Is now a good entry point for carbon credits?

The strong performance of global carbon markets recently has prompted market participants to speculate whether the prices have passed their lowest point.

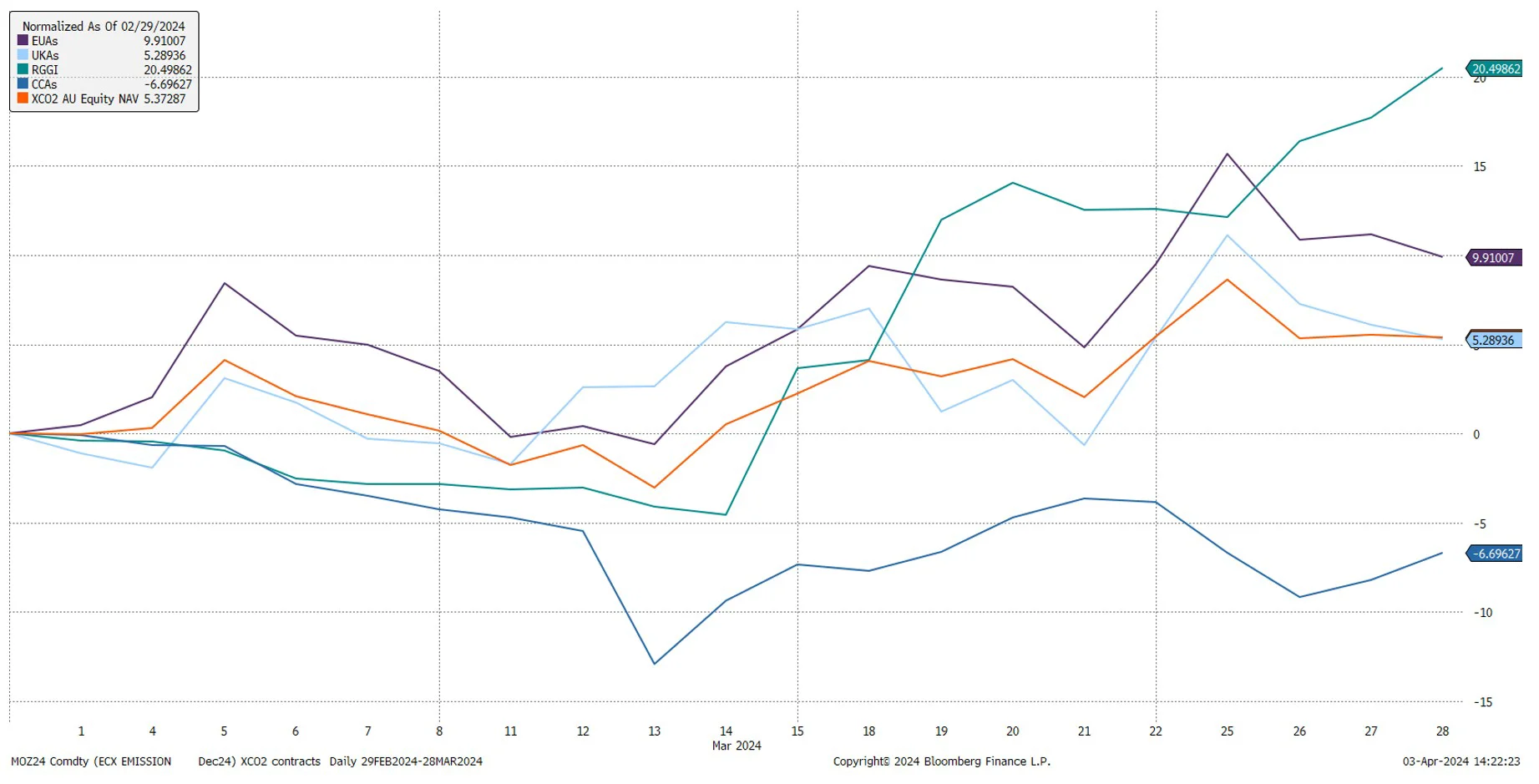

From climate policy tightening to the Russia-Ukraine war, to progress in some of the renewables technology, the carbon credits market globally has endured quite a lot of volatility over the past two years. The ICE Global Carbon Total Return Australian Dollar Index that covers EUAs, UKAs RGGI and CCAs1surged to a near peak in October 2023 and has been on a downward trend since. A strong March 2024 has market participants wondering whether the price level has bottomed out.

There are reasons to believe that the long-term outlook for these markets remains intact.

- Testing the efficacy of the mechanisms

The mandatory carbon credits trading programs are under regular review to ensure effectiveness and robustness. In the UK for instance, two consultations were concluded in March and the market is waiting for the results. The consultations were seeking views on altering the free allocation for the stationary sectors to better target those most at risk of carbon leakage, and ensure that free allocations are fairly distributed. This comes at a time when the UK emission allowance price struggles to find its footing since its split-off from the EU ETS in 2021. Recently a group of UK and EU business and trade associations called on the UK’s energy minister to re-link the two compliance carbon markets.

- Policy ambition and tailwinds

The major economies globally are racing to cut emissions to achieve the goals outlined in the Paris Agreement. After a slow start, many countries and regions are setting more ambitious emission reduction targets.

In California, the state is sticking with a more stringent climate target, to achieve carbon neutrality and reduce greenhouse gas (GHG) emissions by 85 per cent below 1990 levels no later than 2045. Since the announcement at the end of 2022, the CCAs extended their ascent, with the market expecting future scarcity of allowances in circulation in the coming years.

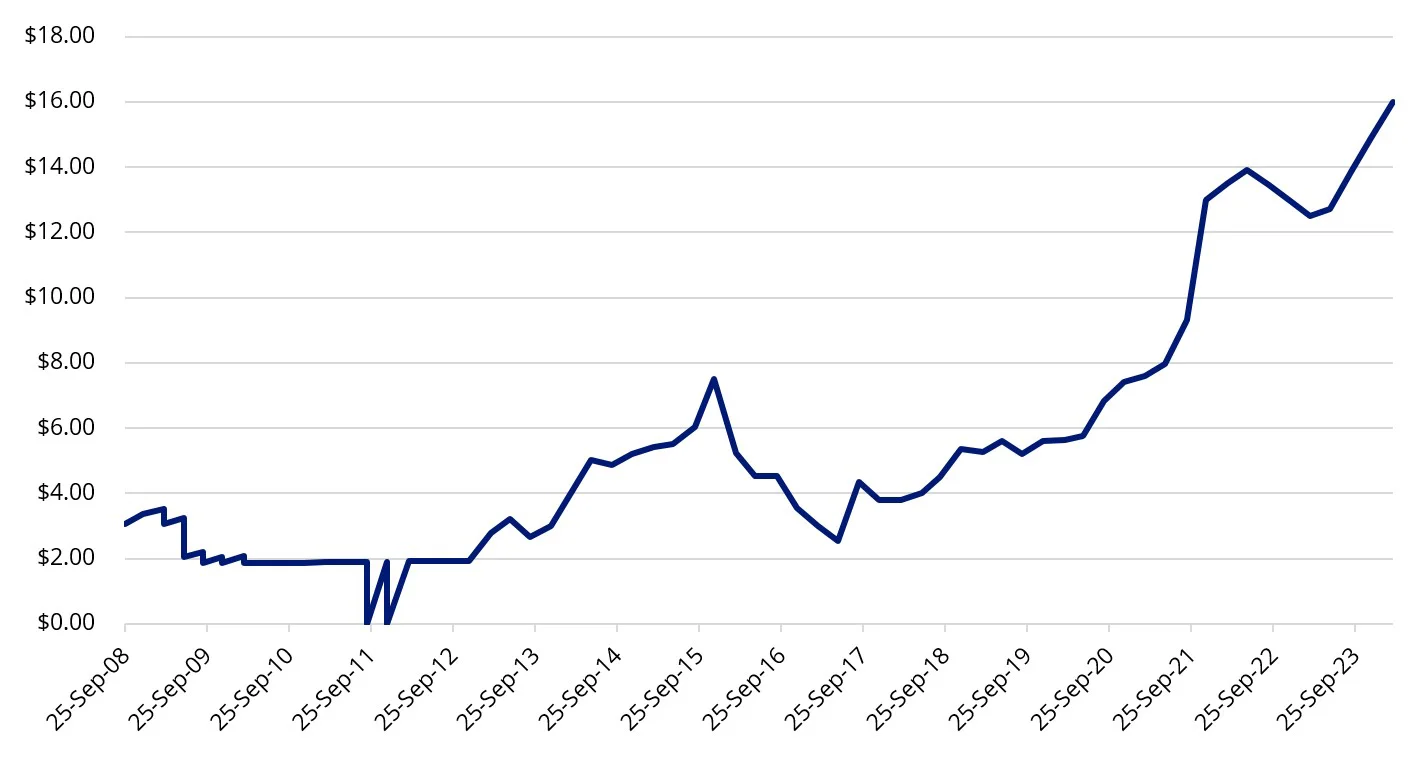

On the east side of the country, RGGI held its first quarterly auction of allowances mid March, with a record-high price of $16 per short ton, up 8% from the last round in December last year. In the secondary futures market, the contract price echoed, jumping over 20% throughout March, with an elevated level of open interest. Similar to California, the member states of RGGI expect a reduced supply of permits in the future given the more ambitious climate target.

RGGI auction clearing price

Source: RGGI

The results appear to have driven carbon markets in March.

The EUAs swiftly rebounded in April on the back of new policy tailwinds. The Science Based Targets initiative (SBTi), the world’s main verifier of corporate climate targets, recently announced that they will allow companies to use carbon credits to offset their full value chain or Scope 3 emission. These emissions are deemed the most difficult type to abate as they are beyond a company’s direct operational control, involving up- and downstream activities of the organisation. This can be a significant driver for the carbon allowances prices, as there are around 3,100 organisations globally set or committed to set a net-zero target as part of SBTi to date, meaning a full reduction and offset of the emissions by 2050.

ASX investors can gain exposure to global carbon markets via the VanEck Global Carbon Credits ETF (Synthetic) (XCO2).

Abbreviation used: EUA = EU emission allowance futures; UKA = UK emission allowance futures; RGGI = Regional Greenhouse Gas Initiative; CCA = California Carbon Allowance.

Published: 11 April 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.