A summary of China’s recent earnings season

The Chinese earning season might have flown under the radar for many investors, overshadowed by the country’s zero-COVID policy and the property downturn. Here is a quick summary and we try to identify the risks and opportunities that potentially lie ahead for the remainder of the year.

The Chinese earning season might have flown under the radar for many investors, overshadowed by the country’s zero-COVID policy and the property downturn. Here is a quick summary and we try to identify the risks and opportunities that potentially lie ahead for the remainder of the year.

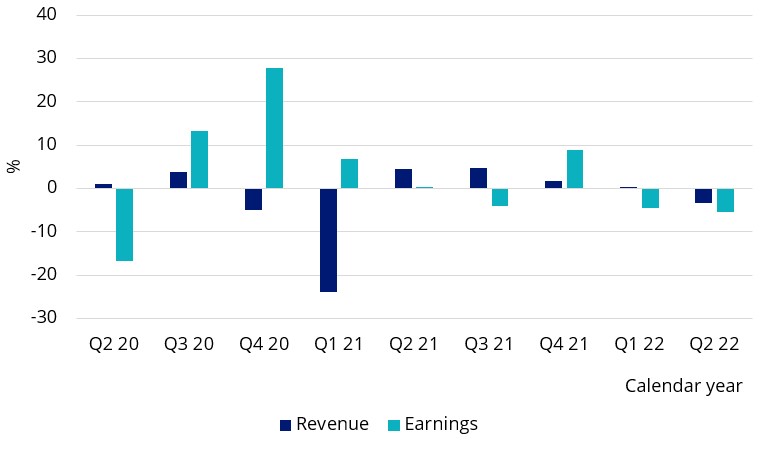

Overall, earnings surprised to the downside during the past quarter for China A shares. Given Shanghai had an extended period of lockdown in April and May, company operations were impacted.

Chart 1: Historical suprise

Source: Bloomberg, VanEck as at 7 September 2022. China A Shares is represented by the stocks with consensus estimates (60% of market cap) in the CSI 800 Index.

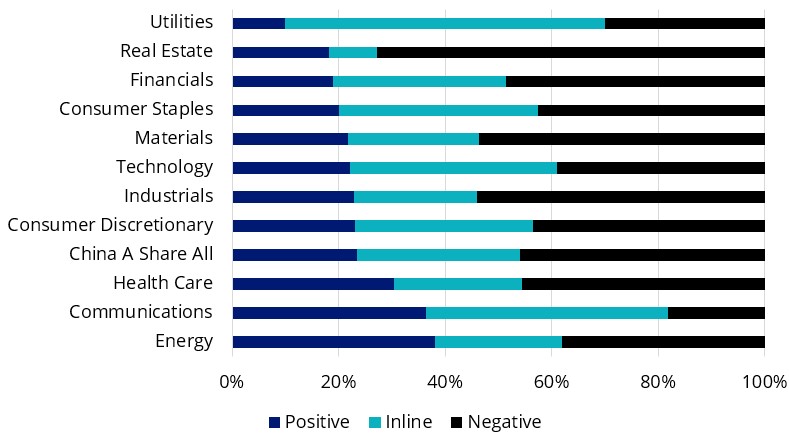

Looking at earnings by sector, energy was one of the few sectors that posted strong earnings (+40.26%) on an aggregate basis, followed by communications (+15.58%) and utilities (+1.03%). On the other hand, real estate was the largest drag (-47.28%), according to Bloomberg data.

Chart 2: Earnings Surprise by number of companies

Source: Bloomberg, VanEck as at 7 September 2022. China A Shares is represented by the stocks with consensus estimates (60% of market cap) in the CSI 800 Index.

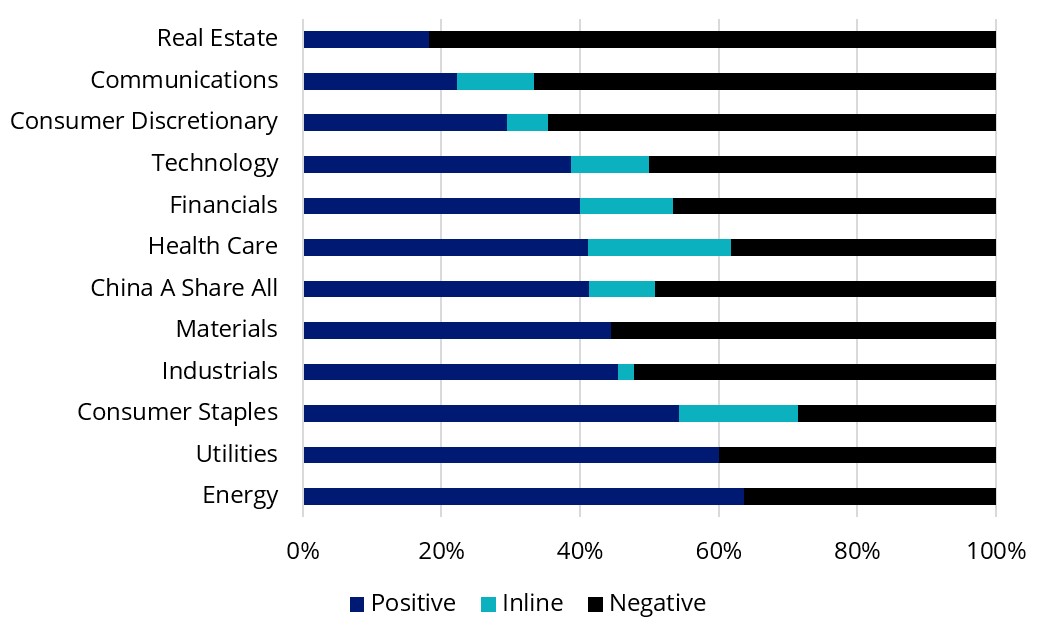

In terms of revenue, financials surprised to the upside the most (+7.62%) on an aggregate basis, while real estate was again a laggard, down by 34.12%.

Chart 3: Sales surprise by number of companies

Source: Bloomberg, VanEck as at 7 September 2022. China A Share All is represented by the stocks with consensus estimates (60% of market cap) in the CSI 800 Index.

In general, large-cap stocks have held up better compared to the small- and mid-cap counterparts, with stronger balance sheets to withstand the uncertainties lingering in the economy.

Energy stocks were the winners in terms of earnings surprise and quarter-on-quarter earnings growth (+66.42%). Companies such as PetroChina and Sinopec did well due to their strong upstream activities in oil and gas, and the gas price hike provided tailwinds. Another bright spot was consumer staples – the sector’s earning growth was ranked the second at 40.73%.

Even though the Chinese economy is not out of woods yet, earnings revision may start to see improvement at the end of the year. The good news is that we could have a clearer picture after the October Party Congress Meeting, in which the country’s senior leadership will consider its COVID policy potential resolutions and the troubled real estate sector.

Infrastructure investment is being used as an economic driver which may benefit the materials and industrials sectors. If the re-opening of the country finally eventuates, domestic consumption may rebound given the pent-up demand that has built up during lockdowns.

Published: 12 September 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.