Indian stocks hitting emerging markets for six

India is accelerating in 2025. Soaring consumption, fintech disruption, and record infrastructure spending are turning it into the hottest emerging market.

India’s economy is gaining investor attention as the nation builds on strong macroeconomic fundamentals and structural reforms. Despite falling short of expectations, India’s FY24 GDP growth of 6.6%1 is relatively attractive to growth rates of other emerging markets countries.

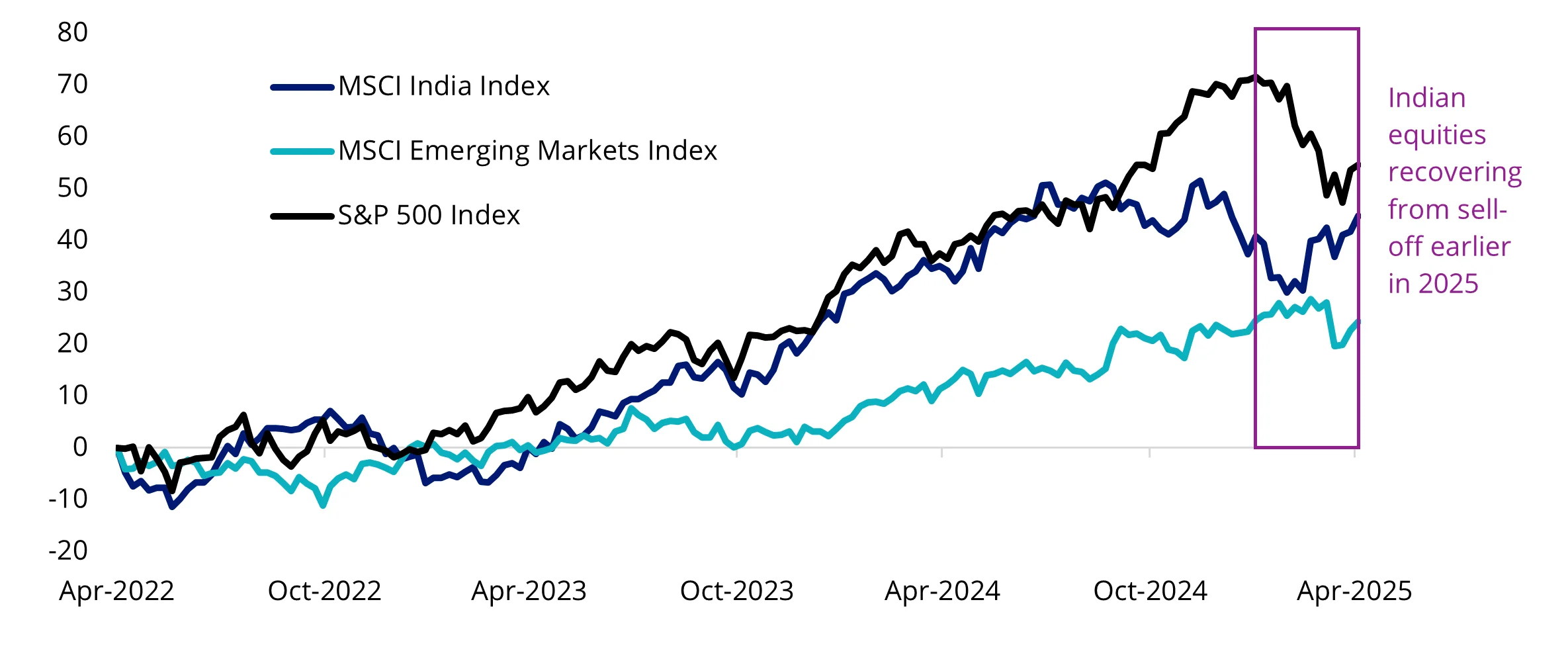

India’s growth is supported by strong domestic consumption, services sector, and high-value manufacturing exports. Indian equities soared for most of 2024, but experienced a short-term pull back, driven by weaker-than-expected private investment, sluggish manufacturing output, and a mild cooling in services demand.

Emerging markets equities are facing pricing pressures due to uncertainty over US tariffs. However, Indian equities have been mostly immune to tariff-related volatility as the country’s growth is mainly a factor of domestic consumption and infrastructure spending. If anything, India stands to benefit from supply chain shifts out of China and Vietnam. In addition, compared to China, India has taken a cooperative stance in trade negotiations with the US, proposing the idea of lowering the tariff rate on all US goods to 0%. This has accelerated the progress of trade talks and moderated the direct impact on its growth outlook. We remain focused on the long-term structural growth of India as it marches on to become the world’s third-largest economy.

Chart 1: Indian stocks are outpacing their emerging markets peers

Source: Morningstar Direct. Data, three years to April 2025, all returns in Australian dollars.

Past performance is no guarantee of future results. Index performance is not representative of fund performance. It is not possible to invest directly in an index.

Monetary and fiscal policy support

India’s GDP expansion of roughly 6% –7% outpaces peers, providing a tailwind for corporate earnings. Even as growth takes off, inflation has been brought under control, dipping to 3.6% in February which is within the central bank’s 4% target ceiling, giving the Reserve Bank of India (RBI) room to cut rates and support growth.

The government has orchestrated a delicate balance of fiscal prudence and growth-focused spending. After the pandemic, India embarked on fiscal consolidation – cutting the fiscal deficit from 9%+ of GDP to 5.9% in FY2023-24– while sharply increasing capital investments. Notably, the FY23/24 budget hiked public capital expenditure by 33% to about $122 billion, an all-time high of ~3.3% of GDP. This hefty outlay, directed at infrastructure, housing, and manufacturing, signals a shift from subsidies to long-term asset creation. By spending almost one-fifth of its budget on development projects, the government aims to crowd into private investment and sustain high growth. Meanwhile, healthy tax revenues from the growing economy have kept public finances on a sustainable path, allowing India to invest in growth without jeopardising stability.

Beyond supportive macro factors, multiple high-growth sectors are driving India’s economic momentum. Structural trends–from a burgeoning middle class to digital innovation and policy reforms–are propelling these industries and creating new investment opportunities.

Consumer boom and premiumisation

India is undergoing a consumer boom, particularly in the premium segment. Rising incomes and urbanisation have unleashed a new wave of discretionary spending. By 2030, India is projected to quadruple consumer spending from about US$1.5 trillion to US$6 trillion with domestic consumption doubling in size forecasted to reach 5 trillion.

The narrative is clear: an aspirational middle class is “trading up,” eager to spend on quality products and experiences. This trend bodes well for consumer-facing companies–from retailers and mall operators to auto makers and real estate developers catering to the upscale market. As India’s consumption story shifts from basic needs to premium indulgences, investors have a chance to ride a powerful wave of domestic demand growth.

Digital finance and credit access expansion

The fintech revolution in India is in full swing, transforming how Indians save, borrow, pay, and invest. Over the past decade, the government’s “Digital India” initiative has dramatically expanded internet access and lowered e-KYC costs for financial institutions. With almost 900 million internet users and cheap mobile data, India is now the world’s largest open market for digital services. As a result, a vibrant ecosystem of digital platforms has emerged, offering everything from peer-to-peer payments and online lending to robo-advisory and insure-tech.

Expanded access to financial services is unlocking credit for underbanked segments, such as small merchants and rural entrepreneurs.

Infrastructure and urban development upswing

India is undergoing an infrastructure renaissance, directing resources into highways, railways, ports, and urban development at an unprecedented scale. The government’s push is evident in budget allocations – capital investment outlays have hit record highs at US$11.6 billion in FY24 (a 33% jump) to build the backbone of a modern economy. Landmark projects like the Delhi-Mumbai Industrial Corridor, new freight rail corridors, and dozens of new airports are under execution, which will reduce logistics costs and spur industrial growth.

The infrastructure boom is not only adding to GDP directly but also enabling other industries (like e-commerce, logistics, manufacturing) to flourish on the back of improved facilities. This virtuous cycle of building and growth makes India’s infrastructure an attractive long-term investment theme.

Green energy and manufacturing

India is spearheading one of the largest green energy and manufacturing transformations globally. The government aims to reach 500 GW of renewable energy capacity by 2030 (up from 125 GW today), with ambitious investments in solar, wind, battery storage, and green hydrogen. Manufacturing is also on a growth trajectory, with the “Make in India” initiative accelerating production in electronics, semiconductors, automotive, and specialty chemicals.

With government-backed incentives and massive industrial investments, India’s shift toward clean energy and advanced manufacturing presents a multi-decade investment opportunity. Reliance Industries possesses the scale and strategic positioning to capitalise on these opportunities.

India’s rapid expansion across consumer, fintech, infrastructure, and green energy sectors presents a compelling investment case. Companies positioned in these high-growth areas are set to benefit as India moves toward a US$7.5T economy by 2031. Now is the time for investors to capitalise on India’s unfolding economic transformation.

Investing in India with VanEck

The VanEck India Growth Leaders ETF (GRIN) offers exposure to the top 50 most fundamentally sound Indian companies exhibiting attractive growth at a reasonable price.

The VanEck MSCI Multifactor Emerging Markets Equity ETF (EMKT) offers access to a diversified portfolio of large and mid-cap stocks from emerging market countries. As at 30 April 2025, India’s weighting of the overall portfolio was 21.3%.

Key risks

An investment in GRIN or EMKT carries risks associated with: ASX trading time differences, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, market access, fund operations, liquidity, and tracking an index. See the relevant PDS and TMD for more details.

Source:

1India’s Economic Report Card for 2024: FDI, Trade, and Infrastructure Growth.

Published: 28 May 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.