Guardians of EM galaxy

These people may not look like Tony Stark or Natasha Romanoff, but they definitely can kick the proverbial derrière and stand up for what’s right. We are talking about a group of emerging markets (EM) central bank governors with stellar credentials and orthodox policy mindsets, who ensure that there are always places to invest in the EM universe, despite scary headlines. The governor of the Peruvian central bank, Julio Velarde, is a prominent member. Velarde was reappointed just days ago, but he wasted no time delivering a surprising 25 basis points rate hike yesterday. Rising inflation and a fear that inflation expectations might become unanchored were the main reasons for the hike. More tightening should be in the cards as the real policy rate is super-negative, the political scene remains complicated and a risk of populist fiscal slippage is non-negligible.

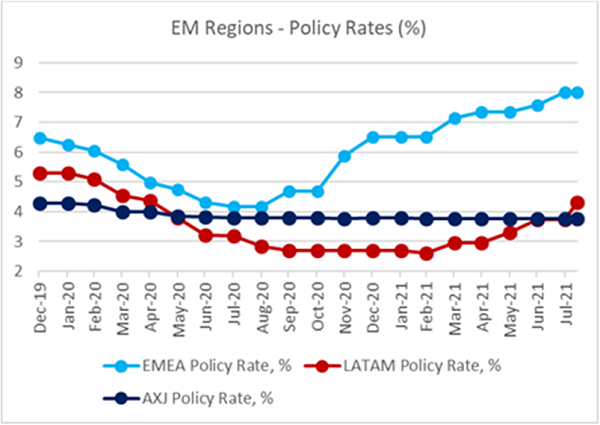

Looking at EM monetary policy landscape, we see several distinct waves there (see chart below), with EMEA being way ahead of other regions in rate hikes, in part because of Turkey’s pre-policy U-turn effort. There is an additional layer of differentiation within regions. Some central banks, like Mexico, Peru, Uruguay, Hungary and the Czech Republic, are just starting their tightening cycles. Poland might join this group due to sticky inflation and accelerating sequential growth (1.9% quarter-on-quarter in Q2). On the other hand, Brazil and Russia are much more advanced and aggressive - actually, the market thinks that Russia’s tightening cycle is almost over and we will see rate cuts in about 6 to 12 months.

The latest signs from EM Asia is that sequential growth is slowing, for example Malaysia’s Q2 print today, due to the Delta variant/low vaccination rates headwinds. While this might not be enough to justify an outright policy rate cut, policy tightening is out of the question for the foreseeable future. In fact, China just announced more targeted support, including up to US$31 billion in cheap loans for “struggling” regions.

Charts at a glance: EM regional policy rates – on different wave-lengths

Source: VanEck Research; Bloomberg LP

Published: 13 August 2021