China growth – diverging tracks?

Supply shocks and regulations continue to weigh on China’s manufacturing activity gauges. However, services rebounded strongly in September – an encouraging sign for the near-term growth outlook.

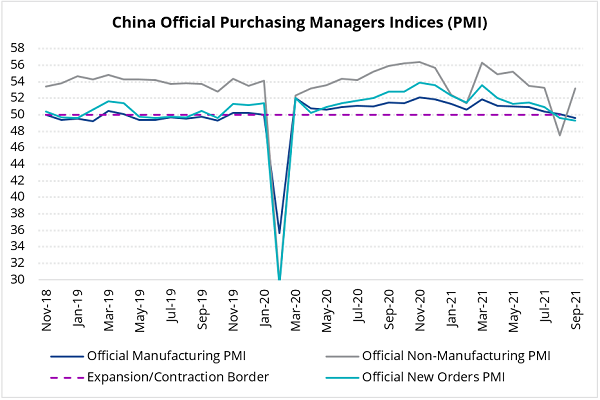

China’s latest activity gauges show that tighter regulations, supply shocks and logistical bottlenecks continue to weigh on the industrial sector. The official manufacturing PMI (Purchasing Managers Index) slipped into contraction zone (49.6) in September, for the first time since February 2020, and details show that deterioration was widespread. Recent reports indicate that some supply side constraints might be easing (first of all in Asia), but it is probably too late for this year, and this factor will limit China’s manufacturing rebound in Q4, especially in energy-intensive sectors. The on-going weakness in new orders (see chart below) and new export orders also point to near-term demand-side growth headwinds.

Against this backdrop, it is noteworthy that authorities are not in the mood to reopen credit spigots and continue to dispense policy support sparingly. There are also no signs of easing the regulatory crackdown or giving up on the environmental targets. The emphasis right now is on providing adequate liquidity (the central bank’s almost daily injections), and limiting Evergrande’s spillovers into the real economy. The government signaled earlier this month that it wants to step up infrastructure investments to prop up growth, but it is unclear how this will work if the energy crunch continues. Another observation is that the current policy response is yet to produce noticeable relief for small private-owned companies. This month’s small companies PMI moved deeper into contraction zone, reaching the lowest point since February 2020 (47.5).

One thing that we find encouraging in today’s release is a sharp rebound in China’s services PMI (see chart below), which reflected not only seasonal holidays (Mid-Autumn Festival), but also the end of lockdowns. China’s full vaccination rate reached 73% (according to Bloomberg LP), so hopefully this will limit activity disruptions during future virus outbreaks. The services rebound is a good sign, not only for China’s growth, but also for those emerging markets that stepped up COVID vaccinations in recent months – especially in emerging Asia, which lagged behind LATAM and EMEA.

Charts at a glance: China’s activity gauges – mixed fortunes

Source: Bloomberg LP

Published: 30 September 2021