Understanding and investing in emerging markets

Emerging markets are crucial when it comes to driving global economic growth. According to the Financial Times, emerging markets have been responsible for 67 per cent of global GDP growth in the past decade. Emerging markets can provide reasonable returns for investors and have come to represent an important part of a diversified global investment portfolio particularly for those with a higher risk tolerance.

There is no universal agreement on which countries are ‘emerging,’ and certain countries float between developed and emerging depending on who is doing the analysis. For example, South Korea is considered emerging by MSCI but developed by FTSE. In reality, it’s a subjective collection of countries that are considered ‘emerging’.

In the picture below you can see the MSCI classification list of countries:

Source: MSCI

It’s worth noting that there are 23 countries considered developed and 24 considered emerging. Between the two classifications there are only 47 countries out of a global total of 195. There is even another list below emerging markets called frontier markets that has 24 countries in it. What is highlighted is that only a quarter of the countries in the world are considered developed or emerging and only two countries are in Africa. This implies that even emerging market countries are still large economic countries in their own right.

Emerging markets and investing

Generally speaking, it is more difficult to invest in emerging markets. A few observations from our investment in these countries:

- It’s often difficult to set up an account to trade in the country. There are often special requirements that require months of work, getting all documents apostilled (signed by DFAT) for example, proving the company structure, meeting local requirements etc. Investing often requires ongoing documentation and a local entity.

- The foreign currency of some countries aren’t freely tradeable like a developed country. There might be restrictions on purchasing it or how it’s traded.

- Trading shares has different settlement requirements. For example, mainland China is T+0 settlement mechanism, meaning it settles on the day of purchase which creates difficulties in getting money into China to purchase shares.

- There are often long holidays which impact the days you can trade. Also, some countries trade on different days of the week, including our weekend.

- Tax is often an issue. On top of requiring a local tax agent some countries like India require capital gains to be paid on the proceeds from a share sale at the time of settlement. The ongoing withholding taxes and other rules make each jurisdiction difficult.

- There is often no English translation of investment documentation.

- Trading costs are considerably higher than in a developed market.

These factors don’t mean that investments in emerging markets shouldn’t be done, it just means that it is far easier to use a professional manager than attempt it yourself.

Emerging markets have also received negative publicity due to exposure to political risk. For example, Russia was a standard inclusion until the war with Ukraine.

Emerging markets and the rapid growth reward

As mentioned above, emerging markets are known for rapid growth. A 2018 McKinsey report found Eighteen of the 71 emerging economies studied outperformed global benchmarks and their peers by achieving more than 3.5 per cent per capita GDP growth over 50 years or 5 per cent growth over 20 years. They include long-term success stories such as China and Malaysia, recent high-growth economies such as India.

Over a 20 year period the MSCI World and MSCI Emerging Markets indexes have performed similarly, but the rise and fall in emerging markets has been greater.

Source: Bloomberg. Data as of 01 July 2023. Past performance is not indicative of future performance. You cannot invest in an index.

Low correlation with other markets

Emerging markets don’t operate the same way as an emerging economy. Generally, when the USA is doing well Australia does well and vice versa when things start to deteriorate. In an emerging market the correlation between countries is considerably weaker hence you can see India do well and Brazil struggle.

Ahead of the inflation curve

At the moment developed countries are dealing with inflation and rising rates. But many of the emerging market countries have already dealt with this scenario over the past 20 years and learned the lessons. Most of them did an amazing job responding to post COVID inflation pressure with early and aggressive rates hikes, which also gave a boost to their currencies.

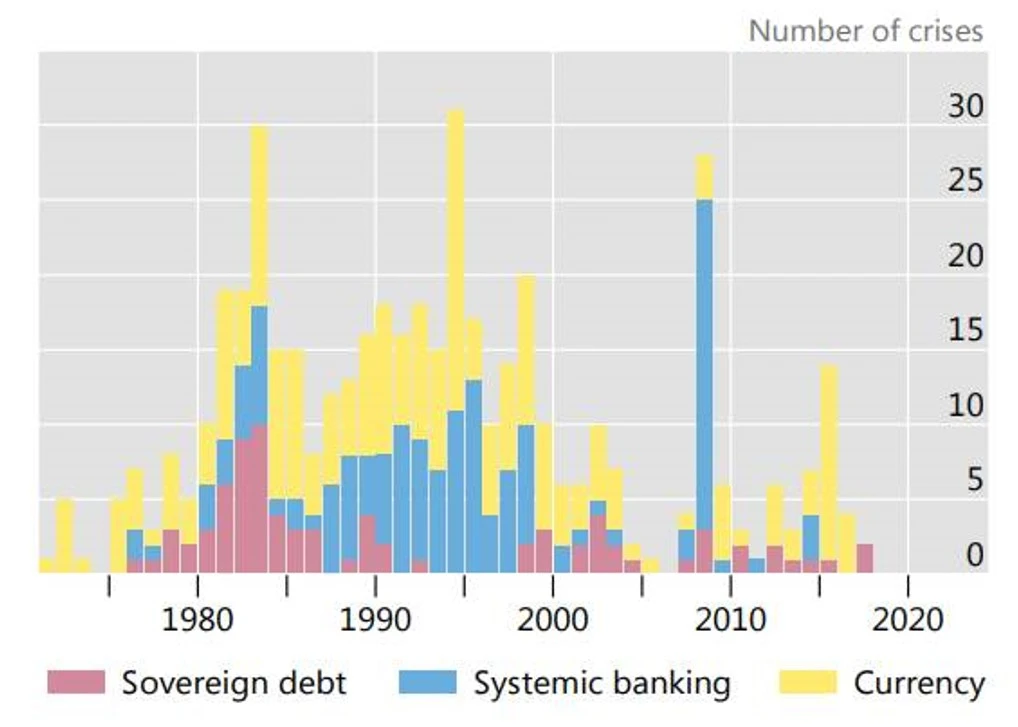

Recent data from the Bank of International Settlements that highlights the significant fall in financial crises over the years. A key reason is that emerging markets did their homework, strengthening their institutional and policy frameworks.

How to invest

The final question is how do you invest in emerging markets? The easiest way is to purchase a fund that invests in a mix of countries so that you diversify across a broad section of emerging market countries. Explore what else to consider when looking to invest in emerging markets.

It is important to note, investing in emerging markets bonds and equities carries risks. These risks vary from trading time differences, foreign currencies, sector and issuer concentration, issuer default, liquidity to fund operations. See the respective PDS for more details on the risks associated with each fund.

Published: 07 July 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.