UK compliance market pushing forward

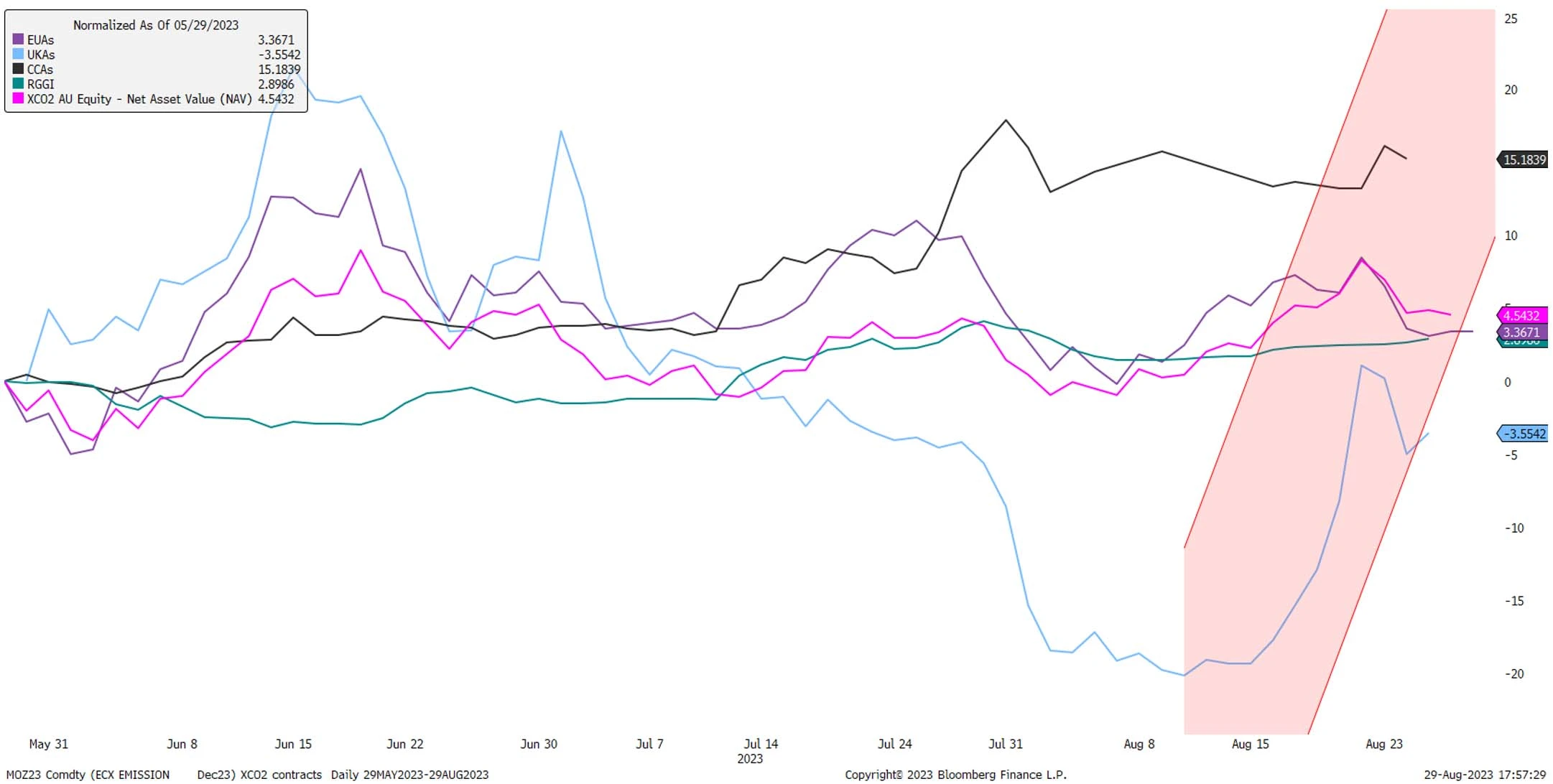

More noticeably the UK carbon allowances (UKAs) have surged close to 20%, from the 10 August low, off the back of the bullish British energy price outlook. UKAs' performance has been highly correlated with the EU allowances (EUAs) since its post-Brexit launch in 2021 until the beginning of this year, when an oversupply of allowances in the UK dragged down the carbon futures prices. However, the program review was conducted this year resulting in tightening the allowances available in the market.

The California cap-and-trade program (CCAs) also had a meaningful uptick following plans to curb supply in the economy-wide carbon market. Bloomberg reports that the proposed scenarios would align the cap-and-trade carbon market with the state’s updated climate change strategy, known as the Scoping Plan, which has a new goal of reducing emissions by 48% by the end of the decade versus 1990 levels, up from the previous 40% cut. The pathways explore curbing the emissions covered by California’s carbon market, together with Quebec, Canada, by 40%, 48% and 55% by 2030. The associated emissions caps are stricter than expected, pushing down the number of allowances available across 2025-2030 to compensate for a 2021-2024 supply that reflected less ambitious climate goals.

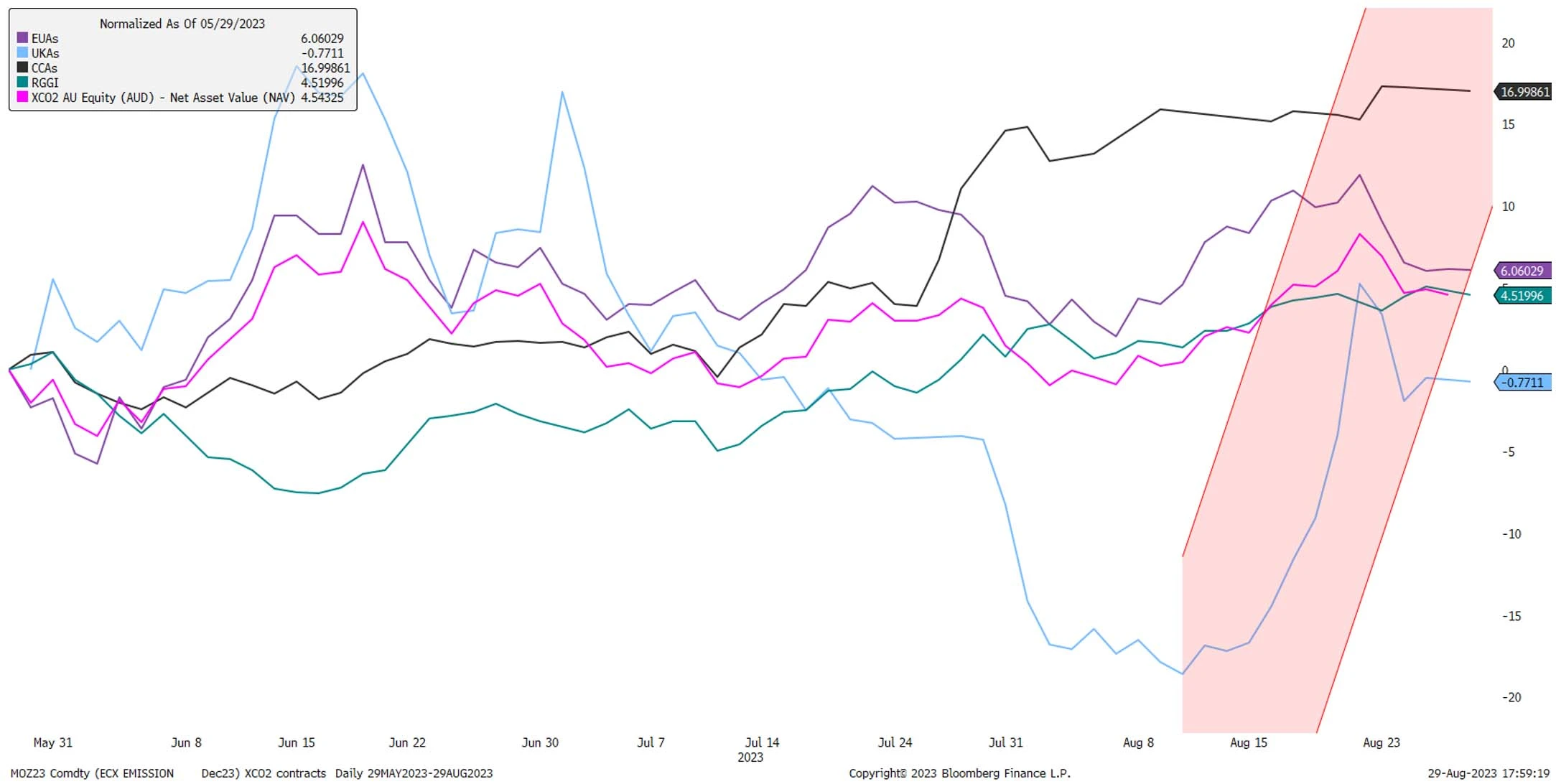

The currency movement has also been a tailwind for performance for Australian investors. The Australian dollar's weakness over the last three months amid weaker-than-expected resource demand from China helped the performance (the AUD is down 3.0% against EUR, down 4.2% against GBP and down 2.6% against USD).

Performance in local currencies:

Source: Bloomberg Past performance is not indicative of future performance.

Performance in AUD:

Source: Bloomberg Past performance is not indicative of future performance.

Investors can access global compliance markets on the ASX via the VanEck Global Carbon Credits ETF (Synthetic) (ASX: XCO2). For more detailed information on the carbon market outlook, you can access the report here.

Published: 06 September 2023