China growth – reboot and rebalance

Global growth outlook

China’s stronger-than-expected Q1 GDP number (4.5% year-on-year) gave more credence to the “two-speed” global growth story, which creates more opportunities for emerging markets assets to perform well in the coming months.

China’s Q1 GDP print suggests that both the consensus growth forecast for 2023 (5.3%) and the official growth target (about 5%) might be too conservative.

The next question is which emerging markets are better positioned to benefit from a stronger rebound in China, and this is where China’s changing growth drivers come into play.

China recovery

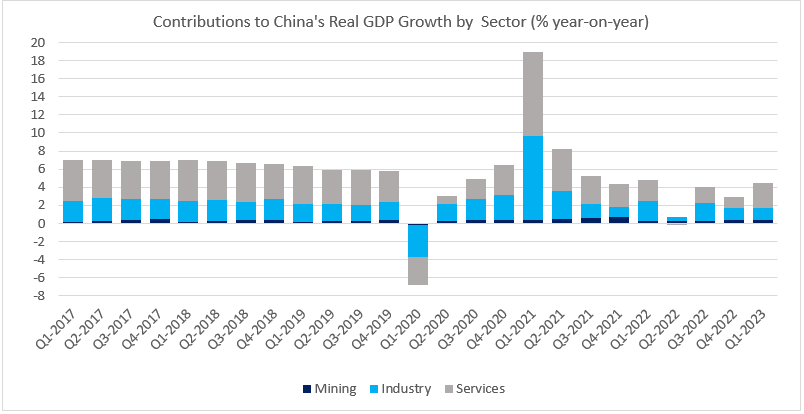

China’s Q1 recovery was led by consumption (see chart below), including post-reopening “revenge” spending on services and travel, among other things. A big upside surprise in March’s retail sales (up by 10.6% year-on-year) seconded this conclusion. This, in turn, gave rise to suggestions about the frontloaded recovery that might lose steam later in the year. “Revenge” spending is not going to last forever, of course, but there is also a possibility that housing can pick up the baton in H2 if the current real estate trends – which show clearer signs of recovery – continue. Further policy calibration can definitely help to boost property construction, as well as address such obvious weaknesses as private investments, which continued to lag well behind state-owned peers.

Emerging markets spillovers from China

China’s recovery is now more “inward-looking”, limiting positive spillovers to emerging markets manufacturing, but still offering support to services - especially tourism - and commodities. And if growth continues to surprise to the upside, we might see more concerns about potential inflation spillovers down the road, which can intervene with a super-supportive H2 base effect across emerging markets. Other potential risks that might slow or temporarily disrupt the disinflation process in emerging markets include Argentina’s mega-drought and a higher risk of El Nino (a 40% probability, according to a recent report from Deutsche Bank).

Chart 1: China growth – services spring back to action

Source: Bloomberg

Published: 21 April 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.