A haven from developed markets financial follies

As developed markets central banks juggle between tightening with higher rates, while loosening by adding liquidity to fragile banking systems, there is little wonder investors’ confidence is waning. Investors are searching for an asset that is supported by demand and has sound fundamentals, that is rewarding investors commensurate to the risk taken. But the answer may be hiding in sight. An answer over 30 years in the making.

Emerging markets aren’t immune to the turmoil sweeping their Western peers. They are however, holding up better. Unlike developed markets’ central banks, it seems a good number of emerging markets have learned the lessons of the past.

It has been an interesting few weeks on markets, but one of the bright spots has been emerging markets bonds, particularly selected local-currency bonds, which is exhibiting positive signs, a bright spot, in the current market environment.

Investors are on edge about the US and European financial systems following the collapses of Silicon Valley Bank, Signature Bank and the bail out of Credit Suisse.

As every crisis is a test, emerging markets are passing with flying colours so far.

Many people made their views about emerging markets bonds during the 1980s and 90s. This prejudice has flowed through to portfolio construction today, where emerging market bonds, as an asset class is rare. The result is that most portfolios have missed out the bonds that have had some of the strongest returns and risk/return profile of the last 20 years.

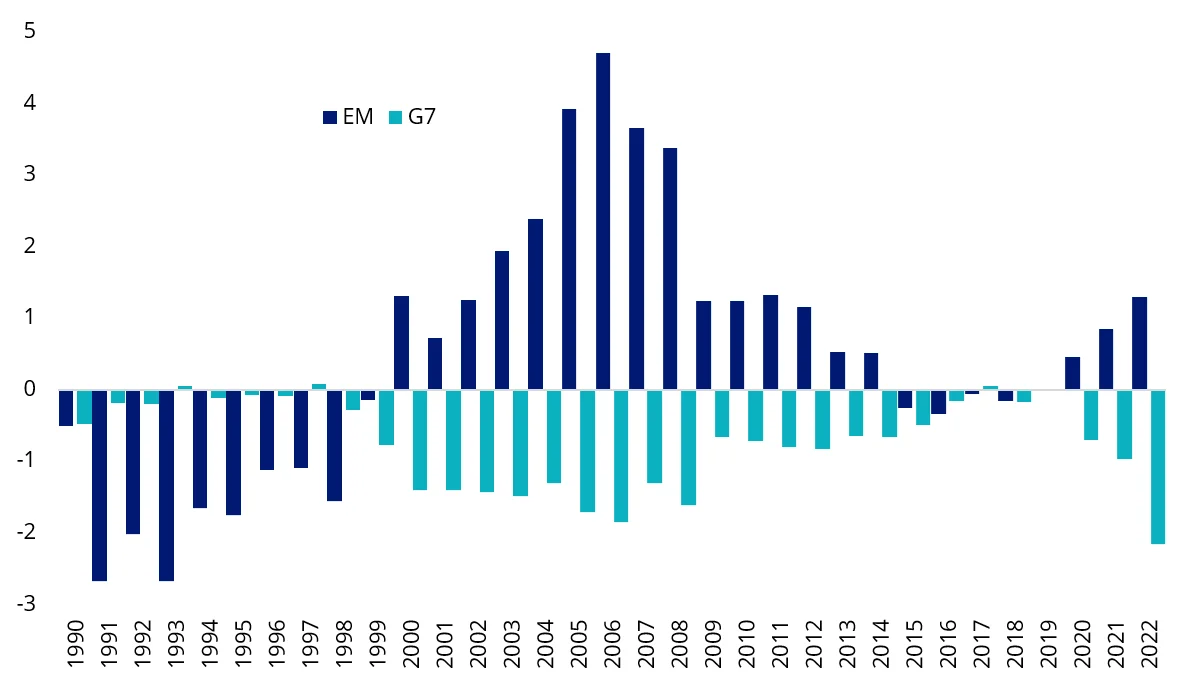

The below chart tells a part of the story of how this came to be.

Chart 1: Emerging markets and developed markets current account balances, % GDP

Source: IMF, Bloomberg. Data as of January 2023.

You can see in the 1990s, emerging markets ran high deficits resulting in many defaults. Think the Asian and Russian debt crisis, but then during the start of the century authorities in emerging markets became more fiscally sound. At the same time developed markets incurred deficits, made worse during the crises of 2008. At this time, developed markets central banks resorted to unorthodox policy, while in emerging markets central banks fought inflation.

During COVID, developed markets went further into debt, worse still, when inflation came it was overlooked as ‘transitory’. Emerging markets’ central banks were generally ahead of the inflation curve and hiked interest rates earlier and more aggressively than developed markets. The result, emerging markets economies are in better shape than developed markets and policy makers can better manage turbulence. If needed, emerging markets central banks can hike interest rates without bankrupting the government, like we almost saw in the United Kingdom, but for the Bank of England’s unconventional intervention undertaken without consulting its Monetary Policy Committee.

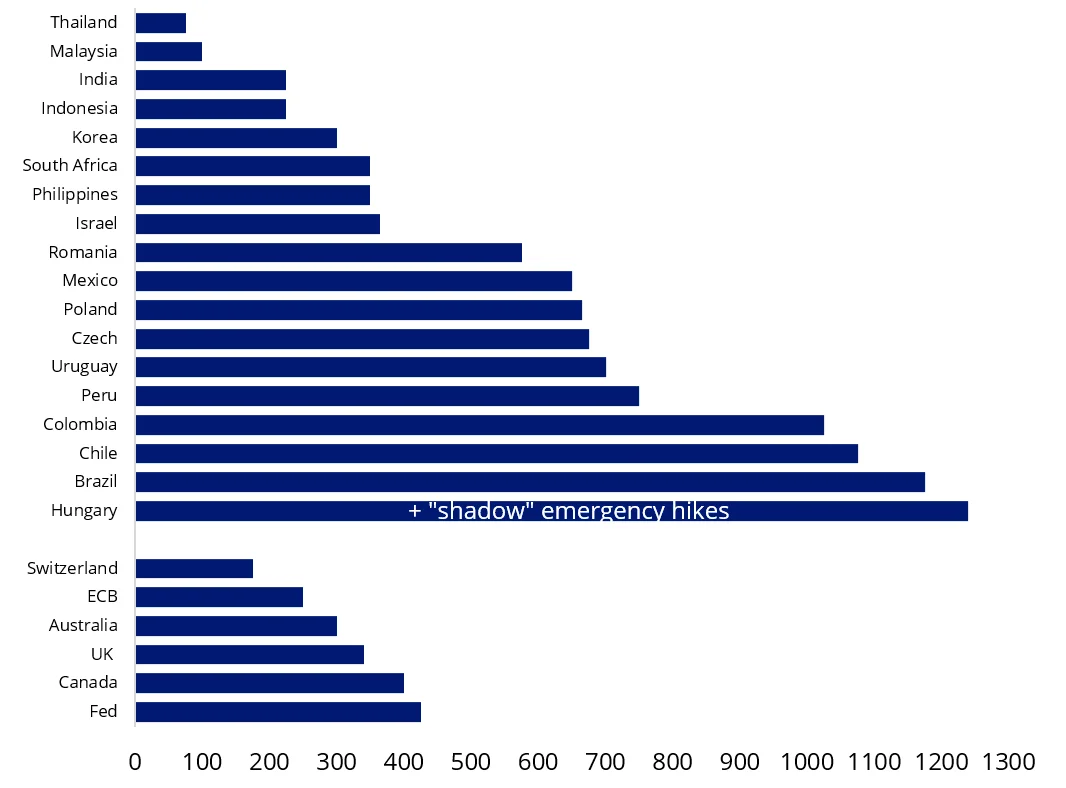

Chart 2: Global Policy Rate Changes - From COVID Min to Post-Pandemic Max, bps

Source: VanEck Research; Bloomberg LP. Data as of January 24, 2023.

Past shocks and widespread volatility have left emerging market financial sectors, on the whole, more consolidated, more firmly regulated, and more careful about matching assets to liabilities than the US and Europe.

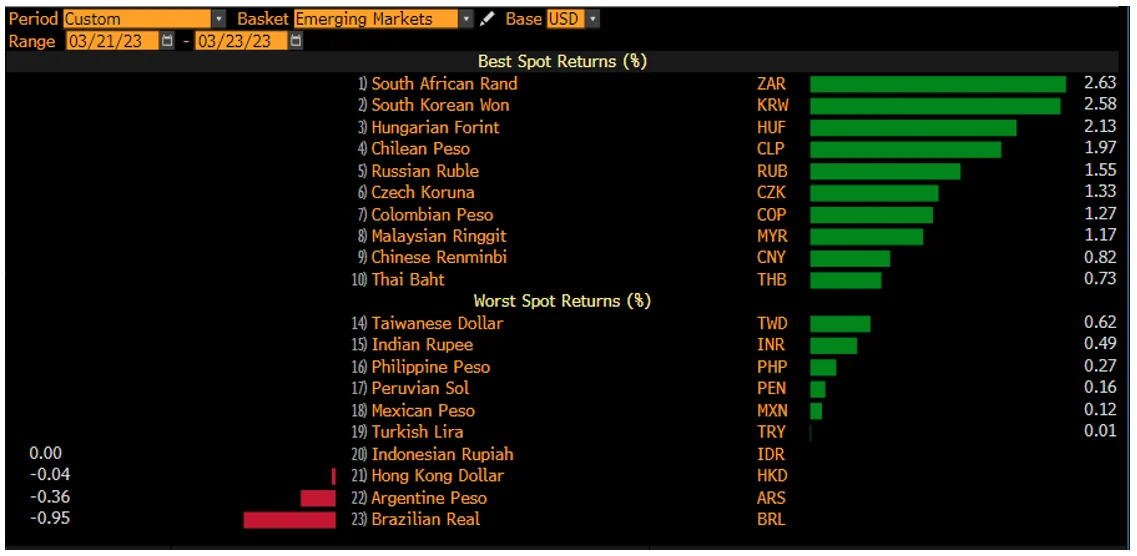

Twenty-plus years of fiscal prudence is playing out now, virtually all emerging markets currencies rallied following US Federal Reserve Chair’s Jerome Powell’s press conference on 21 March 2023 as he managed the US central bank’s response to the banking crisis sweeping across Europe and the US. There was only one emerging markets currency that was weaker, and it was the Mexican peso (the Argentine Peso is still non-investible in our opinion). This too makes sense; Mexico is a bundle of economic and asset-price correlations with a US characterised by recession and other risks.

Chart 3: EM Currencies following Federal Reserve meeting March 2023

Source: Bloomberg

The market is connecting-the-dots on the implications of the current crisis, and there are two –the attractiveness of emerging markets bonds and the correlating unattractiveness of developed markets bonds. We expect money from one to flow to the other.

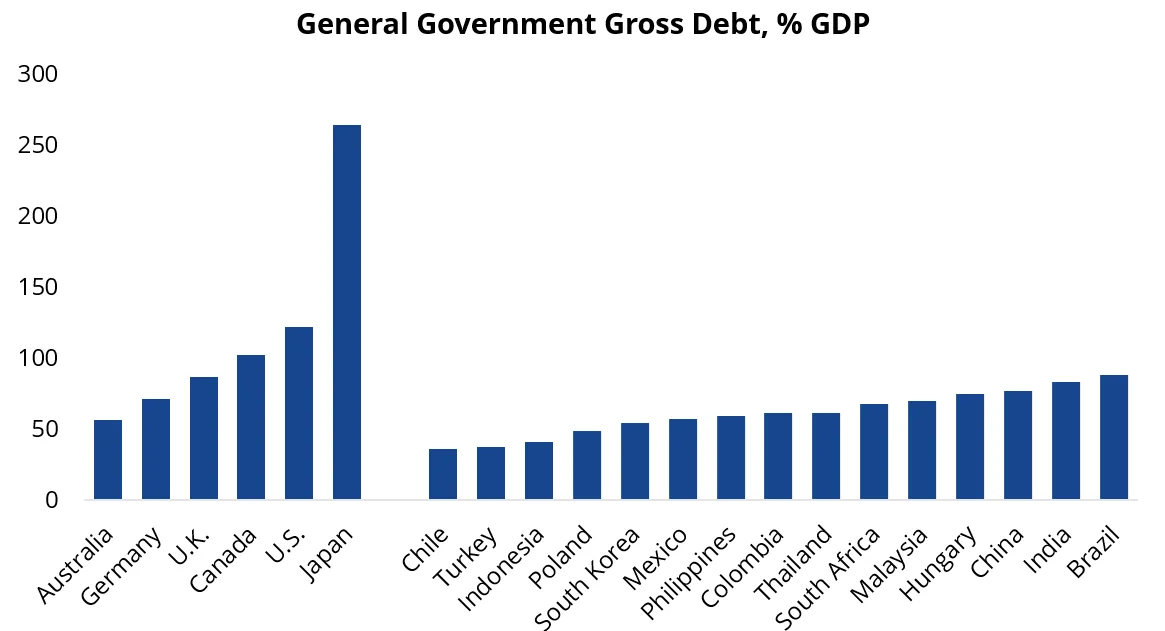

In terms of fundamentals, emerging markets generally have low debts and deficits.

Chart 4: Debt levels of emerging market countries are relatively attractive, % GDP

Source: IMF. Data as of October 2022.

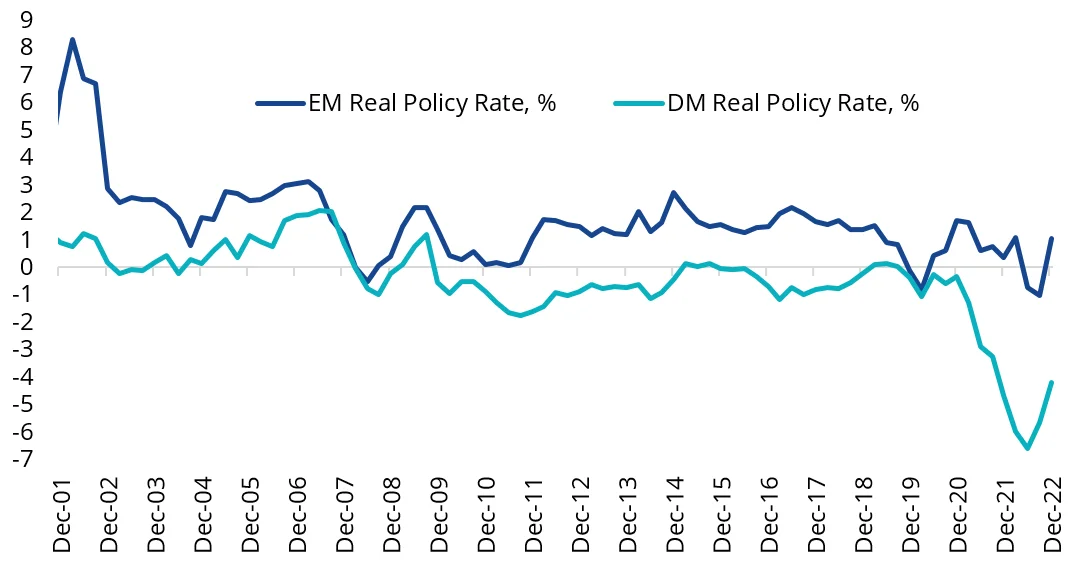

The primary focus of emerging markets’ central banks has been to concentrate on controlling inflation not asset prices. They have done this by maintaining high real interest rates. For investors, the result has been not only higher nominal yields but higher real yields. The benefits to emerging markets local currency investors are a more substantial level of income that is not eroded by the loss of purchasing power (further compounded by a potentially weakening currency). Additionally, if the central bank's actions are successful in controlling inflation, it can lead to a stronger and more stable economy.

Chart 5 Real Policy Rates in emerging markets are higher, %

Source: VanEck Research; Bloomberg LP. Data as of January 2023.

The push out of developed markets into emerging markets

All of these dynamics are resulting in a push out of developed markets and into emerging markets, in our view. The push out of developed markets is fairly straightforward, at first glance. The US yield curve is pricing in a recession but hasn’t yet escaped inflation fears, which must be overcome for any meaningful cutting in the future. The market view is that Fed hikes increase recession risks, while easing keeps the inflation genie out of the bottle. By way of contrast, emerging markets don’t have these problems, in general. For example, even a “problematic” country like Brazil sports 13% rates and 5% inflation.

Emerging markets benefitting from commodity prices

Unlike developed markets, which experience higher commodity prices as a price shock, emerging markets export more commodities than they import, which means they benefit from higher prices. This dynamic means emerging markets are good creditors in dollar terms and have dollars on hand to stabilise their local currency if needed.

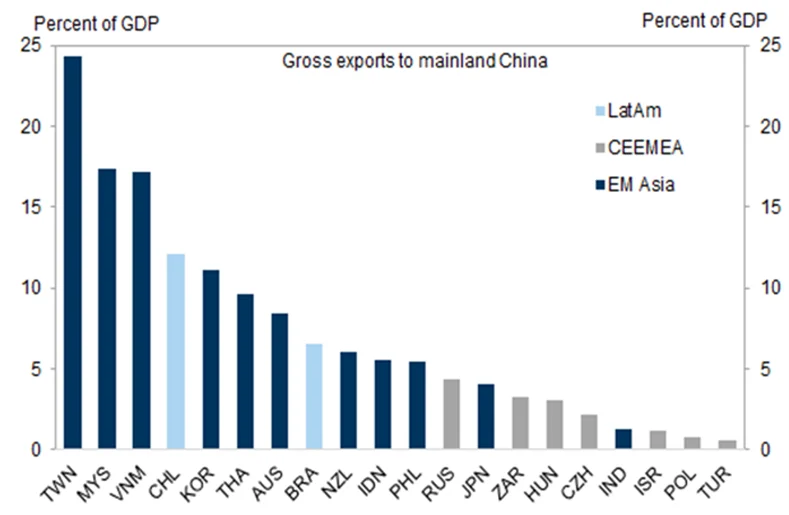

And for investors choosing between equity and debt exposure in emerging markets, keep in mind that net commodity exporters make up a much more significant portion of most emerging markets local debt indices than they do of emerging markets equity indices, which tend to be much more concentrated in the Asian export-led economies.

Emerging markets debt stands out as having asset prices that can benefit directly from China’s reopening with its higher yielding bonds that can generate returns in a potentially sideways, choppy or bumpy bond world. Chart 6 shows those countries expected to benefit most from a resurging China and demand for resources. Many emerging markets stand out as beneficiaries of higher commodity prices, not victims of them.

Chart 6: China’s reopening and direct repercussions for commodities and rest of world growth

Source: Haver Analytics, Goldman Sachs Investment Research, 2022

We believe that to take full advantage of the opportunities within the EM bonds universe, it is necessary to take an unconstrained active approach to bond selection, to avoid having the highest weighting to the most indebted, poorly run nations.

EBND, VanEck’s emerging markets bond ETF, therefore takes an unconstrained approach and invests in bonds that offer the best value relative to their fundamentals while managing risk.

Most Australian investors have been missing the opportunities presented by emerging markets bonds, but many are waking up to the benefits they offer, a way to diversify from developed markets central bank follies.

Published: 31 March 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.