Emerging markets growth outlook

The accelerating pace of vaccinations can be a powerful tailwind for emerging markets growth.

Reports about COVID flare-ups and new lockdowns raise legitimate concerns about the near-term growth outlook in emerging markets (EM). The situation, however, is not necessarily one-dimensional. Yes, the average 2021 growth forecast (Bloomberg consensus) for countries with the administered vaccine doses/population ratio of less than 20% was cut by 0.26% in the past three months. At the same time, the average 2021 growth forecast for countries where the ratio is above 20% was raised by 0.46%. So, even though some countries are going through a rough patch right now (Malaysia), the accelerating pace of vaccinations could be a powerful tailwind for EM growth as a whole.

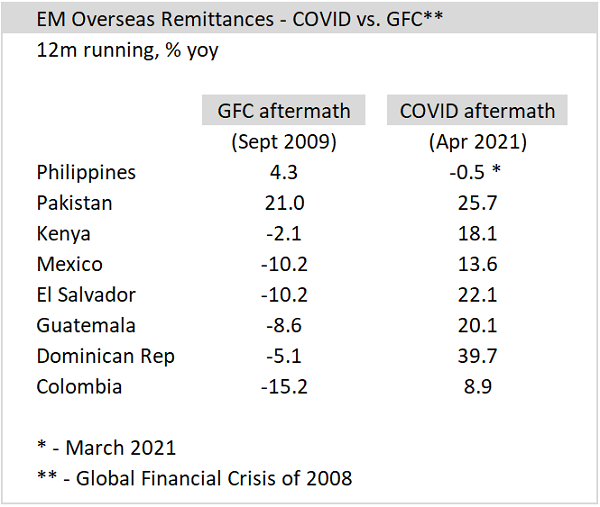

International reserves and overseas remittances are the two areas where things look different in EM compared to the aftermaths of the previous crises (see chart below). Of course, the double-digit remittances growth reflects a low base effect. But the inflows are still very sizable as a percentage of GDP. In the case of Mexico, remittances equaled 3.4% of GDP in 2020 and are getting close to 4% of GDP so far this year. This is not an insignificant amount as regards support for domestic consumption in the absence of a large-scale fiscal stimulus.

Charts at a glance: Emerging markets overseas remittances – this time it is different!

Published: 02 June 2021