Act on it

The passage of the Inflation Reduction Act this month in the United States will inject US$369 billion into the US clean energy economy, boosting investment in a range of greener energies, including electric, wind and solar. The stimulus has come at a time when valuations for clean energy stocks are starting to look attractive and a positive outlook is springing from earnings reports.

Clean energy stocks have rallied since the Act was passed by both the US House of Representatives and the Senate (It passed the Senate on 7 August 2022 with an amendment that the House of Representative agreed to five days later) before President Biden signed the legislation on Tuesday.

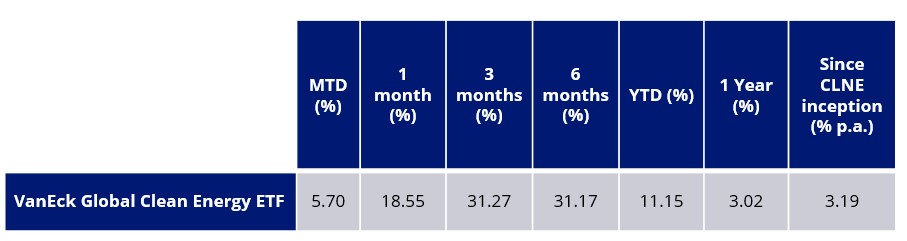

The VanEck Global Clean Energy ETF (CLNE) is up 31.17% over the past six months and 5.70% so far this month (to 18 August 2022, source Morningstar). As always, this is by no means an indication of future performance.

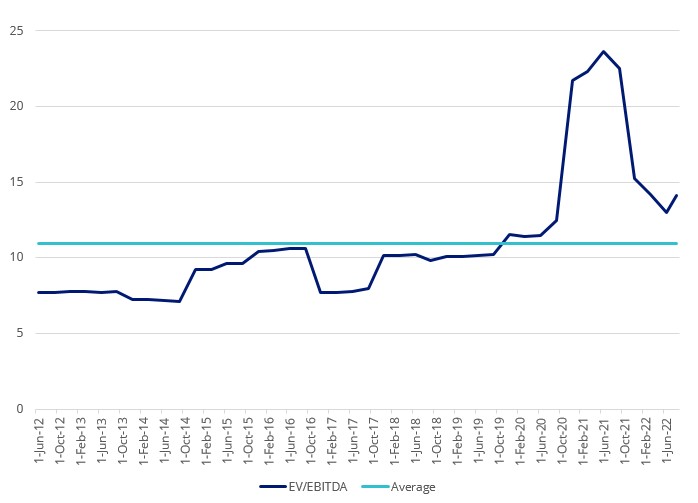

The stimulus has come at a time when valuations for clean energy stocks are starting to look attractive, with Enterprise Value/EBIDTA (EV/EBITDA) trending back to the long-term averages after having been at historical highs during 2020 and 2021. As companies in the sector report their earnings and provide guidance, there is an overwhelming optimism relative to other parts of the market.

The passage of the Inflation Reduction Act in the United States will inject $369 billion into the US clean energy economy, boosting investment in a range of greener energies, including electric, wind and solar. The bill could reduce emissions by approximately 43 per cent below the nation’s 2005 emissions levels by 2030; and net zero by 2050.

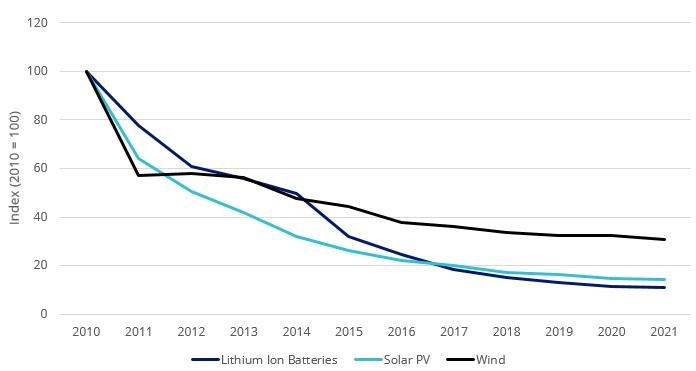

According to Eric Beinhocker, director of New Economic Thinking at the Oxford Martin School, the bill will lead to a massive increase in clean technology and will drive the cost of renewables down even further.

The legislation offers nearly four times as much funding compared to the previous act, the 2009 Recovery Act. Combined with the falling cost of clean energy, the impact of the Inflation Reduction Act will be unprecedented, and represents a strong and comprehensive commitment to climate change from the US.

Chart 1: Falling Renewable energy costs

Source: Bloomberg, Lazard.

There are three key areas of focus for the Act:

- Decarbonising power with wind, solar, batteries and nuclear. This sector will receive the bulk of the funding. This will be primarily achieved by the expansion and extension of tax credit schemes. The bill also sets aside a significant sum to incentivise US manufacturing of wind solar and batteries.

- Tax credits to encourage the use of electric vehicles. The credits require final assembly in the US and strict requirements for battery manufacturing.

- Funding for new clean energy technologies, with a strong focus on carbon capture and storage, and hydrogen technologies.

Clean energy valuations

The stimulus comes at a time when we are seeing valuations for clean energy stocks starting to look attractive with EV/EBIDTA trending back to the long-term averages having been at historical highs during 2020 and 2021. EV/EBIDTA has fallen from a high of 22.5 in September 2021 to the current level of 14.1, as the chart below shows.

Chart 2: Improving energy valuations

Source: FactSet as at 31 July 2022. Clean Energy valuations as measured using a basket of companies with operations related to clean energy production and associated technology and equipment globally.

While some clean energy companies have been hit by higher US interest rates and bond yields this year, they are still performing relatively well overall.

Clean energy stocks have performed well since the beginning of the year showing a strong resurgence.

Table 1: CLNE Performance to 18 August 2022

Source: VanEck, Morningstar, Bloomberg

Results are calculated daily and assume immediate reinvestment of distributions. CLNE results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of future performance.

CLNE inception date is 8 March 2021 and a copy of the factsheet is here.

For reference, since the beginning of the year to the 18th August, the broader global equity market, as represented by the MSCI World ex Australia Index, has fallen 7.58%. Over the past three months, it has rallied just 7.70%.

The recent recovery of solar and wind energy companies is not only due to the favourable legislative environment.

Wind energy stocks have done well recently due to a fall in the European steel prices to €1,500 at 30 June 2022 from €1,850 in March 2022. Steel is a major cost for wind energy production and its price could continue to fall as global growth slows amid fears of recession. Costs have also been reduced on the shipping side.

Reporting results

A number of clean energy companies that released their quarter two financials prior to the bill have also been beneficiaries of an emboldened investor attitude towards green energy stocks. Smart energy company, SolarEdge Technologies CEO Zvi Lando says, “The growing demand for energy in general and clean energy in particular continued to drive top line growth this quarter resulting in record revenues in Europe and the United States.”

Following news of the legislation’s successful passage through the US Senate, a number of clean energy stocks rallied, including solar energy company Sunrun which rose by 4 per cent on the day after the senate passed the Act with its amendment. The daily gain comes on the back of a 40 per cent jump in July. Meanwhile, wind turbine company, Vestas Wind Systems rose 26 per cent in July.

Plug CEO Andrew Marsh said, “with the passage of the Act, we expect a boom for our electrolyzer and green hydrogen business. All applications that use gray hydrogen (produced from fossil fuels) today, such as fertilizer manufacturing, will now be able to buy green hydrogen at a competitive price with gray.”

Other tailwinds for the clean energy sector include some easing in supply chain bottlenecks, as well as backlogs in retail orders due to increased demand.

Looking forward, the outlook is positive on the clean energy sector as a whole in light of demand re- re-rating of the entire sector and increased governmental support in many countries including the US, Europe and China.

CLNE allows investors to participate in this structural, long-term trend. CLNE, which launched in March 2021, was the first clean energy ETF listed on ASX. It is a diversified exposure that can include companies involved in:

-

- biofuel & biomass energy production, technology & equipment;

- ethanol & fuel alcohol production;

- fuel cells technology & equipment;

- geothermal energy production;

- hydro electricity production, turbines & other equipment;

- solar energy production, photo voltaic cells & equipment; and

- wind energy production, turbines & other equipment.

Key Risks

An investment in CLNE carries risks associated with ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, emerging markets, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 26 August 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.