an equity fund with a bias to high-yielding stocks to reduce the risk of low payments. These funds became popular at one stage under the name ‘equity income funds’. While these funds may have had higher payments they haven’t always performed that well. Some increased their payments through higher exposure to REITs and some used complicated options strategies. Their popularity has waned in recent years.

Under the new tax laws the portfolio doesn’t have to be distorted to give more regular payments. Any fund can simply choose to make the payments more consistent.

The surprise has been though that many fund managers are not taking advantage of these new laws. Many fund managers have continued to follow the old rules even though they don’t have to. They are continuing to make volatile payments to their investors.

VanEck’s ETFs take advantage of the new tax regime.

If you would prefer smiling faces in your client meetings, you may have to put pressure on the funds that aren’t modernising. Give them the feedback that they haven’t been listening to you about volatile payments.

And while you are at it, keep giving us feedback on what we are doing. We also want you and your clients to smile.

IMPORTANT NOTICE:

Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of VanEck Vectors Australian Corporate Bond Plus ETF ARSN 617 941 241 ASX code: PLUS (“the Fund”). This information is general in nature and not financial advice. It does not take into account any person's individual objectives, financial situation or needs. Before making an investment decision investors should read the product disclosure statement and with the assistance of a financial adviser consider if it is appropriate for their circumstances. A copy of the PDS is available at www.vaneck.com.au

The fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the fund.

Related Insights

Published: 23 September 2018