The overlooked opportunity in today’s market

Emerging markets bonds are often overlooked. We believe this is set to change, with several compelling reasons that justify an allocation in portfolios.

The fundamental case for investing in emerging markets bonds has been building for some time, but it seems many investors have been hesitant and shown little interest in the asset class over the past several years. It could be they still associate emerging markets bonds with the crises of the late 1980s and 1990s (the world has changed since then). It could be the difficulty of access. Either way, we believe that is changing. Ongoing tariff drama, rising developed markets government debt concerns and recent high-profile developed markets bond crises (UK and Japan) have served as a catalyst, but the long-term drivers of this shift are not new, and we believe are set to continue.

This year, emerging markets bonds have outperformed Australian and global aggregate bonds, and we believe this could continue in the current global macro environment that is characterised by:

- growing developed market debt;

- tariff tensions; and

- strong, relative emerging markets fundamentals.

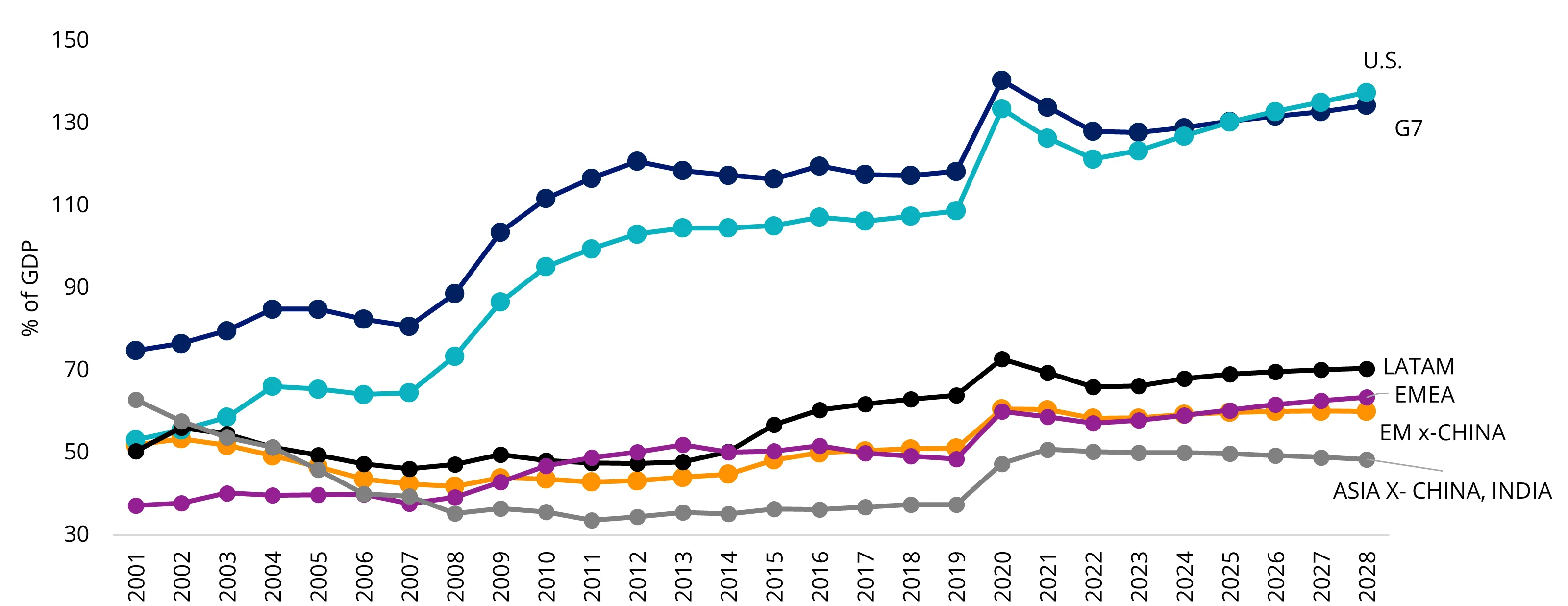

Emerging markets have low debt (and developed markets have high and persistent debt)

Debt levels in emerging markets remain below developed markets. Among emerging markets countries, Asian debt levels are lowest. This dynamic has been supportive of emerging markets bonds.

Chart 1: General government gross debt, % GDP

Source: VanEck Research; International Monetary Fund; Bloomberg LP. Data for the years 2025 to 2028 is projected. Not intended as a prediction of future results. For illustrative purposes only.

Low debt levels allow emerging markets central banks to be independent and maintain high real policy rates.

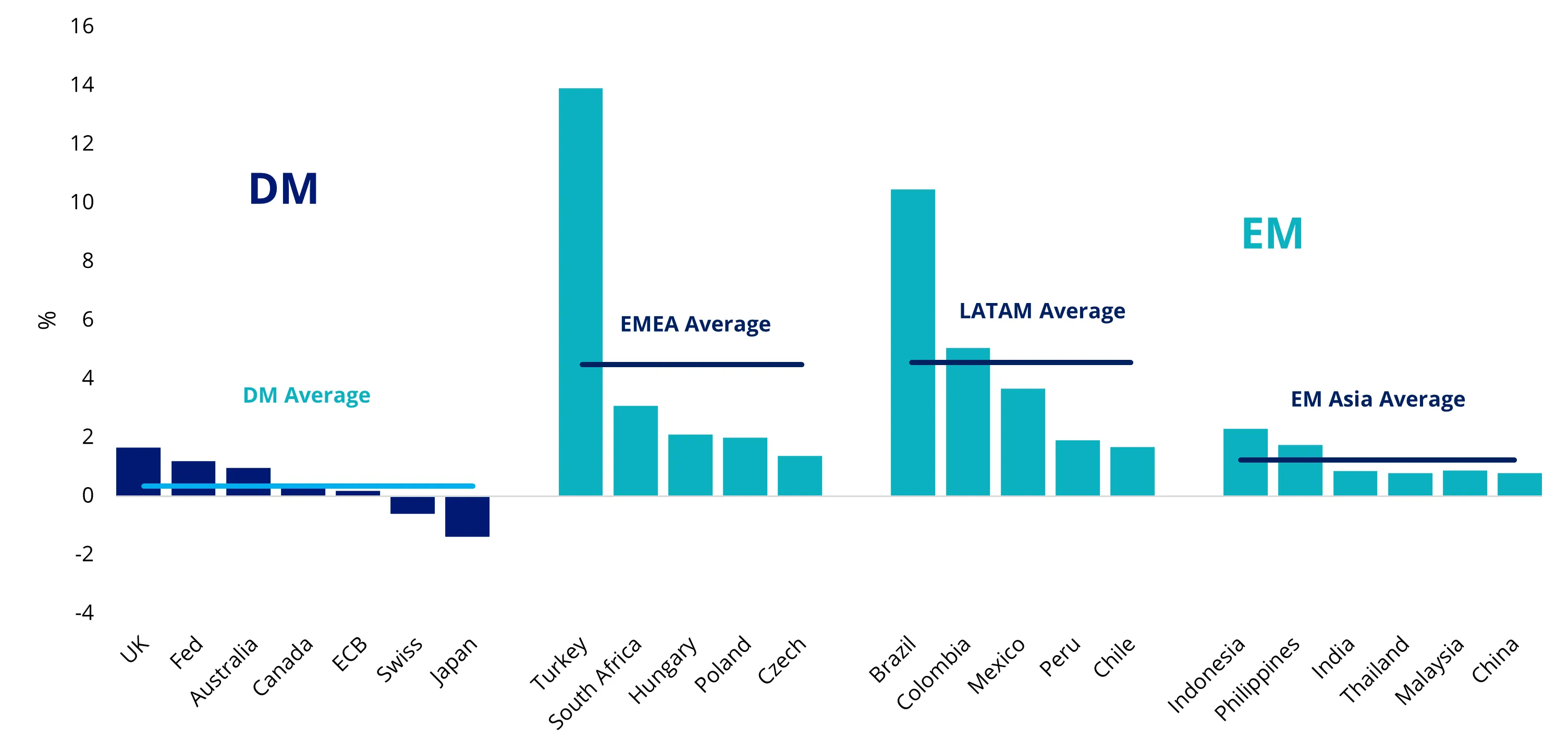

Higher yields, higher real rates, stronger fundamentals

A key driver of the relative performance of emerging markets bonds’ is their yields. Emerging markets’ real policy rates are much higher than in developed markets. In addition to these high nominal yields, real yields in emerging markets have been higher than those in developed markets, favouring the case for local currency bonds.

Chart 2: Real policy rates in emerging markets and developed markets (%)

Source: VanEck, Bloomberg, Data as of 30 September 2025.

Emerging markets central banks have also demonstrated a strong focus on keeping inflation under control. High real rates support emerging markets’ foreign exchange (EMFX) rates, providing central banks with flexibility to ease rates if needed to support economic growth. Further, fundamental metrics, such as debt-to-GDP ratios, fiscal deficits, and current account balances compare favourably to developed markets.

Geopolitics are helping emerging markets

Developed markets need financing from the surplus-producing emerging markets. Emerging markets countries that are net US dollar creditors and are commodity exporters are benefiting from the current tumultuous environment which has been characterised by tariffs (and a falling US dollar), and central banks around the world allocating away from US treasuries and toward gold.

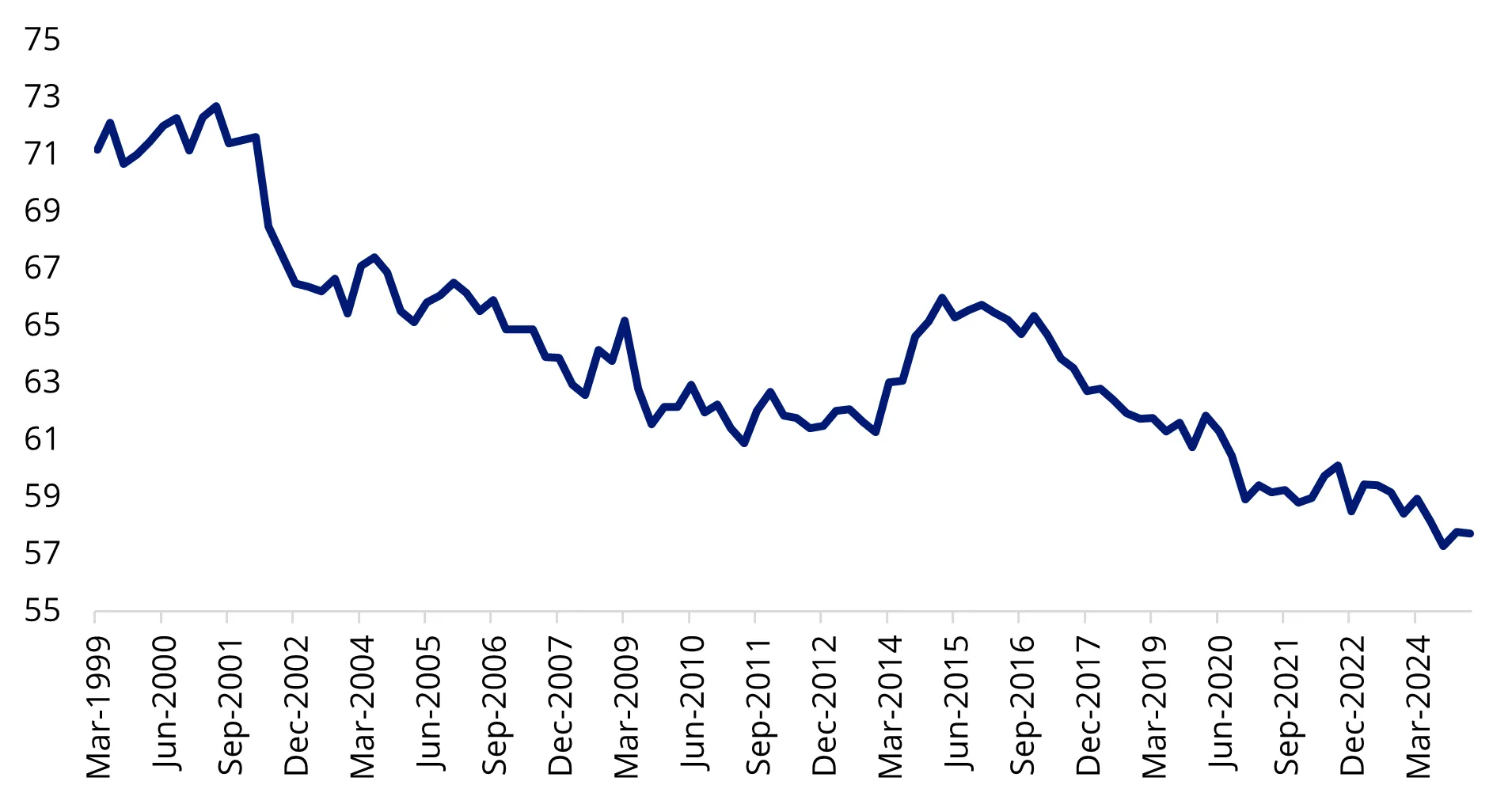

The US dollar’s share in total allocated international reserves has fallen to lowest levels since the mid-1990s, reinforcing a broader shift away from the dollar dominance. In 2025, this trend has accelerated, contributing to a decline of over 10% in the US dollar from its peak. Catalysts include US economic policy instability and rising government debt.

In addition, rate cuts by the Fed will likely add downward pressure on the dollar. Although a steeper yield curve or higher long-term rates may temper that to an extent, we believe that is driven largely by higher inflation expectations, concerns about the US fiscal deficit and increasingly, concerns around Fed independence. All these factors do not support a stronger dollar.

Chart 3: US dollar share in total allocated international reserves, %

Source: International Monetary Fund (IMF) Currency Composition of Official Foreign Exchange Reserves (COFER) released 9 July 2025.

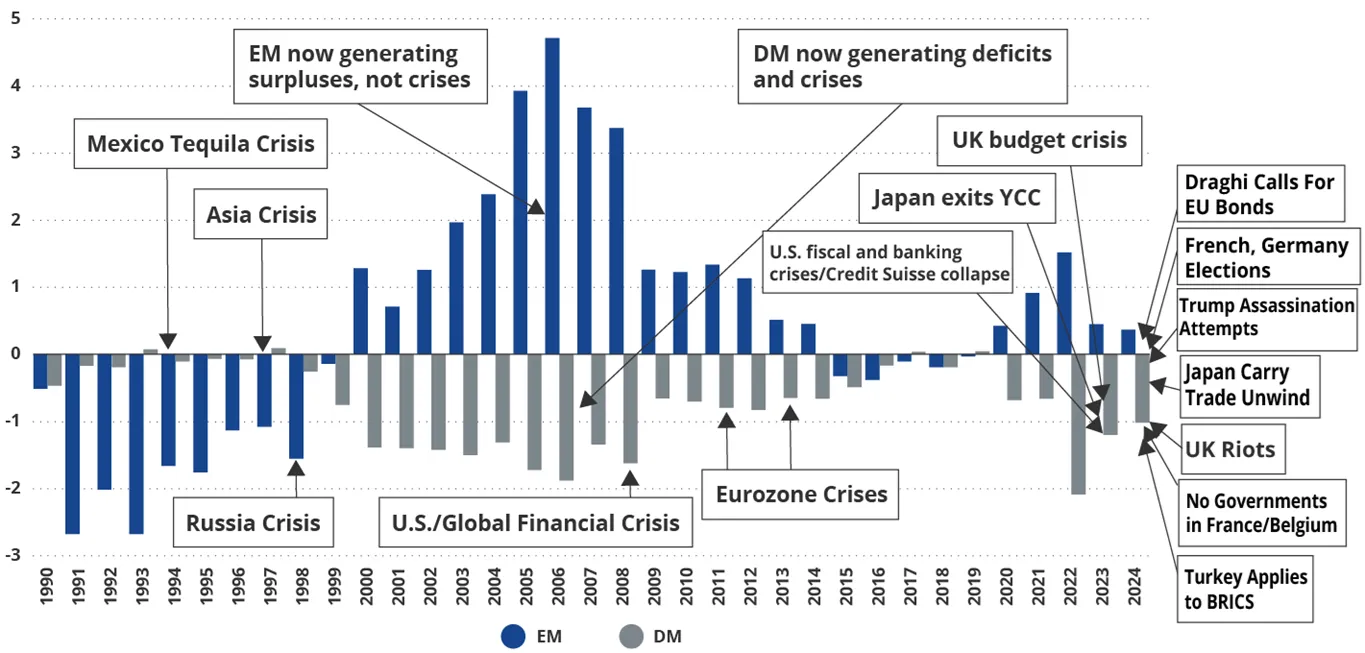

Fiscal dominance

The ‘fiscal dominance’ thesis has appeared in the financial press recently, for example in the Financial Times here and in Bloomberg here.

We have been writing about it for some time, including in this 2024 whitepaper. We think it is one of the key reasons why investors should consider emerging markets bonds. Fiscal dominance occurs when debts and deficits are so high that monetary policy loses traction. This condition has led developed markets countries to decrease their focus on inflation control and has led to crises in developed markets in recent years.

Meanwhile, fiscal policy discipline in emerging markets has strengthened, with monetary independence improving since the post-1990s crisis era. This has translated in emerging markets nations running current surpluses, while developed markets have accumulated persistent deficits over the past 30 years. This has contributed to many of recent financial crises stemming from developed markets. In addition, the emerging markets net exporter status reflects strong global demand for its products, which supports domestic industries and employment, encouraging foreign investment and economic stability.

Chart 4: Current account balances, % of GDP – developed markets versus emerging markets

Source: VanEck, International Monetary Fund (IMF), Bloomberg LP. Data as of December 2024. Past performance is not indicative of future results.

Stellar performance: emerging markets bonds have significantly outperformed global bonds

VanEck’s Emerging Income Opportunities Active ETF (EBND) is a way to access an emerging markets bonds portfolio on ASX. EBND has not only outperformed its performance benchmark, it has also outperformed the Bloomberg AusBond Composite Bond 0+ Yr Index and the Bloomberg Global Aggregate Index Hedged into AUD index.

Table 1: Trailing returns

Source: Bloomberg, VanEck. Inception date for EBND is 11 February 2020. Benchmark is 50% J.P. Morgan Emerging Market Bond Index Global Diversified Hedged AUD and 50% J.P. Morgan Government Bond Emerging Market Index Global Diversified. Australian Bond Index is Bloomberg Aus Bond Composite 0+ Years. Global Bond Index is Bloomberg Global Aggregate Index Hedged into AUD. The table above shows past performance of the Fund from its Inception Date. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. Fund results are net of management fees and costs, but before brokerage fees or bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of current or future performance which may be lower or higher.

While many fixed-income portfolios remain underweight emerging markets, we think it's only a matter of time before more and more investors start including them in their portfolios. Because of the idiosyncrasies between the nations included in the emerging markets universe and the nuances between the different types of bonds available, we think an active, unconstrained approach, like the one employed by EBND, is an ideal way for investors to access this asset class.

VanEck’s EBND advantage

- EBND enables investors to access an actively managed and diversified portfolio of emerging markets bonds via a single trade on ASX.

- VanEck manages more than US$4 billion in emerging markets fixed income assets globally (as at 31 August 2025).

- VanEck has been investing in emerging markets since 1993.

- The depth and breadth of VanEck’s experienced emerging markets bond team is unparalleled. The team has an average of over 25 years of investing experience across a variety of market conditions and stages of the economic cycle.

Table 2: EBND statistics

Source: Bloomberg, VanEck. ^yield measures are not a guarantee of future dividend income from the funds.

Key risks: An investment in the Fund carries risks associated with: ASX trading time differences, emerging markets bonds and currencies, bond markets generally, interest rate movements, issuer default, currency hedging, credit ratings, country and issuer concentration, liquidity, fund manager and fund operations. See the PDS for details.

EBND is likely to be appropriate for someone seeking capital growth and a regular income distribution, is intending to use the product as a minor or satellite allocation within a portfolio, has an investment timeframe of at least 5 years, and a very high risk/return profile.

Published: 15 October 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.