Inside the rise of star stocks in China’s new economy

China’s “new economy” has maintained its growth momentum despite growing tariff headwinds.

The bullish promises1made by China at its National People's Congress (NPC) earlier this year seems a distant memory given the ensuing escalation of US-China trade disputes. While China’s response has been muted relative to the bluster of the Trump administration, this has not necessarily been a reflection of weakness – particularly for China’s equity market.

In this note, we dive into the top performers in China’s technology, healthcare, consumer discretionary and consumer staples sectors as a proxy for the growth potential of its "new economy" segment.

Technology: The push for a domestic-powered AI value chain

Navigating a fierce competitive landscape amid escalating US tech sanctions in recent years, China’s artificial intelligence (AI) industry has continued to grow at a breakneck speed.

Further restrictions announced by Trump’s administration in late May against exporting any US-based AI technology (including critical chips and chip-design software) has galvanised China to build its own, fully domestic-powered AI value chain. As a result, China’s AI developers and provincial “smart city” programmers have shifted to domestic hardware manufacturers for critical supplies.

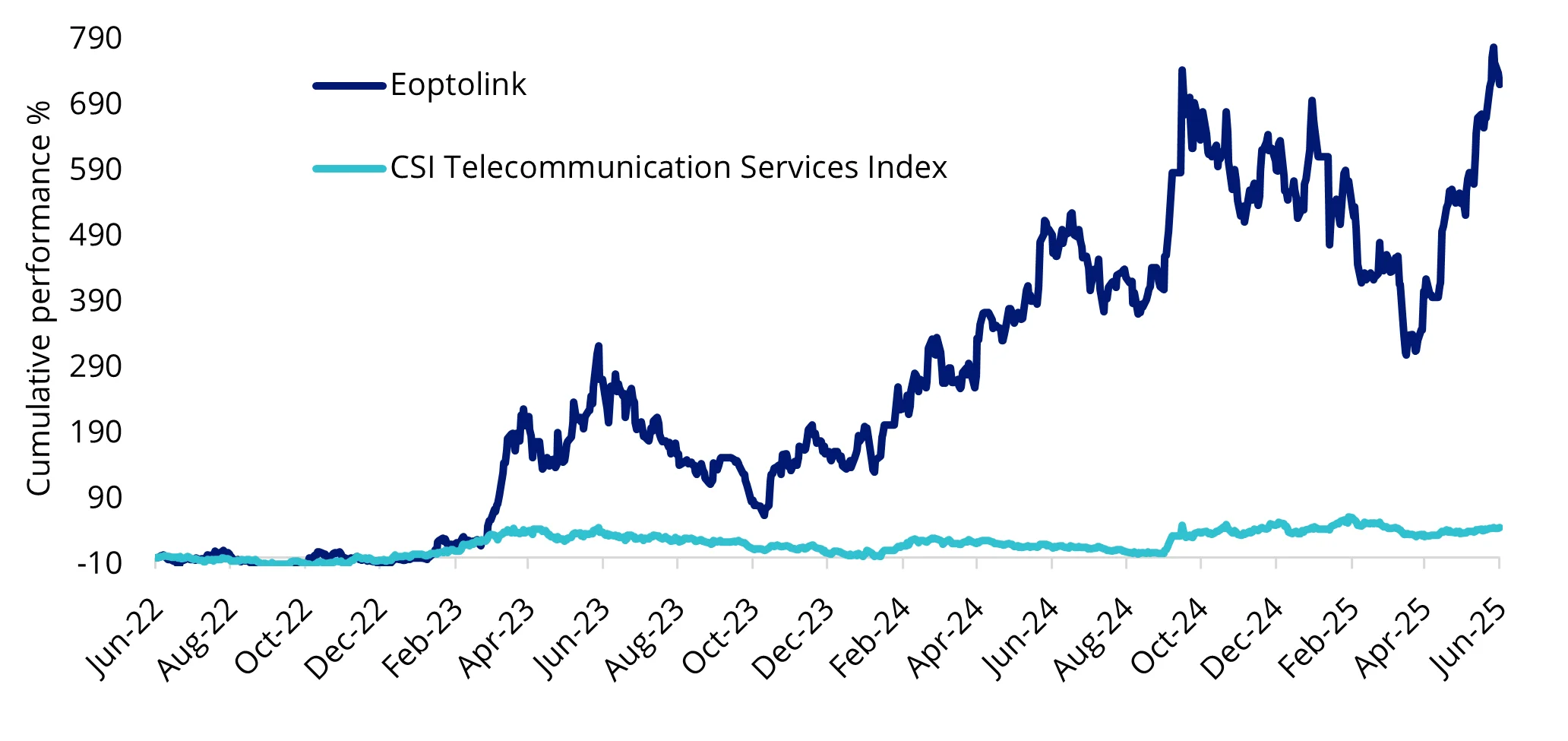

Stock in the spotlight: Eoptolink - up 63% since 3 April 2025

As China’s leading manufacturer of optical transceivers and critical components of data centres, Eoptolink is a direct beneficiary of China’s AI localisation push. Cloud operators in China have been lining up to lock in long-term orders for Eoptolink’s modules pursuant to the government’s “buy Chinese” mandate.

At the Optical Fiber Communication Conference & Exhibition (OFC) in San Francisco this year, Eoptolink unveiled its new 800G and 1.6T transceivers, which it claims could enable AI developers to wire GPU clusters using half the hardware, cabling, and energy currently required. This “DeepSeek style” efficiency has further boosted investor confidence in the company’s outlook.

Chart 1: Eoptolink’s growth in recent years

Source: VanEck, Bloomberg. Data to 23 June 2025. Performance in AUD. Not a recommendation to act. Past performance is not indicative of future performance.

Healthcare: Roadblocks cleared for innovation

Covered by the “AI+”2 initiative announced at the NPC this year, the healthcare sector has benefited from policy stimulus and market tailwinds. AI-led product design, such as DeepSeek’s breakthrough protein-design earlier this year, has demonstrated significant potential as a way for pharmaceutical companies to streamline and reduce the cost of drug development processes.

From April 2025, China’s National Healthcare Security Administration (NHSA) introduced a Category C fast-track that cuts the approval time for high-cost, innovative domestic drugs to apply for reimbursement on the National Reimbursement Drug List (NRDL). This allows pharmaceutical companies, particularly those at the cutting edge of healthcare innovation, to earn insured sales several quarters sooner. Furthermore, drugs that pass Category C approval are exempt from deep price cuts and bulk-purchase quotas, allowing them to capture higher margins.

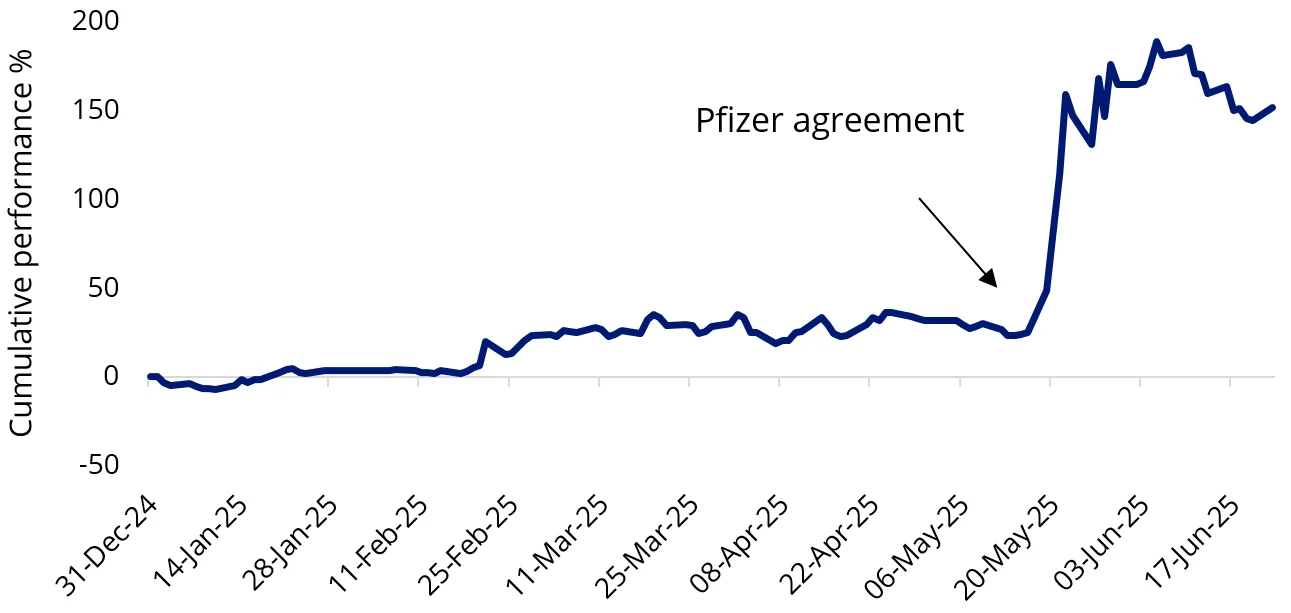

Stock in the spotlight: Sunshine Guojian Pharmaceutical (or “Sunshine”) - up 112% since 3 April 2025

Sunshine Guojian Pharmaceutical-A has surged more than 150% year to date (as of 23 June 2025) within this pro-innovation environment. The company developed China’s first antibody for TL1A, which clinical studies have shown to have a critical role in inflammatory bowel disease patients.

The company’s next generation SSGJ-707, a treatment for advanced lung cancer, is now on the fast track for new Category C reimbursement. This breakthrough has led to a landmark licensing agreement with Pfizer, worth up to US$6 billion, which has led Sunshine’s stock to surge a whopping ~107% between 16-22 May. The Pfizer deal has been viewed by markets as a credible endorsement of the efficiency of major Chinese drug makers, forming tailwinds for the sector.

Chart 2: Sunshine Guojian Pharmaceutical’s “Deepseek” moment

Source: VanEck, Bloomberg. Data to 23 June 2025. Performance in AUD. Not a recommendation to act. Past performance is not indicative of future performance.

Consumer discretionary & staples: Government support bolstering domestic consumption

Years of economic downturn since COVID-19 have pushed Chinese households into a “saving-over-spending” mindset. To stimulate domestic consumption, the Chinese government has doubled the budget for the consumer goods trade-in program to RMB 300 billion in 2025. This nationwide program aims to incentivise Chinese consumers to swap old appliances and vehicles for lower-emission models. As a result, domestic EV makers, particularly affordable local brands qualified for the “trade-in” policy, have received a boost in earnings.

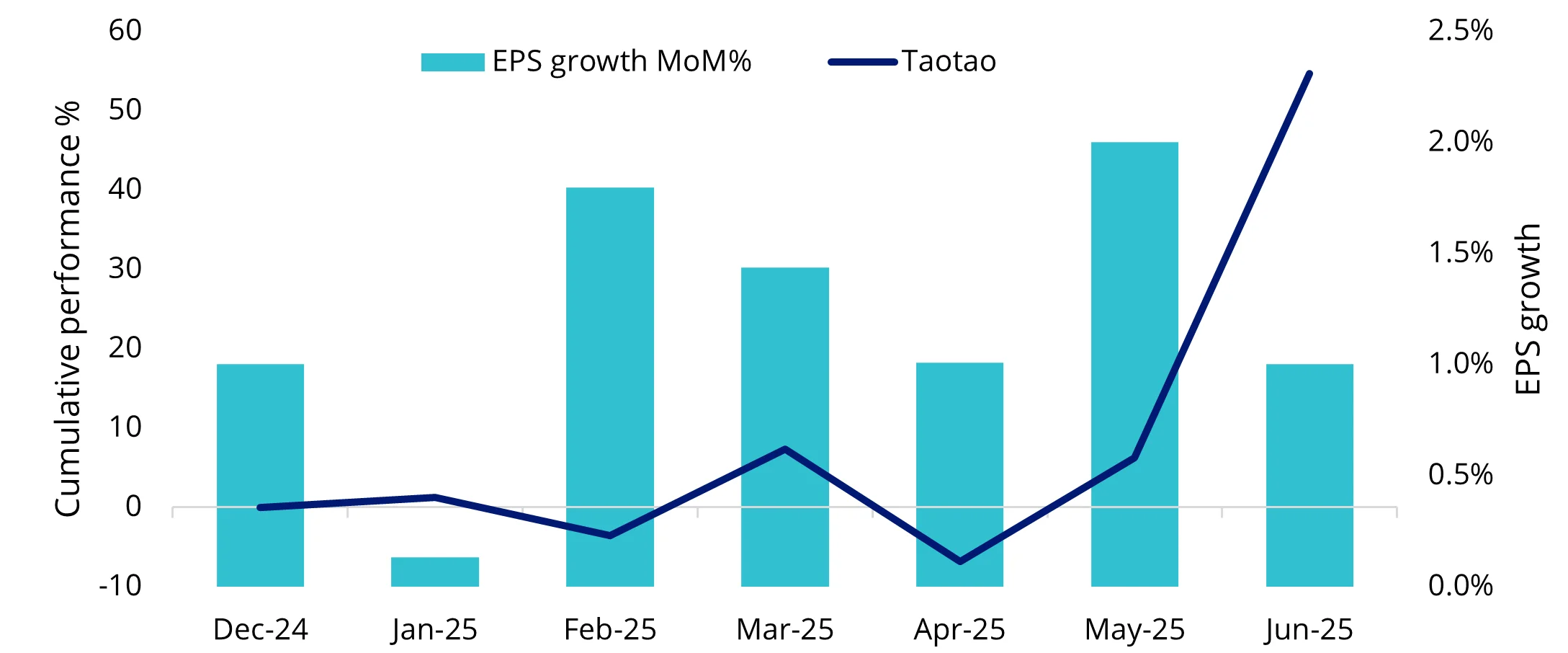

Stock in the spotlight: Zhejiang Taotao Vehicles - up 59% since 3 April 2025

The electric scooters and low-cost EVs manufactured by Zhejiang Taotao Vehicles qualified for both the national “trade-in” program and Zhejiang province’s local top-up EV subsidy, reducing the company’s purchase cost significantly. TaoTao saw a spike in orders from rural logistics fleets and “smart city” ride-share projects, further strengthening its revenue outlook.

Chart 3: TaoTao’s rally backed by positive EPS growth

Source: VanEck, Bloomberg. Data to 23 June 2025. Performance in AUD. Not a recommendation to act. Past performance is not indicative of future performance.

Shifting focus to consumer staples, there’s been a noticeable change in consumer behaviour in recent years, impacted by an aging population and tougher job markets. China’s “Special initiatives to boost consumption” plan announced in March, includes a 30-point strategy that channels government funding support for marketing, tax relief, and credit for the pets, wellness, and outdoor activity sectors, making these the new “hot tickets” in consumer stapples.

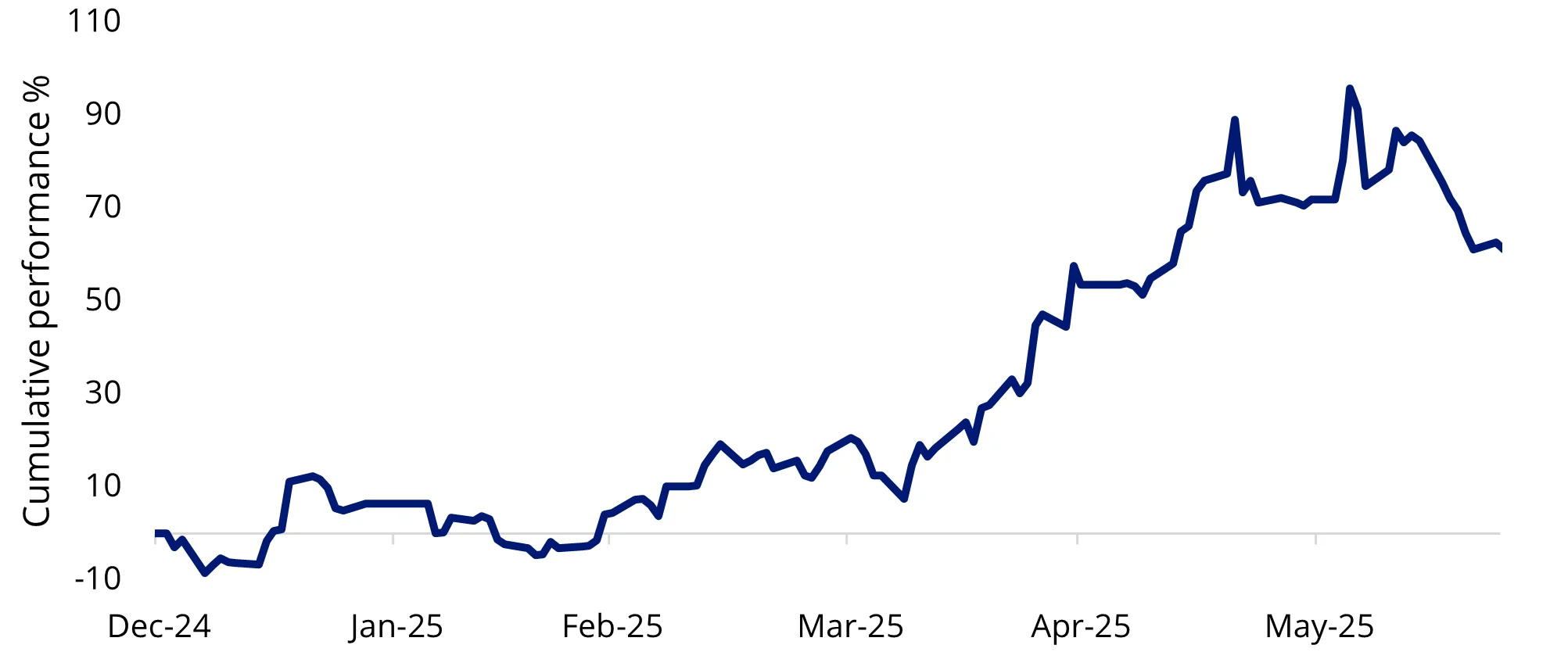

Stock in the spotlight: Yantai China Pet Foods (“Yantai”)- up 44% since 3 April 2025

Sitting at the crossroad of the “special initiatives” and China’s aging population, Yantai’s focus on premium pet food and treats saw its most recent revenue numbers up by 18% and profit up by 30% YoY. In May, the company further boosted its revenue outlook with newly-signed export agreements across Southeast Asia.

Chart 4: Yantai a clear beneficiary of China’s “special initiatives”

Source: VanEck, Bloomberg. Data to 23 June 2025. Performance in AUD. Not a recommendation to act. Past performance is not indicative of future performance.

Accessing China's “new economy”

VanEck’s China New Economy ETF (CNEW) invests in 120 fundamentally sound and attractively valued companies considered to have strong growth prospects in China's technology, healthcare, consumer staples, and consumer discretionary sectors, which are collectively considered as the “new economy” stocks in Chinese equities. Despite navigating a challenging macro environment characterised by rising tariff risks, geopolitical tensions and structural growth challenges, CNEW’s losses from “Tariff Liberation Day” in April were recovered by the next month. The Fund has maintained a gain of nearly 20% over the past year.

Key risks:

An investment in CNEW carries risks associated with: ASX trading time differences, China, financial markets generally, individual company management, industry sectors, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the relevant PDS and TMD for more details.

Source:

1NPC 2025: China’s bold bet on AI, stimulus, and growth

2The term "AI+" in the 2025 NPC (Two Sessions) represents China’s strategic push to integrate artificial intelligence (AI) into key industries to drive economic transformation.

Published: 02 July 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.