Mastering asset allocation with ETFs

The asset allocation decision is responsible for around 90% of portfolio movements, while the remaining 10% comes from security selection and market timing. Are you doing it right?

The aim of many investors is to develop a resilient investment portfolio that stands the test of time. While unlisted managed funds used to be the vehicle of choice for investors looking to allocate to different asset classes, Australian investors have increasingly been opting for exchange-traded funds (ETFs). The ETF industry reached a record $150 billion in funds under management as at 30 June 2023, earlier than forecast, and for good reason. Using ETFs to create resilient portfolios at a lower cost than active managers.

The ASX says “The continued popularity of ETFs is no surprise, given their ability to provide investors with exposure to a wide range of companies, regions, asset classes and strategies, making it easier to diversify.” Furthermore, investors who hold ETFs were most likely “to be seeking diversification opportunities, looking for a balance between risk and return, aiming to maximise their capital growth or secure a sustainable income stream. They appeal to both high-value investors and SMSF owners.”

In other words, ASX ETF investors are creating their own diversified portfolios. This asset allocation decision is, perhaps the most important they will make.

In the 1986 article “Determinants of Portfolio Performance”, Brinson et al, demonstrated that the asset allocation decision was responsible for 93.6% of a diversified portfolio's return pattern over time. Subsequent studies have confirmed this (Donaldson et al, 2013). The asset allocation decision is responsible for around 90% of portfolio movements, while the remaining 10% comes from security selection and market timing.

An informed understanding of risk and return of the various asset classes is important to the portfolio construction process. VanEck has partnered with Lonsec Investment Solutions Pty Ltd (Lonsec) to provide four low-cost model portfolios comprised entirely of ETFs. Information on these can be found here: VanEck ETF Model Portfolios.

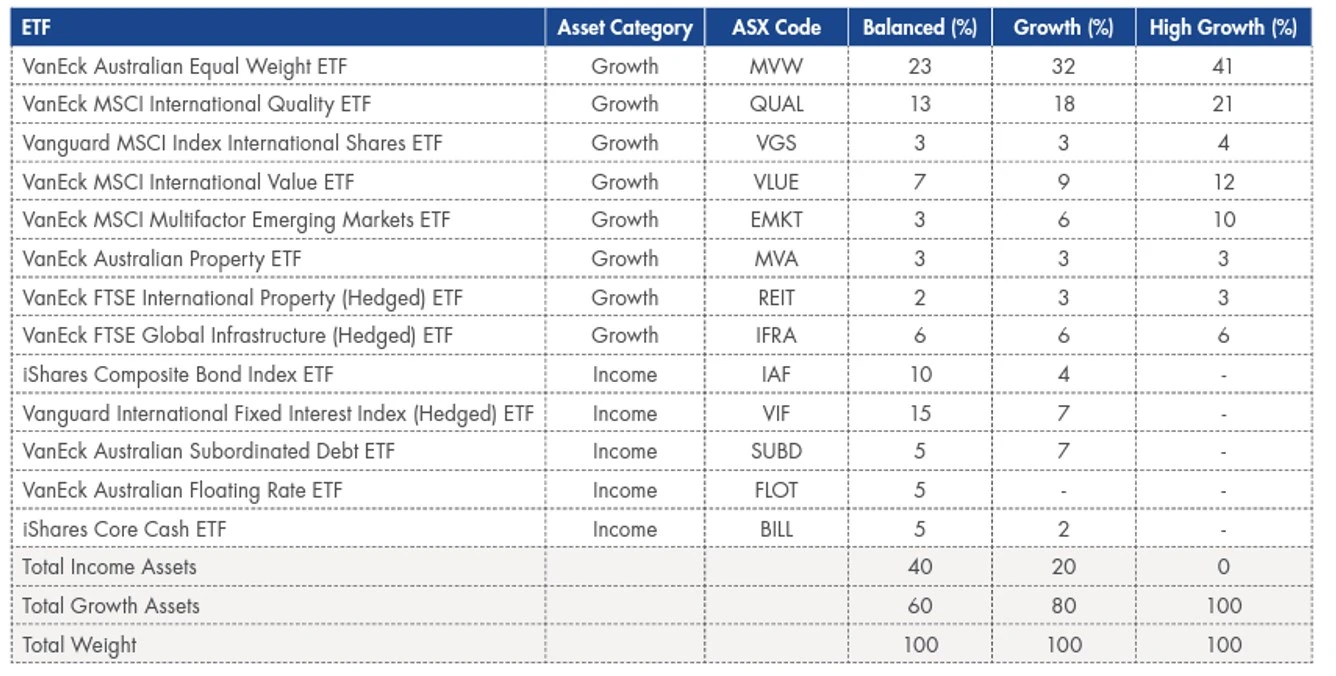

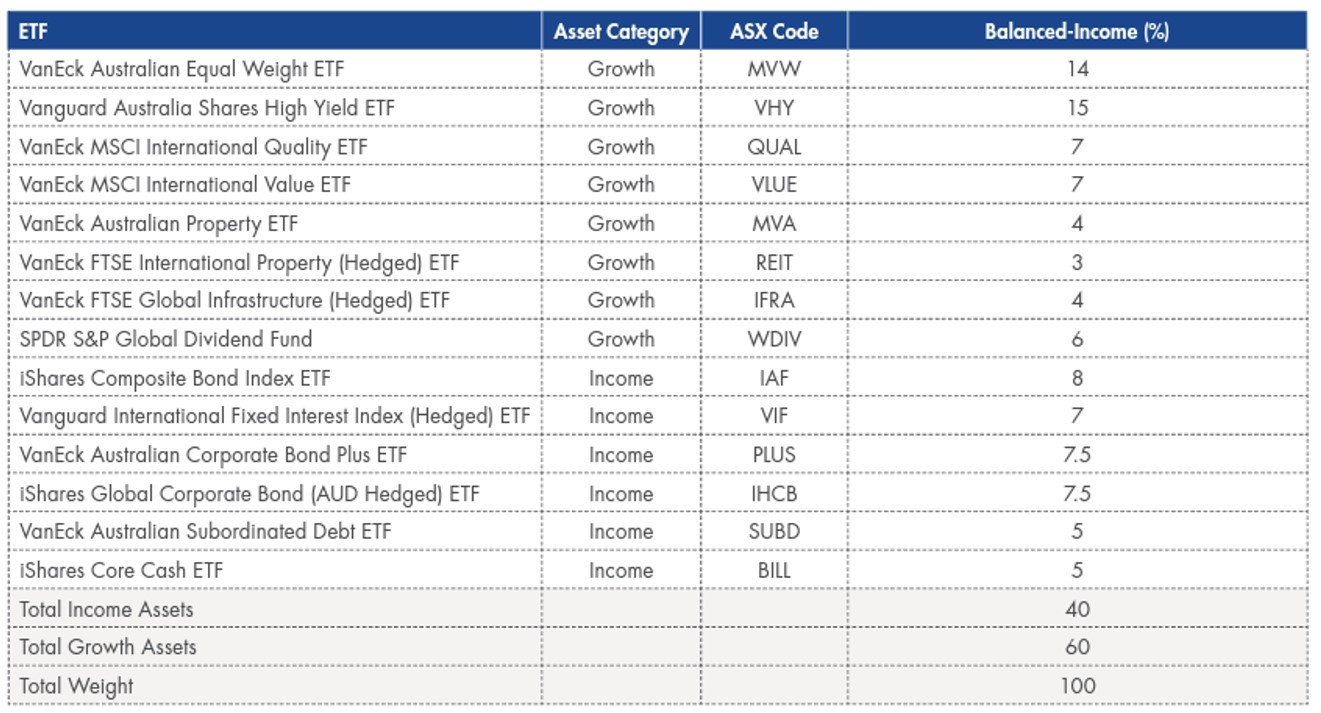

VanEck ETF Model Portfolios are powered by Lonsec drawing on its established research and portfolio construction expertise to provide recommended strategic asset allocations tailored to three risk/return profiles: High Growth, Growth and Balanced and Balanced Income. Each model portfolio is split between growth and defensive assets across a range of ETFs that Lonsec considers providing an appropriate exposure to the relevant asset class.

You will note it includes VanEck’s ETFs, as well as funds from our ETF peers, where we do not have an equivalent capability. The portfolios include a mix of ‘beta’ and ‘smart beta’ strategies.

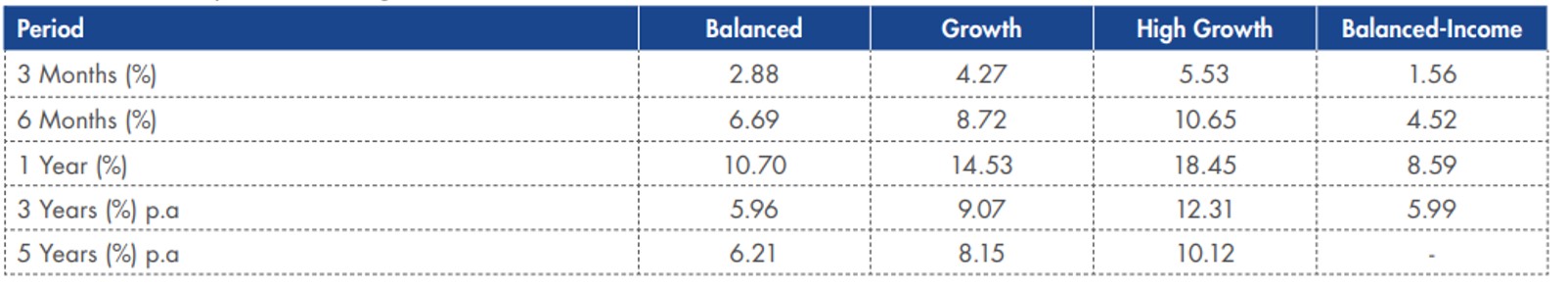

The table below show the returns of hypothetical portfolios based on the asset allocations outlined above. Each model portfolio provides broad market exposure across asset classes including Australian equities, global equities, property, infrastructure, Australian fixed income and international fixed income. Utilising simple low-cost ETF strategies delivers diversified exposure for considerably less cost than the average cost of Australian managed funds.

Period returns for periods endings 30 June 2023

Source: Lonsec. Past performance is not a reliable indicator of future performance. The Model Portfolios are notional portfolios. Model Portfolio performance is calculated after management fees and before taxes.

As you can see from the above table a hypothetical one-year investment in our model high growth portfolio for the period ending 30 June 2023 would have returned 18.45%. compare to ASX. High-growth technology companies have soared this year riding a wave of enthusiasm for the emerging field of generative AI. It’s been a welcome recovery from a lacklustre 2022 performance where tech fell heavily and was a casualty of rising inflation and interest rates on a global scale as the cost of money became more expensive. Notwithstanding last year’s poor performance a hypothetical investment in our high growth model portfolio over 5 years to 30 June 2023 would still have netted a return of over 10%. The hypothetical returns are demonstrative of the benefits diversification can have for investors as a long -term portfolio strategy.

For more information on VanEck’s ETF Models click here, or to contact one of our ETF specialists click here.

Published: 04 August 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.