Powering on: The rush to renewables

New forecasts from the International Energy Agency (IEA) predict renewable energy will become the largest source of electricity generation as soon as 2025.

The International Energy Agency (IEA) says solar power is undergoing a boom as the energy crisis drives a shift to renewable energy following the war in Ukraine. Forecasters are predicting renewables to surpass coal power by 2025, with the world adding twice as much renewable capacity from 2022 to 2027 as in the previous five years.

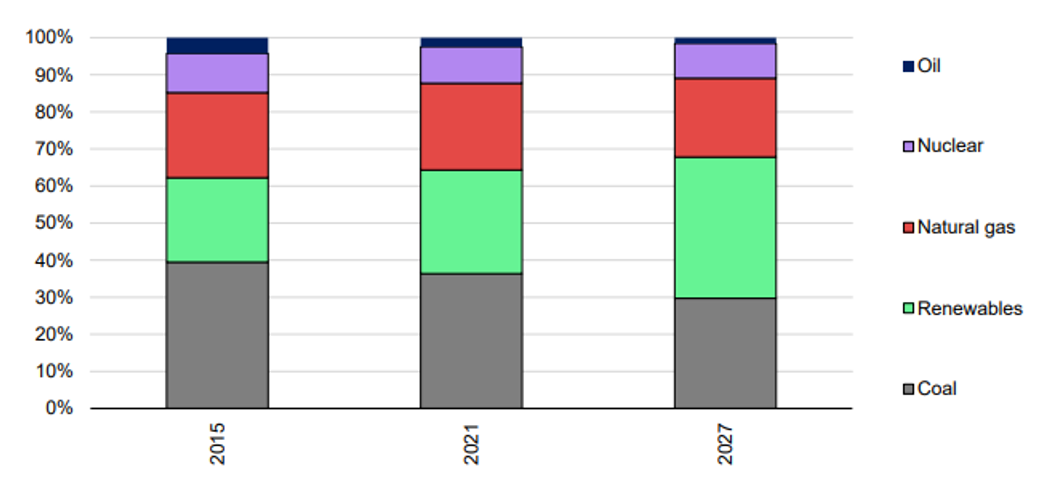

Figure 1: Global electricity generation by technology, 2015, 2021 and 2027

Source: IEA, based on World Energy Outlook (2022) Fossil fuel and electricity generation.

According to the IEA, the drivers of the expansion of renewables are climate goals but also energy security and the need to diversify renewable supply chains away from China.

IEA Executive Director Faith Birol says, “there is strong competition between the largest economies of the world to have pole position when it comes to the next chapter of the industry sector, whether in solar, wind power, batteries or electric vehicles.”

Also pushing the rush to renewables, the need to replace the oil and gas that is no longer coming from Russia, and to build domestic renewables sectors, which has in turn led to a push for industry incentives and subsidies.

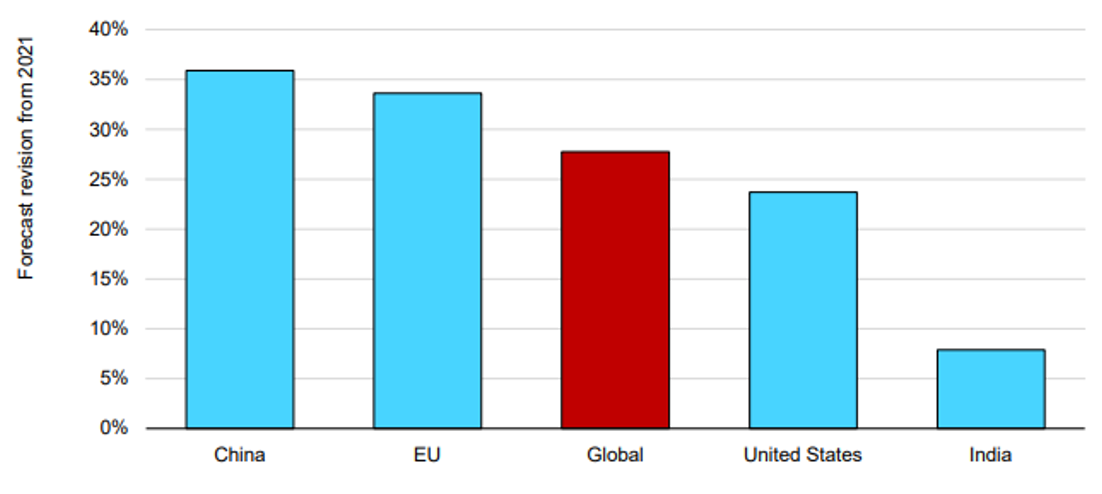

The expected increase is 30% higher than the amount of growth that was forecast a year ago, highlighting how quickly governments have thrown additional policy weight behind renewables.

Figure 2: Upward revisions to renewable capacity expansion forecasts from Renewables 2021 to Renewables 2022

Source: IEA, December 2022.

One example of such Government policy is the Inflation Reduction Act in the US which has been a catalyst for Investment Bank analysts recently placing ‘buy’ targets on renewables companies Sunrun, Enphase Energy and First solar due to their strong domestic presence amid the new US legislation.

Barrons recently reported that Deutsche Bank analyst Corienne Blanchard expressed confidence in the future of the stocks due to their exposure to the US markets after the passing of the Inflation Reduction Act earlier this year.

The Act, which was signed into law in August gives homeowners and other buyers of solar energy substantial tax credits to incentivise the move toward cleaner energy.

In a recent note Blanchard said, “We initiate broadly on the Clean Tech industry, launching coverage on six solar companies, with a bullish view supported by an acceleration in government support including the recently passed Inflation Reduction Act… This favorable regulatory environment and improving incentive support should help further boost demand for the solar industry.”

Blanchard added that the U.S. solar market has much room for growth, with only about 4% of the total addressable market currently using solar panels. She believes that in 10 years, about 15% of the market will be penetrated, driven by increased costs of utilities, declining solar costs, and benefits from the Inflation Reduction Act.

The VanEck Global Clean Energy ETF (ASX: CLNE) has had a strong second half of 2022 despite a rising rate, inflationary environment which has seen the majority of equities lose ground. As always though, past performance is by no means an indication of future performance.

CLNE includes all of the aforementioned stocks and many more at the forefront of renewables technology, allowing investors to participate in this structural, long-term trend in one easy trade.

It has diversified exposure that includes companies involved in:

- biofuel & biomass energy production, technology & equipment;

- ethanol & fuel alcohol production;

- fuel cells technology & equipment;

- geothermal energy production;

- hydro electricity production, turbines & other equipment;

- solar energy production, photo voltaic cells & equipment; and

- wind energy production, turbines & other equipment.

Key Risks

An investment in CLNE carries risks associated with ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, emerging markets, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 19 December 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.