A shift in China’s policy path could be near

China is considering raising its budget deficit for 2023 to help boost economic recovery with more stimulus to meet the official growth target.

China is considering raising its budget deficit for 2023 to help boost economic recovery with more stimulus to meet the official growth target, according to Bloomberg. The news comes as recent central bank and government support failed to boost growth in the world’s second largest economy. The plan is still subject to approval and could be announced as early as this month according to the news agency.

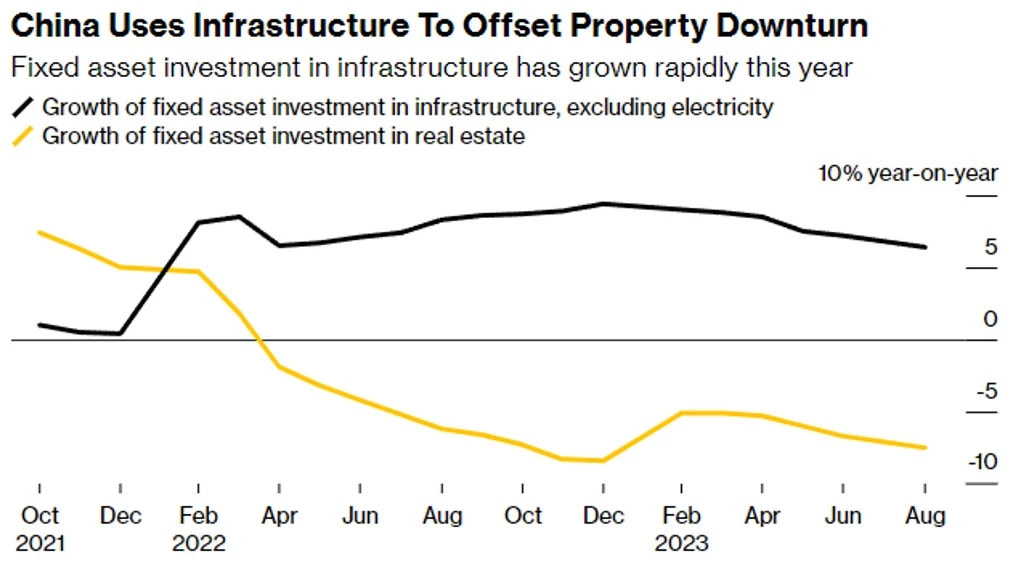

Bloomberg reported, “policymakers are weighing the issuance of at least 1 trillion yuan ($US137 billion) of additional sovereign debt for spending on infrastructure such as water conservancy projects.”

The move would mark a shift in Beijing’s stance as the government has so far avoided broader fiscal stimulus despite a deepening property crisis and rising deflationary pressure that have put the growth goal of around 5% for the year at risk.

According to Bruce Bang, chief economist at Jones Lang Lasalle Inc, “the ad hoc issuance of additional debt from the central government could provide extra policy support and more resources to re-engineer a stronger and faster recovery…“China’s recovery story could be a relay race” spurred by infrastructure investment at first before “hopefully” being fueled by spending among businesses and households.”

Source: China National Bureu of Statistics via Bloomberg.

Also this week China’s sovereign wealth fund snapped up shares in the nation’s big four banks and said it plans to continue the purchases, a move apparently aimed at boosting the stocks.

The news comes on the back of China’s extended Mid-Autumn and National Day holiday ‘Golden Week,’. Travel boomed in the country over the holiday with domestic tourism recording 826 million visitations and RMB753.4 billion in revenue. Both were higher compared to 2019 levels according to a recent note by Investment Bank Citi. Average spending also improved materially from the long Labor Day holiday.

Meanwhile, goods consumption enjoyed a broad-based boost from Golden Week. Citi said revenue of key retailers and restaurants increased 9% YoY. Compared to the cumulative reading of 7% for January-August this year. While cross border travel counts rose to 11.8 million, almost 3 times last year’s Golden Week and 85.1% of 2019’s.

Investment Bank Citi says recent data out of China confirmed a cyclical bottom amid continuous policy support and “see a synchronized upbeat of the economy and policies possible ahead of us.” Investors should continue to watch the China space closely as government policies continue to evolve.

Published: 20 October 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.