China bond market – A force to be reckoned with

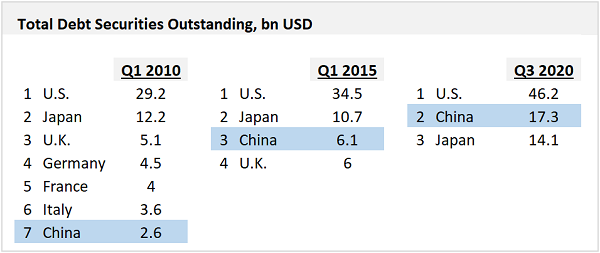

China is the second largest bond market in the world (on a country basis—see chart below). The progression over the past 10 years had been quite incredible—giving more support to the emerging “two-polar world” narrative, as regards independent global growth and policy drivers (just in case you were wondering, on a purchasing power parity basis, China’s share of global GDP is now above those of the US and the Eurozone).

Is that a sign of rising leverage? In part, yes. But this is also a sign of deepening local capital markets, and the maturing financial system (which can lead to a higher tolerance of corporate defaults, for example).

Another aspect of China’s bond market evolution is the currency—the correlations between the renminbi and EMFX (especially in Asia and Europe, the Middle East and Africa (EMEA)) are noticeably higher than a few years ago, which means that we can have greater spillovers across emerging markets (EM) from changes in China’s exchange rate policy. This is the reason why the latest comment from the central bank about using the renminbi’s appreciation to offset the rising commodity prices made quite a splash. Stay tuned!

Charts at a glance: Incredible evolution of China’s bond market

Source: Bank For International Settlements

Published: 21 May 2021