Gaming growth and the first esports Olympics coming soon

Esports have entered the mainstream. Earlier in the month, the International Olympic Committee released event details for the inaugural Olympic Esports Week, taking place in Singapore during June 2023. There will be Olympic Esports Finals action across 10 events including the International Shooting Sport Federation’s challenge featuring Fortnite. The rise of video gaming and esports is irrefutable. And, it’s a potential opportunity for investors.

Most investors have exposure to technology via the MAGMA (Microsoft, Amazon, Google, Meta and Apple) stocks however recent volatility has highlighted investor’s apprehensions about overpaying. One way to diversify your technology exposure is to look beyond the mega-cap tech stocks and consider the investment opportunity in video gaming and esports.

Long-term structural trends favour the growth of video gaming and esports companies, as players and spectators flock to digital games. With US$182.9 billion revenue in 2022, it is expected revenues will exceed US$206 billion by 20251. More than 75% of industry revenue comes from free-to-play games.2

Investors can gain exposure to opportunities in this thriving industry via the VanEck Video Gaming and Esports ETF (ASX: ESPO). ESPO offers a pure play and targeted exposure to leading video gaming and esports companies, including publishers Tencent, Nintendo, Electronic Arts and Activision Blizzard. Not only has ESPO performed better than the broader US and global stock markets so far 2023, its valuation looks attractive compared to other investment strategies providing technology growth exposure.

Long-term growth story

The spike in video gaming that occurred during the COVID-19 pandemic entrenched a trend underway for several years. Esports and video game engagement metrics have been setting records across several platforms, including broadcast TV, online viewership of gaming and player numbers.

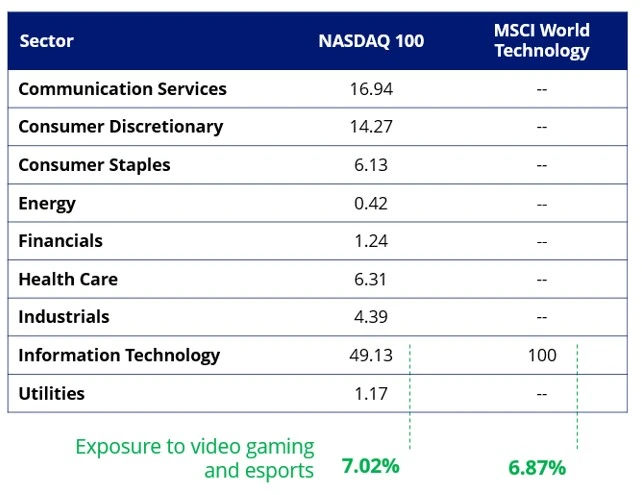

There are now around 3.2 billion gamers globally3, which is more than Facebook users, Apple devices and Netflix subscribers. Yet most investors have limited exposure to this sector because esports and video game companies make up only 7.02% of the NASDAQ 100 and only 6.87% of MSCI’s Information Technology sector.

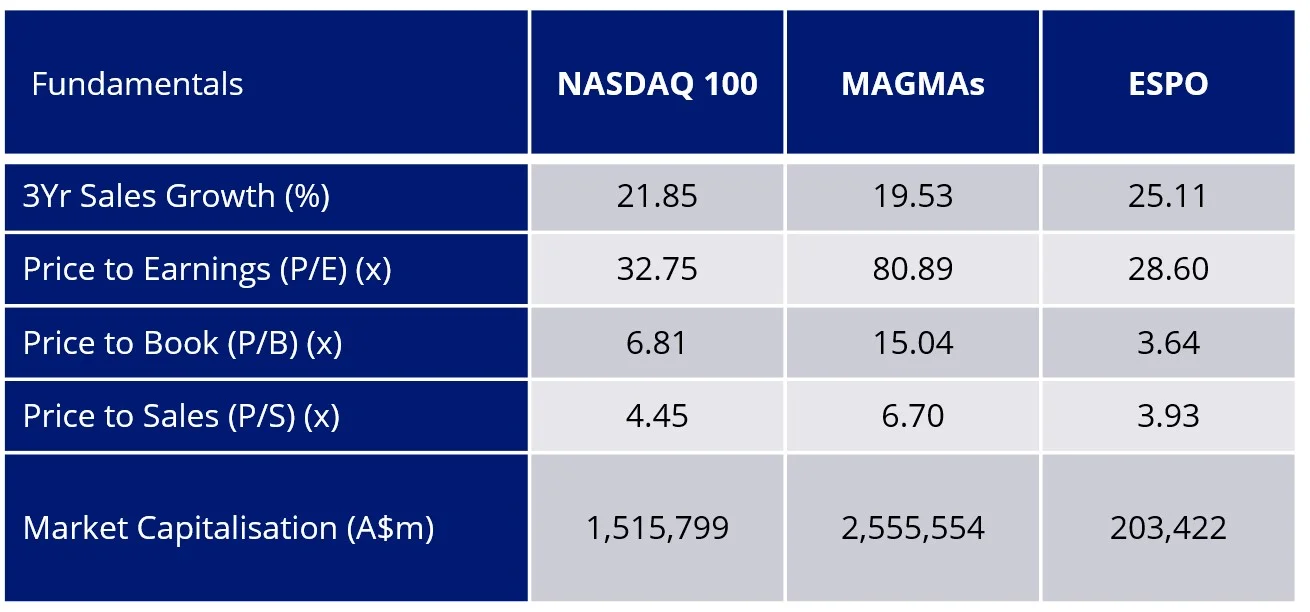

Table 1: Exposure to video gaming and esports

FactSet, as at 30 April 2023

This makes the video gaming sector an attractive diversifier to the MAGMA giants Microsoft, Amazon, Google, Meta and Apple.

However, we believe in the continued growth in video gaming and esports that has shown no signs of slowing since we emerged from COVID lockdowns. Over the past 12 months ESPO has returned 15.30% (to 30 April 2023).

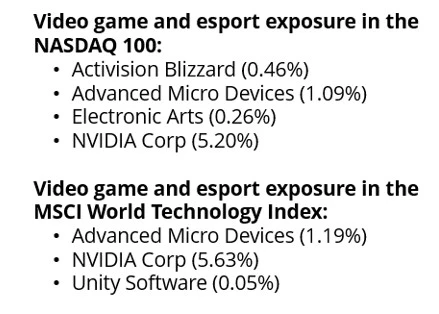

Video game companies have been benefiting from unprecedented growth for a number of years. Based on hypothetical back-testing after fees, the video game sector, as represented by the MVIS Global Video Gaming & eSports Index (ESPO Index net of management fee) has outpaced the broader global equity market and the tech-heavy NASDAQ 100 index since its base date at the end of 2014.

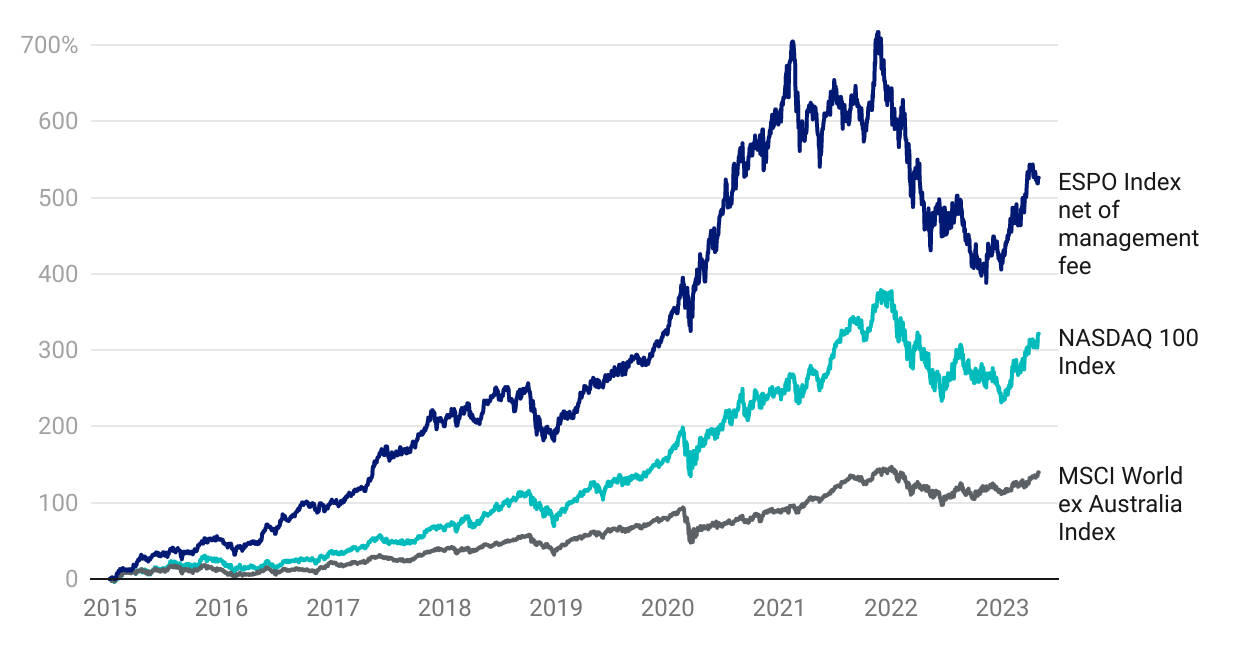

Chart 1: Hypothetical cumulative performance: ESPO Index after fees1vs major global indices

Table 2: Trailing returns: ESPO, ESPO Index after fees1

Chart 1 and Table 2 Source: VanEck, Morningstar, Bloomberg as at 30 April 2023. Past performance is not a reliable indicator of future performance of the ESPO index or ESPO. You cannot invest directly in an index. The comparison in chart 1 to the MSCI World ex Australia Index (“MSCI World ex Aus”) and the NASDAQ 100 is shown for illustrative purposes only, as they are widely recognised international and technology equities benchmarks. ESPO’s index measures the performance of companies involved in video game development, eSports, and related hardware and software globally. ‘Click here for more details’.

1ESPO Index results are net of ESPO’s 0.55% p.a. management fees, calculated daily but do not include brokerage costs or buy/sell spreads of investing in ESPO. You cannot invest in an index.

2ESPO inception date is 8 September 2020 and a copy of the factsheet is here.

3ESPO’s Index base date is 31 December 2014. ESPO Index performance prior to its launch in August 2020 is simulated based on the current index methodology.

VanEck Video Gaming and Esports ETF (ASX: ESPO)

ESPO was an Australian first. It offers investors the unique opportunity to invest in the largest pure-play video gaming and esports companies in the world. ESPO tracks the MVIS Global Video Gaming & eSports Index which includes companies which generate at least 50% of their revenues from video gaming and/or esports.

When compared against the NASDAQ 100, ESPO exhibits favourable valuations. The fund’s Price to Earnings (P/E) ratio of 28.60 times is lower than the NASDAQ’s 32.75 times. It also has a lower Price to Book (P/B). Considering ESPO against the MAGMAs, ESPO is also cheaper.

You can find more dedicated resources on esports - click here.

We also wrote a research paper - click here that is summarised here.

Past performance is no guarantee of future performance. The above is not a recommendation. Please speak to your financial adviser or stock broker.

For further information you can contact us at +61 2 8038 3300.

Key risks

An investment in ESPO carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.

Published: 24 May 2023

1Newzoo. Global Games Market Report, May 2023. Projected revenues for 2025.

2Edvice, 2022

3Statistca 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

MVIS Global Video Gaming and eSports Index (AUD) (‘MVIS Index’) is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany (‘MVIS’). MVIS is a related entity of VanEck. MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVIS Index. Solactive uses its best efforts to ensure that the MVIS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVIS Index to third parties.