Growth outlook – winners, losers, nuances

The global GDP forecast for 2021 had been revised higher in the past few months, but there are important nuances that can have material implications for growth-sensitive asset classes.

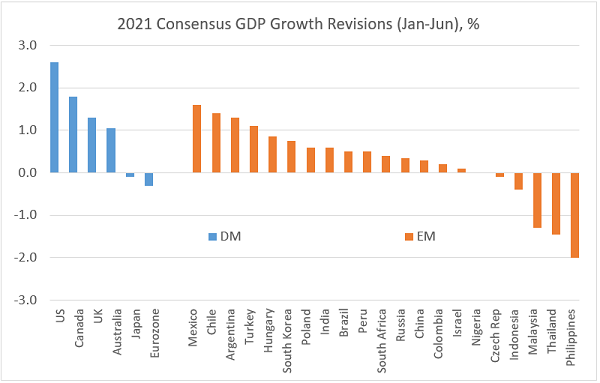

First and foremost, the year-do-date (YTD) growth forecast revisions in the US dwarf the rest of the world (see chart below). Other DMs are catching up – but the Eurozone’s 2021 forecast is only starting to move (up by about 25 basis points since April and still negative YTD). If the “staggered recovery” narrative holds, and Europe’s growth picks up in the coming months on the back of the on-going stimulus and higher vaccination rates, the growth differential with the US should narrow. The question we would ask here is, what impact this will have on the relative policy stances in Europe and the US, as well as on the EUR/USD cross? Emerging markets FX and local bonds are watching intently – not just in terms of global aggregate indices, but also as regards relative trades (for example, European emerging markets getting an extra boost if the euro outperforms).

We often say that the pace of vaccinations can be a major tailwind for emerging markets. And indeed, things keep improving – the administered vaccines/population ratio is emerging markets is nearing 50% (as of this morning, according to Bloomberg LP). We suspect that the upward growth revisions in LATAM and EMEA are already reflecting this positive trend. Still, regional gaps persist. The slow pace of vaccinations in parts of Asia is a risk, and it is weighing on the near-term growth prospects in Malaysia, Thailand, and the Philippines (see chart below). Another consideration that might gain in importance in the coming weeks is what kind of vaccines emerging markets are using. The headline vaccination rate might matter significantly less if some vaccines are more effective against the virus’s mutations than the others. Stay tuned!

Charts at a glance: Global growth revisions – a lot of improvement

Source: VanEck Research; Bloomberg LP

Published: 21 June 2021