Investing in the world’s next industry leaders

There has been talk about the end of US exceptionalism. One of the beneficiaries of investors looking beyond the US could be emerging markets.

Emerging markets, like the US, have been at the forefront of innovation with some of the fastest-growing technology firms listing on emerging market exchanges. Like investing in the US, it is prudent to take the right approach in emerging markets. Australian investors have been investing offshore for some time, and the rise of ETFs has increased the opportunity set and further expanded the investment landscape. That investment landscape is changing.

One of the investment themes this year has been the end of US exceptionalism. What this narrative suggests is that there will be a decline in the US’s economic influence. The shift could lead to the loss of global dominance and a decrease in US economic competitiveness. One of the symptoms of the decline in US exceptionalism so far in 2025 has been a decline in the value of the US dollar.

Usually, when the US dollar falls, emerging market equities are a beneficiary. This is why emerging markets are currently piquing investors’ interest.

Investing in emerging markets makes sense. Emerging markets have been a key contributor to global economic growth for some time. According to the IMF, emerging markets contribute more to global GDP than developed economies, and that proportion of growth is increasing. Additionally, emerging markets are associated with sizable populations that are becoming increasingly affluent. 87% of the world’s population is in emerging and developing markets. 77% of the world’s population between 15 and 24 years olds live in emerging markets and it is these consumers of the future that are driving growth in some of these markets. As technology improves, many of the economies are undergoing fundamental shifts.

Despite these favourable demographics and growth potential, many Australian investors do not have exposure to emerging markets.

Of course, not all emerging market companies are desirable from an investment standpoint. Some emerging market companies remain state-owned or family-dominated, so business decisions are sometimes different to what an independent, public company would do, and inefficiencies within emerging markets allow astute investors to take advantage of mispricing. Therefore, being selective in emerging market equities is important.

Additionally, when investing in emerging markets, there are other risks to consider, such as currency, geopolitical, economic, market and sector risks. It can also be difficult to access some emerging markets.

This is why many investors have been happy to pay higher fees for a professional active manager to select the best emerging market opportunities.

Active managers aim to outperform the benchmark index. When it comes to emerging market equity investing, the widely used benchmark is the MSCI Emerging Markets Index (MSCI EM Index). Active emerging market managers are trying to outperform this index. If the MSCI EM Index rises 10%, investors would expect their active manager to return higher than 10%. Likewise, when the MSCI EM Index falls 10%, investors expect their fund manager not to fall by more than 10%.

As many investors are aware, the returns in active funds can be good, but often they are not. Another alternative is lower-cost passive funds that track the MSCI EM Index, but because of the index rules, many emerging market companies that are undesirable from an investment standpoint can be included in the index.

Innovations in index design for passive funds have delivered above-market benchmark returns over the long term while retaining low costs. It is known as smart beta, and this is the approach VanEck offers in emerging market equities.

VanEck MSCI Multifactor Emerging Markets Equity ETF (ASX: EMKT) tracks the MSCI Emerging Markets Multi-Factor Select Index (EMKT Index), and it provides investors with diversified access to companies that demonstrate four factors: Value, Momentum, Low Size and Quality. Factors are identifiable, persistent drivers of risk and return.

Last year, we released a white paper supporting this approach. Historically, taking a diversified approach across factors has been proven to produce outperformance over the long term compared to a benchmark market capitalisation approach in emerging markets.

So, let’s walk through the difference between EMKT and the MSCI EM Index, starting with performance.

EMKT vs MSCI EM Index - Performance

EMKT launched on ASX in April 2018 and has demonstrated strong outperformance since its inception, as highlighted by the table below. As always, it is important to note that past performance is not indicative of future performance.

Table 1: Trailing performance as at 31 July 2025

Source: VanEck, Morningstar Direct

#EMKT inception date is 10 April 2018 and a copy of the factsheet is here.

Results are calculated to the last business day of the month and assume immediate reinvestment of distribution. Performance is calculated net of management fees, calculated daily but do not include brokerage costs or buy/sell spreads of investing in EMKT. Past performance is not a reliable indicator of future performance.

The MSCI Emerging Markets Index (“MSCI EMI”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of emerging markets large- and mid-cap companies, weighted by market capitalisation. EMKT’s index measures the performance of emerging markets companies selected on the basis of their exposure to value, momentum, low size and quality factors, while maintaining a total risk profile similar to that of the MSCI EMI, at rebalance. EMKT’s index has fewer companies and different country and industry allocations than MSCI EMI. Click here for more details

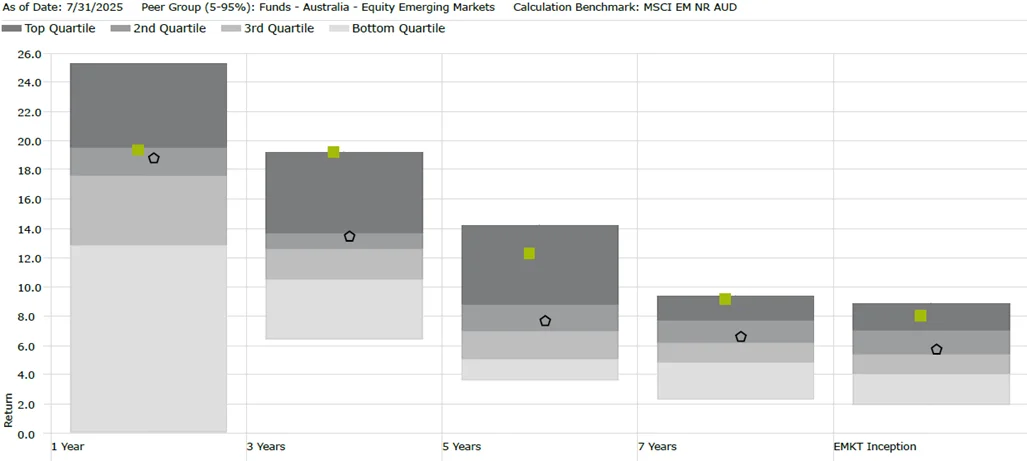

EMKT’s performance is impressive, relative to the MSCI EM Index. It is also worth considering its performance relative to its active peers. EMKT’s performance puts it in the top quartile (the top box) of active peers for all the trailing periods noted in the table above. It is worth noting in Chart 1 below that the MSCI Emerging Markets index has beaten more than 50% of active emerging market managers in all those trailing periods. In other words, over 50% of active managers are not achieving their objective noted above.

Chart 1: Performance relative to active manager peer group

Source: Morningstar, to 31 July 2025. Past performance is not a reliable indicator of future performance. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. Results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads. Returns for periods longer than one year are annualised. Peer group Equity Region Emerging Markets funds invest in companies listed in emerging markets from around the globe. Emerging market securities typically account for at least 75% of the portfolio.

EMKT vs MSCI EM Index - Top 10 holdings

Below you can see the top 10 companies. The top 10 holdings are companies that investors can relate to in their day-to-day lives such as Taiwan Semiconductor Manufacturing and Kia. Notable differences to the MSCI EM Index top 10 include the UAE’s property developer EMAAR and Korean behemoth Hana Financial Group – to see all the holdings in EMKT and their weightings, click here.

Table 2 & 3: Top 10 holdings EMKT and MSCI EM Index

Source: FactSet, VanEck, MSCI, as at 31 July 2025. Current weightings may differ.

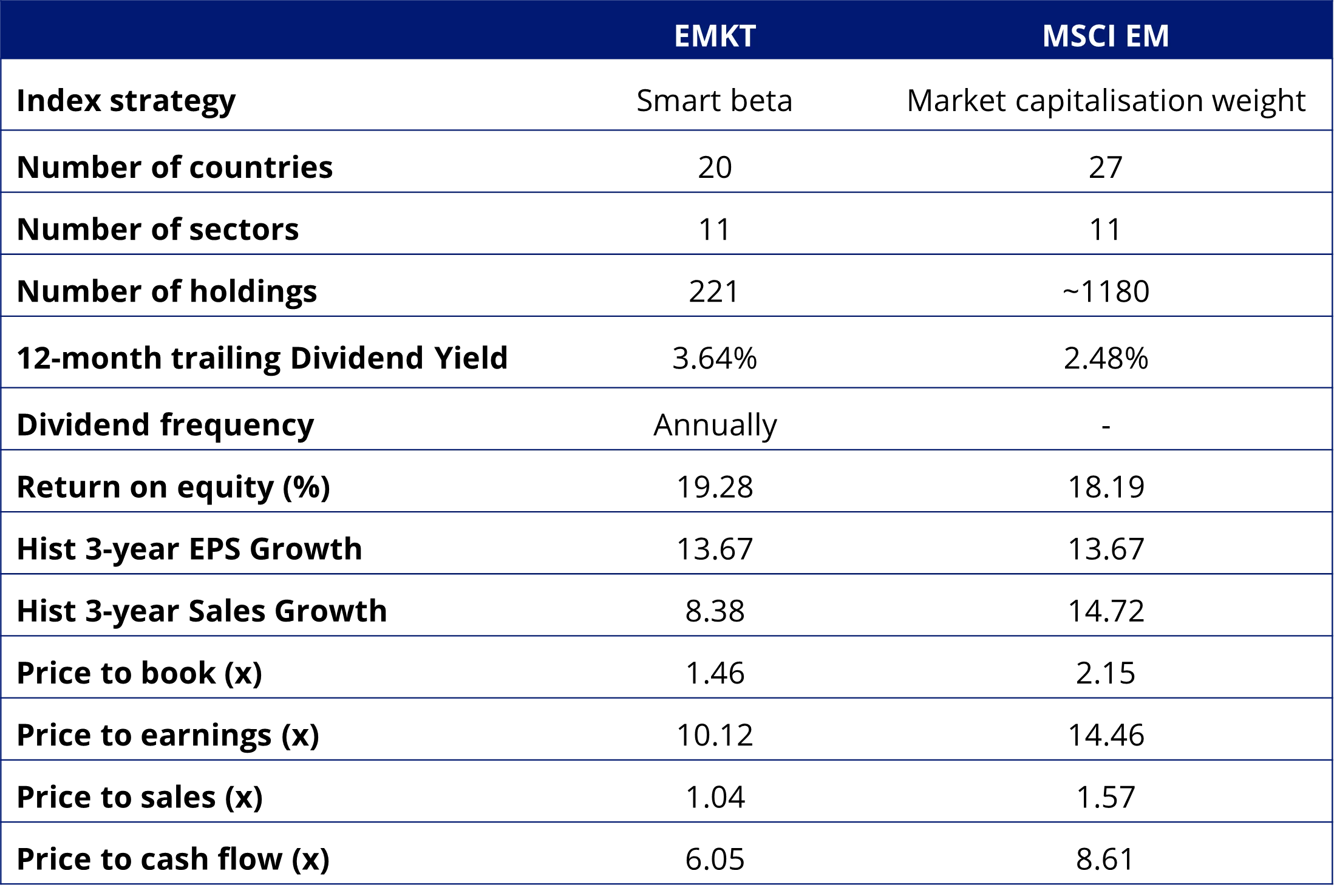

EMKT vs MSCI EM Index – Fundamentals

Table 4: Statistics and fundamentals

Source: FactSet as at 31 July 2025. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

As you would expect, EMKT has a lower price to book, price to earnings, price to sales and price to cash flow. It also has a higher return on equity. While emerging markets are not typically associated with income, EMKT’s current trailing dividend yield is higher than the market index.

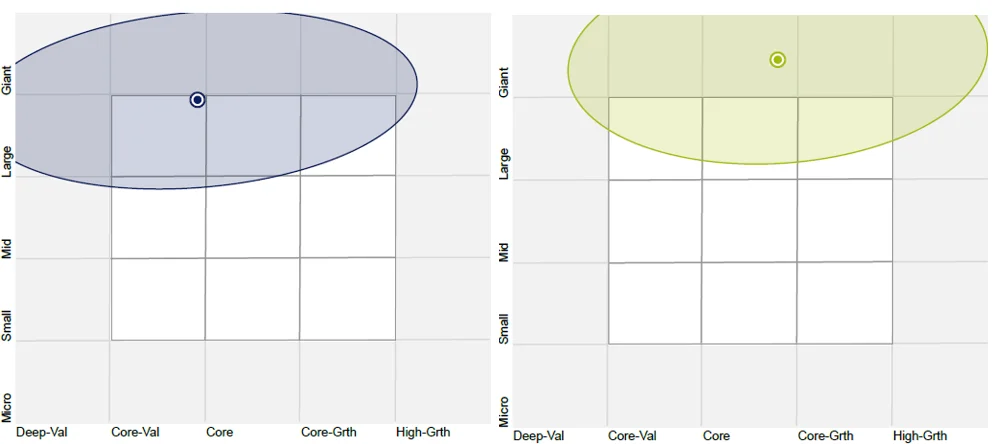

EMKT vs MSCI EM Index - Style

When considering portfolios, it is important to determine what style e.g. value or growth, and what size bias a portfolio holds e.g. giant, large, mid or small. Below we can see EMKT’s. Importantly, EMKT holds large and giant-sized companies with a value-core orientation relative to the MSCI EM Index, which skews larger and more toward growth.

Chart 2 & 3: EMKT and MSCI EM Index holdings-based style map

Source: Morningstar Direct, as at 31 July 2025

Past performance is not indicative of future performance. The above is not a recommendation. Please speak to your financial adviser or stock broker.

For further information you can email us at [email protected] or call on us on +61 2 8038 3300.

Key risks

An investment in EMKT carries risks associated with: ASX trading time differences, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS and TMD for details.

Published: 21 August 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

EMKT is indexed to a MSCI index. EMKT is not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to EMKT or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and EMKT.