The investment case for bitcoin

What is bitcoin?

Bitcoin is often called ‘digital gold’ because, like the metal, it is a potential store of value. Bitcoin was the first cryptocurrency - a decentralised digital currency independent of governments and central banks. It was designed as a peer-to-peer electronic medium of exchange and since its creation in 2009 has undergone rapid growth and change. It has become a significant currency both on- and offline and currently has a market capitalisation in excess of US$1 trillion1, which is higher than Berkshire Hathaway and more than double the market cap of Tesla2.

Like gold, bitcoins are mined and share other characteristics with the shiny yellow metal which include:

- Limited supply: There will be a maximum supply of 21 million bitcoins. This scarcity means that the price could move upward as adoption increases.

- Increasing adoption: Bitcoin has been gaining traction in terms of the number of merchants that accept it as payment.

- Potential inflation hedge: Monetary stimulus is currently eroding purchasing power globally and bitcoin is not subject to the same inflationary manipulation as traditional currencies.

- Diversification benefits: Bitcoin tends to be uncorrelated to traditional asset classes.

However, unlike gold, bitcoin:

- Splits according to a schedule: While there will be a finite number of bitcoins, new bitcoins are still available to be mined and continue to enter circulation. In addition, coins undergo a “halving” approximately every four years and these have historically been followed by price surges.

- Divisible: As a physical asset, gold can only be divided into smaller units to a certain extent, making smaller transactions cumbersome and, in some instances, impractical. Bitcoin, on the other hand, is divisible up to eight decimal places (with the smallest unit called Satoshis), making it easier to use for microtransactions.

- Has unique transparency: All bitcoin transactions are publicly accessible and permanently recorded within the bitcoin network. However, the transactions can also be anonymous.

Bitcoin has a history of a robust performance

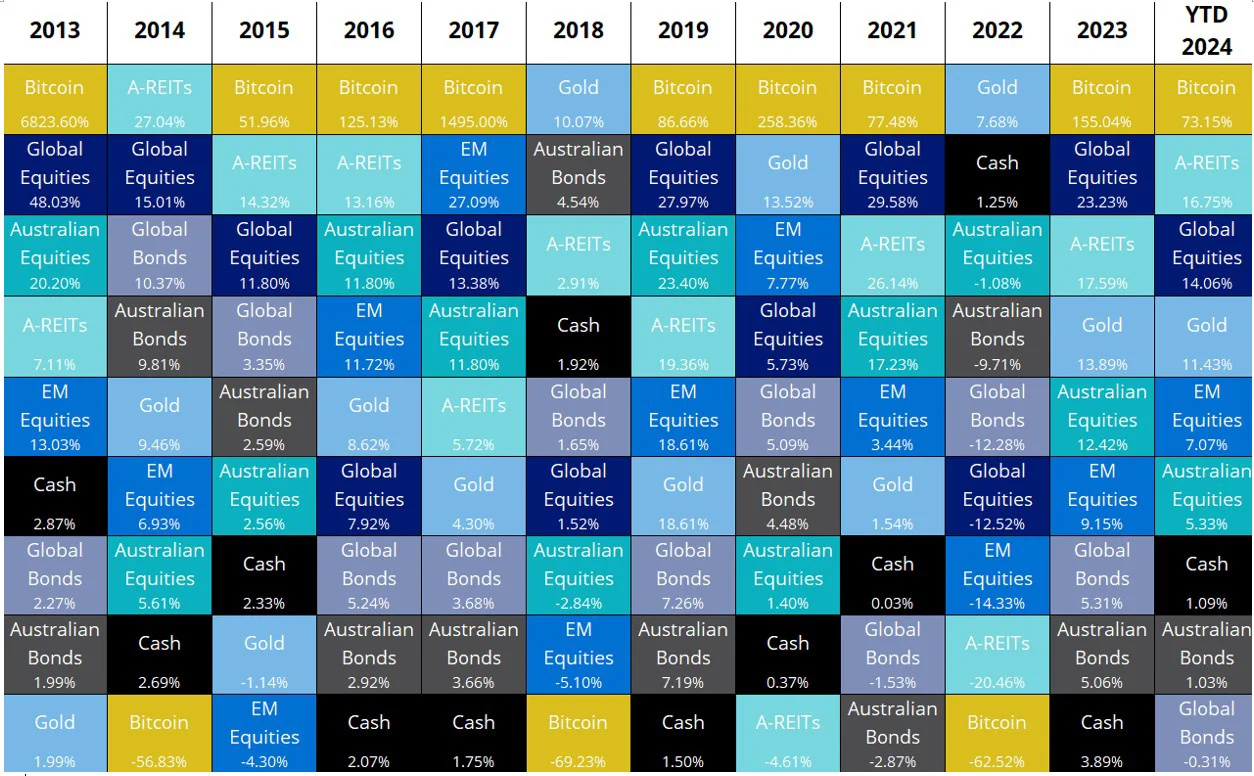

Despite its infamous volatility, bitcoin has managed to outshine other asset classes over the past decade. In fact, it has been the best-performing asset class for eight out of the past eleven years. Although, as always, past performance is not indicative of future performance.

Let's take a closer look at bitcoin's historical returns for various holding periods:

|

Holding period (years) |

Total cumulative return |

|

1 |

149.91% |

|

3 |

19.73% |

|

5 |

1634.35% |

|

7 |

6664.23% |

Source: Bloomberg as at 31 March 2024. BBX index used. In US dollars. Past performance is not indicative of future results. You cannot invest directly in an index. The value of bitcoin is highly volatile.

These figures underscore the incredible growth potential that bitcoin has exhibited over time, making it an attractive option for investors seeking high return potential commensurate with a high risk tolerance.

Figure 1: Bitcoin has been the best performing asset class in 8 out of the past 11 calendar years

Source: Morningstar, as of 31 March, 2024. Bitcoin is represented by MarketVector Bitcoin PR USD; Cash is Bloomberg AusBond Bank 0+Y TR AUD; Gold is LBMA Gold Price PM USD; Emerging markets is MSCI EM NR AUD; Global equities is MSCI World Ex Australia NR AUD, Australian bonds is Bloomberg AusBond Composite 0+Y TR AUD; A-REITs is S&P/ASX 200 A-REIT TR; Australian equities is S&P/ASX 200 TR AUD. Past performance is not indicative of future results. You cannot invest directly in an index. The value of bitcoin is highly volatile.

Bitcoin’s limited supply creates scarcity; scarcity typically leads to increased value

There will only ever be 21 million bitcoins in existence. This supply cap was designed intentionally and is one of the primary characteristics of bitcoin. Furthermore, bitcoin has “halvings” programmed into it. A halving is defined as a 50% block reward cut to the bitcoin production rate, meaning bitcoin miners will earn half as many bitcoins as they did prior to the halving event. Halvings occur roughly every four years and results in a slowdown in the rate at which new bitcoins are introduced into circulation over time until it eventual reaches zero (estimated to occur around the year 2140).

These halvings decrease the profit from mining bitcoin and will occur until the supply cap is reached. In addition, the built-in finite supply of bitcoin means that it is not subject to inflation in the same manner that fiat currencies are. Central banks around the world have ushered in unprecedented growth in money supply, effectively eroding their currencies’ purchasing value. In comparison, bitcoin’s limited supply and increased mining cost over time may support the idea of bitcoin as a long-term store of value.

The last halving occurred on 20 April 2024. Historically, the price of bitcoin has rallied leading up to and following a halving.

Bitcoin as a hedge against inflation

Unlike fiat currencies, which can be printed by governments and central banks, bitcoin has a fixed supply, with supply growth decreasing by 50% roughly every 4 years with the halving events. Bitcoin is not subject to the same inflationary pressures caused by fiat money supply growth, making it an attractive option for investors concerned about the impact of inflation on their portfolios and their subsequent purchasing power.

Bitcoin’s decentralised nature makes it less price sensitive to geopolitical events or economic policies that may lead to currency devaluation, such as QE (quantitative easing) or excessive government spending.

Bitcoin is increasingly becoming a mainstream asset class

The SEC approval of bitcoin ETFs has transformed crypto into a regulated asset class in the US. This is undeniably a significant step in the maturity and mainstream acceptance of bitcoin and digital assets broadly. It enables the wealth management community and individuals to access bitcoin via a regulated and insured investment vehicle, opening up the asset class to institutional investors including hedge funds, sovereign wealth funds, pension funds, 401Ks and registered investment advisors.

This is a scenario that is playing out globally, with the asset management establishment increasing adopting bitcoin as a mainstream currency and asset class.

Now, more than ever, merchants and businesses are accepting bitcoin as a form of payment and infrastructure has been built to make it more convenient for the average person to use. Users can now buy and pay for items using bitcoin wherever PayPal is accepted. The development of user-friendly wallets, exchanges, and marketplaces has removed the technical barriers to entry that existed in bitcoin’s early years.

1MVIS, as at 2 May 2024.

2Bloomberg, as at 2 May 2024.

Last Updated On: 05 May 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.