The other CO2mmodity: What investors need to know about carbon

As equity markets tumbled around the globe during April spooked by high inflation, many investors have sought the ‘defense’ of gold. Gold is perhaps the world’s oldest investment asset class, and its price has been hitting historic highs.

As gold shone in recently, so has the price of what is perhaps the newest investment asset class, carbon.

VanEck’s Global Carbon Credits ETF (Synthetic) (XCO2) is one of the few asset classes with a positive return so far in April. XCO2 gives investors exposure to the price of carbon as reflected in futures markets.

Credit Suisse has said, “carbon is an emerging asset class that could potentially rival the global oil market in size.”

So, let’s talk about carbon, the carbon price, carbon markets and why investors should take note.

Introducing carbon

Carbon is a chemical element with the symbol C. In combination with two oxygen atoms, it forms carbon dioxide CO2. While CO2 is necessary for life, its concentration in the earth’s atmosphere has increased since the pre-industrial era due to human activities.

The carbon price

Some governments and institutions are targeting to reduce the level of CO2 via a carbon price. Put simply, a carbon price is a permit to emit CO2, it is a price to pollute. The carbon price is unique and misunderstood.

It is important to understand what a carbon price is, and what it is not (an explanation of what a carbon price is not, is outlined further below).

In 2019 comedian John Oliver on his show “Last Week Tonight” described carbon pricing, pointing out “we’ve universally agreed polluting is bad, and yet it is free to do it. When you litter you pay a fine, when you drive above the speed limit you pay a fine.”

Likewise, carbon pricing requires polluters to pay for the CO2 they release into the atmosphere. So, what used to be free (polluting), you now pay for.

Carbon pricing makes polluting more expensive and clean energy more affordable following innovation and investment in green solutions.

There are two main forms of carbon pricing:

- Carbon taxes; and

- Cap-and-trade programs.

A carbon tax is simply a levy on carbon. The price is set by the government. That is of no interest to investors.

A cap-and-trade program (also known as an Emissions Trading Scheme or ETS) allows market participants to buy and sell permits for emissions or credits for reductions in emissions. Emissions trading allows established emission goals to be met most cost-effectively by letting the market determine the lowest-cost pollution abatement opportunities. By limiting the supply of carbon credits, the government is putting a cap on total emissions.

Carbon credits are either:

- auctioned by the government and then traded (primary market), or

- given free to regulated firms who can then trade them (secondary market).

These primary and secondary market sales and purchases result in a market price for carbon. In other words, there is a market setting the carbon price. Because there is a market, there is an opportunity. This is of interest to investors.

Carbon markets

The carbon market is like the markets for other chemicals such as gold, copper, nickel and iron.

In an ETS, the price of carbon is determined by supply and demand. A key characteristic of carbon markets is that the supply of credits is controlled and limited, determined by the government at an amount deemed acceptable and in line with its emissions reduction targets.

The cost of credits will rise and fall depending on whether firms find alternatives to polluting.

As supply is constrained and expected to fall over time, the market price of carbon credits is expected to rise, resulting in an increased incentive to emit less.

The by-product is a price that is structurally designed to rise over time.

The oldest and largest active market is the European Trading System which has been operating since 2005.

Growth in global ETS markets has continued to rise. In 2023, it was US$909 billion, up from an estimated US$220 billion in 2018 (source: Refinitiv).

The carbon market will continue to grow due to the expansion of emissions coverage, while its trading value could be multiples of that, driven by improved accessibility and liquidity.

We believe this space will develop and therein lies opportunity.

Investors should take note

Like other commodities, the global carbon market has experienced fluctuations due to the macro environment, geopolitics and individual market pressures, but the opportunity persists as governments accelerate towards net zero by 2050.

Generally, each year governments with an ETS will reduce the caps, or the amount of emissions entities are legally allowed to make, thus reducing the supply of permits on the various markets which should lead to higher prices for carbon.

If companies are unable to meet the regulated emissions caps, particularly as the caps reduce on an annual basis they are going to have to pay a potentially increasing price to purchase more carbon credits or face heavy fines and penalties. This will create demand from companies that continue to pollute.

External factors such as variations in general economic conditions will impact the price of carbon. If GDP falls, demand for carbon credits will fall, conversely, if GDP is rising there will be more demand for credits.

From time to time, it may be necessary to revise the rules of the systems, including those governing offsets and market stability mechanisms, which will impact the price of carbon credits.

Investor interest in carbon markets is growing rapidly. According to the Institute of Chartered Financial Analysts (CFA) carbon has exhibited attractive historical returns and a low correlation with other asset classes, making it potentially attractive as part of a diversified portfolio.

Many experts see carbon as an emerging asset class. According to McKinsey, “When we look at the development of carbon markets, what strikes us are the parallels it has with the evolution of other commodity markets, whether its soybeans, pork bellies or natural gas.”

Accessing carbon markets

It is difficult for investors to access carbon markets directly and take advantage of changes in the price of carbon, but VanEck is giving investors that opportunity via its ETF, XCO2.

XCO2 tracks the ICE Global Carbon Futures Index which is an index made up of carbon prices from the four most actively traded carbon futures markets in the world:

- European Union Emissions Trading Scheme (EU ETS), started in 2005

- Western Climate Initiative (California Cap and Trade Program), started in 2013

- Regional Greenhouse Gas Initiative (RGGI), started in 2009

- UK Emissions Trading Scheme (UK ETS), started in 2021

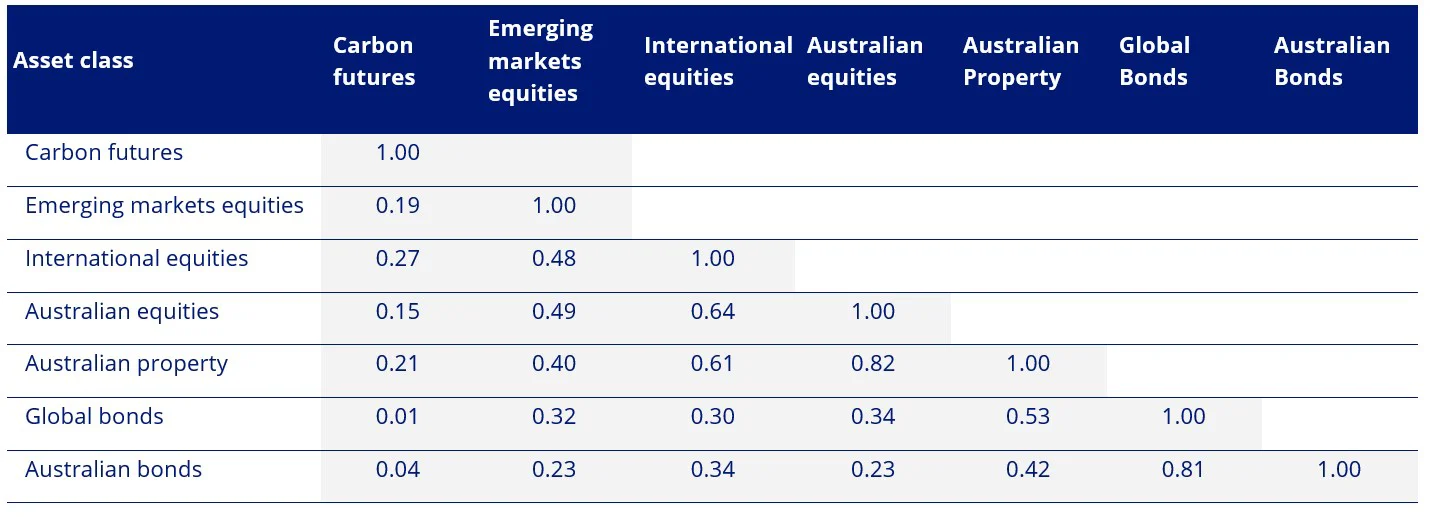

As a diversifier, investors are attracted to carbon credits because of its historically low correlation to other asset classes. The table below shows the correlation of carbon futures compared to other asset classes. In the table, a 1 is perfectly correlated. The lower the number, the lower the correlation.

Table 1: ICE Global Carbon Futures Index correlation to other major asset classes

Source: Morningstar Direct, 1 Jan 2014 to 31 March 2024 correlation. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Indices used: Carbon futures is ICE Global Carbon Futures Excess Return Index - AUD; Emerging markets equities is MSCI EM NR Index; International equities is MSCI World ex Australia Index; Australian equities is S&P/ASX 200 Accumulation Index; Australian property - S&P/ASX 200 A-REITs Index; Global bonds is Barclays Global Aggregate Bond Index A$ Hedged; Australian bonds is Bloomberg AusBond Composite 0+ years.

What a carbon price is not: The Australian ‘experience’ - voluntary carbon markets and offsets

You may have read about Voluntary Carbon Markets (VCM) because that is what Australia has. Australia’s voluntary market has been the subject of criticism. It’s important to note that these are not ETSs. VCMs are not regulated by governments, and the contracts being traded are called carbon offsets.

Consulting firm EY says, “voluntary carbon market does not have any governance body. At VCM, the entities that set the criteria for project certification and carbon credits generation – the standards – are purely private entities.”

It is even possible for individuals to purchase carbon offsets. You may have seen a tick-box on an online order to offset the carbon for your delivery. Some airlines give you an option to buy a carbon offset for flights.

Carbon offset contracts represent sponsorship of a project that is meant to decrease the amount of carbon being emitted, which serves to offset the emissions. The projects backing these contracts are varied; they range from reforestation initiatives to solar farms.

There are well-noted issues surrounding the legitimacy of carbon offsets. John Oliver dedicated a whole episode in 2022 to carbon offsets, and as he humorously pointed out about himself in that episode, he “doesn’t open this beak to squawk out good news.”

The Financial Times says, “The market is opaque and unregulated, with resellers in the form of middlemen brokers accused of cashing in at the expense of environmental causes.”

Unlike carbon allowances at ETSs, where rules are set by national or international public authorities, the voluntary carbon market does not have any governance body. The price is not set by any demand or supply factors.

Is now a good entry point for carbon?

We recently wrote a blog, highlighting the recent strong performance of global carbon markets. This has prompted market participants to speculate whether the prices have passed their lowest point. We think they may have.

Key risks

An investment in the ETF carries risks associated with: ASX trading time differences, market risk, concentration risk, futures strategy risk, cap and trade risk, currency risk, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

As always, if you are considering an investment in VanEck Global Carbon Credits ETF (Synthetic), we recommend that you speak to your financial adviser or stock broker.

Published: 26 April 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

ICE is a registered trademark of ICE Data Indices, LLC or its affiliates. This trademark has been licensed, along with the ICE Global Carbon Futures Index (“Index”) for use by VanEck in connection with XCO2 (the “Product”). Neither VanEck nor the Product(s), as applicable, is sponsored, endorsed, sold or promoted by ICE Data Indices, LLC, its affiliates or its third party suppliers (“ICE Data and its Suppliers”). ICE DATA AND ITS SUPPLIERS MAKE NO REPRESENTATIONS OR WARRANTIES REGARDING THE ADVISABILITY OF INVESTING IN SECURITIES GENERALLY, IN THE PRODUCT(S) PARTICULARLY, OR THE ABILITY OF THE INDEX TO TRACK GENERAL MARKET PERFORMANCE. ICE DATA AND ITS THIRD PARTY SUPPLIERS ACCEPT NO LIABILITY IN CONNECTION WITH THE USE OF THE INDEX, INDEX DATA OR MARKS. See PDS for a full copy of the disclaimer.

© 2025 Van Eck Associates Corporation. All rights reserved.