Outlook for global carbon markets

We are bullish on the long-term outlook for carbon permit prices in compliance markets as they remain the policy tool of choice for incentivising abatement. Further the current environment could potentially be a compelling entry point as each of the four major markets has either recently increased its climate ambition or is expected to do so soon.

There are two categories of carbon markets and it is important for investors to understand the difference. “Compliance” carbon markets are established, regulated markets that operate on a mandatory basis. By law, businesses must adhere to emissions limits set by the government and exceeding the limit requires the purchase of carbon credits so the business “pays” for their excess emissions.

The other category of carbon markets is “voluntary”, which is unregulated and operates, as the name suggests, on a voluntary basis whereby businesses can choose to offset their emissions by purchasing carbon credits. According to Reuters, the International Organization of Securities Commissions (IOSCO) says potential vulnerabilities in voluntary carbon markets include the lack of standardisation for measuring emissions, and concerns over quality and double counting of carbon credits, all of which could leave the sector open to fraud and manipulation. For these reasons, we believe the better investment opportunity lies within compliance markets.

The biggest of these compliance markets is the European Emissions Trading System (EU ETS). The price of polluting under this scheme hit a record high in February this year, with the December 2023 futures contract bursting through the key €100 threshold in response to new rules that will make it harder for EU polluters to buy allowances. The €100 price was considered important. According to a Reuters article at the time, “The 100-euro level has long been cited as a price that could incentivise some of the expensive technologies seen as necessary to limit global warming.”

Compliance carbon market schemes such as the EU ETS force manufacturers, power companies and airlines to pay for each tonne of carbon dioxide they emit as part of a country or region’s efforts to meet its climate targets. Compliance markets have grown rapidly, by 2021 they had an annual trading value of more than $900 billion, the EU ETS is by far the biggest accounting for about 90 per cent of trading volume and value for that year according to LSEG Carbon Research.

Meanwhile, authorities in the UK have just revealed the UK Emissions Trading Scheme will be reformed next year to tighten limits on carbon dioxide pollution and expanded in 2026 to include new sectors. The UK Emissions Trading System Authority has decided that industries covered by the scheme will need to bring down emissions at a faster rate to reach net zero goals. We believe changes to the scheme are a positive for carbon prices under the UK system going forward.

According to Reuters, this will lower the net-zero cap for Phase 1 to the top of the consulted range of 887-936 million UK allowances, the authority said. The current cap is 1,365 million, according to the consultation papers.

It also announced that the UK ETS will be extended to cover domestic maritime transport from 2026 and to cover waste from 2028, while a phased removal of free carbon allowances for the aviation industry will be rolled out in 2026.

While the European ETS is the oldest and biggest carbon trading scheme, the Regional Greenhouse Gas Initiative (RGGI) was the first ETS in the US and has grown to include eleven states. With supply and demand adjustments being finalised by the end of 2023, these are likely to be supportive for RGGI prices going forward.

Figure 1: European Union ETS Futures Price

Source: ICE, June 2023. Past performance is not indicative of future performance.

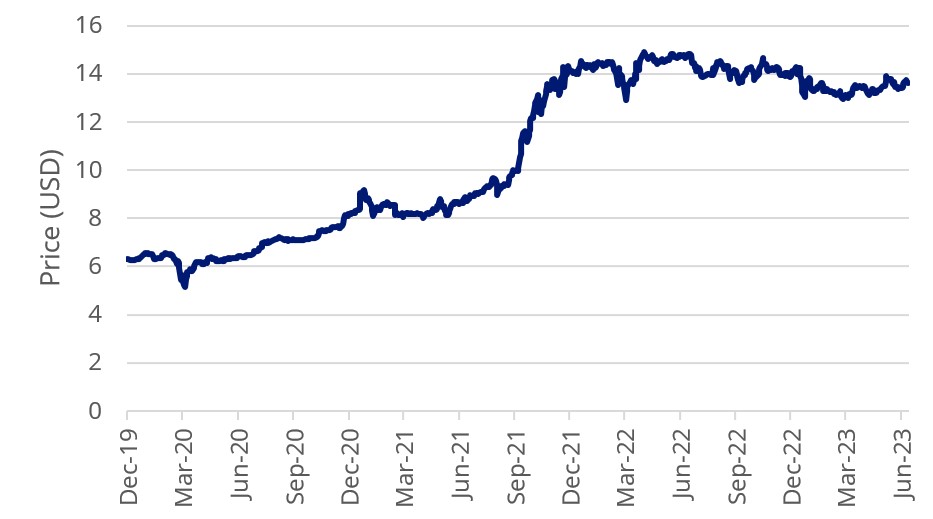

Figure 2: RGGI Futures Price

Source: ICE, June 2023. Past performance is not indicative of future performance.

2023 could be a vintage carbon year

We are bullish on the long-term outlook for carbon permit prices in compliance markets as they remain the policy tool of choice for incentivising abatement. Further the current environment could potentially be a compelling entry point as each of the four major markets has either recently increased its climate ambition or are expected to do so soon.

Elsewhere, Morgan Stanley takes a similar view, “We continue to see the case for structurally higher EUA carbon prices ahead to support the decarbonisation of industry. We consider this objective to be synonymous with energy security as much as climate action.” And CitiBank also note that, “despite a steepening contango of rising costs of carry, we continue to believe the market is underestimating the long-term EUA price.”

To achieve UN goals, being to limit global temperature increases to 1.5 degrees Celsius (ratified by the Paris Agreement), the International Monetary Fund and Organization for Economic Cooperation and Development report on tax policy and climate change has estimated that a carbon price of US$144 is needed by 20301. Currently, prices are not near that level.

Investors can access global compliance markets on the ASX via the VanEck Global Carbon Credits ETF (Synthetic) (ASX: XCO2).

Read more about global carbon markets in our latest Portfolio Compass.

Key risks: An investment in the ETF carries risks associated with: ASX trading time differences, market risk, concentration risk, futures strategy risk, cap and trade risk, currency risk, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

Published: 07 July 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.