Gold traded near record highs in July as ETF inflows surged and earnings season kicked off strong. Robust free cash flow is fueling M&A, with royalty firms gaining investor attention.

August gold investment update: gold stays strong

Gold Steadies Near Highs as Investment Demand Accelerates

With major equity indices reaching new highs, it is not surprising that the gold price closed July unchanged at US$3,289.93 per ounce (-0.40% for the month). However, it traded near record levels, reaching a high of US$3,439 on July 22. This is an indication that investors, while perhaps more optimistic about the economic outlook, still see plenty of reasons to own gold.

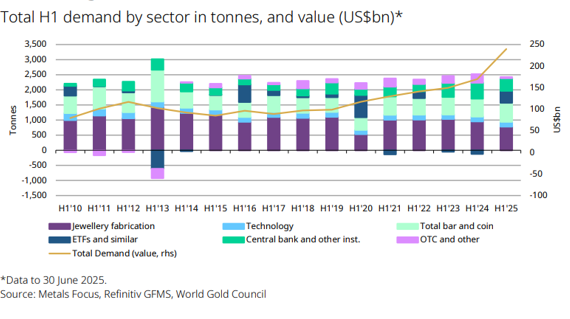

In fact, total gold bullion ETF holdings, our proxy for investment demand, increased by more than 615,000 ounces during July, a 0.68% month-on-month rise, contributing to a 10% gain so far in 2025. The World Gold Council’s Gold Demand Trends report for Q2 2025, highlighted significant investment in gold-backed ETFs as the main driver behind a 3% year-on-year increase in gold demand, reaching 1,249 tonnes for the quarter. In value terms, a record-high quarterly gold price average of US$3,280 per ounce supported a 45% year-on-year jump in total gold demand gain to US$132 billion.

Chart 1: H1 gold demand volume firms, while value rockets

The gold miners, as represented by the NYSE Arca Gold Miners Index held up well despite the lower gold price, rising 1.15%.

Q2 earnings season begins on a strong note

During July, gold companies began reporting their Q2 2025 results. On July 24, Newmont kicked off the earnings season with strong operational performance that led to better-than-expected earnings and record free cash flow generation. During the quarter, the company continued to reduce debt, returned US$1.0 billion to shareholders in the form of dividends and share buybacks, and approved an additional US$3.0 billion share repurchase programme, bringing total authorisation to US$6.0 billion (US$2.8 billion executed to date). Newmont also reaffirmed that it is on track to meet its 2025 guidance of 5.6 million ounces of gold at all-in sustaining costs of US$1,620 per ounce. These results are what gold equity investors want to see during a period of record gold prices. Newmont shares rose 7% on July 25. The company also provided gold price sensitivities, noting that every US$100 per ounce increase translates into more than US$500 million in additional revenue. Newmont set a constructive tone for the reporting season, with senior producers and top fund holdings, Agnico Eagle Mines, Kinross Gold, and AngloGold Ashanti, also posting strong results and reaffirming their 2025 targets.

M&A activity heats up on strong cash flows

The gold mining sector’s record margins are translating into record levels of free cash flow. This abundance of cash is enabling companies to refocus on their growth strategies, fueling an increase in M&A activity for the industry. Producers need to replace the ounces they mine each year, and while organic growth projects are the preferred option, the ounces associated with those projects are not enough to offset depletion. Acquisitions usually come at a higher price tag, but with gold shares trading higher this year and plenty of cash and debt capacity in most balance sheets, companies can more aggressively pursue M&A. Our hope is that they continue to do so with discipline, such as by protecting margins and seeking value creation. Bigger is not always better in the gold sector, so management teams need to be selective.

Torex Gold Resources and Royal Gold announce strategic acquisitions

In July, Torex Gold Resources (“Torex”) announced its proposed acquisition of Prime Mining. If completed as expected, the deal will give Torex full ownership of the multi-million-ounce Los Reyes gold-silver project in Mexico, a jurisdiction where Torex has successfully worked since 2010. Its experience in Mexican operations, project development, permitting, community and labour relations, procurement and supply chain management and stakeholder engagement, gives it a clear competitive advantage in unlocking value and delivering synergies.

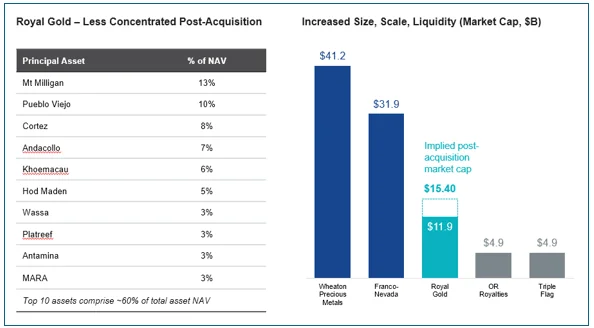

Also, in July, Royal Gold announced its proposed acquisition of Sandstorm Gold and Horizon Copper. The transaction is expected to deliver immediate meaningful revenue growth, strengthen Royal Gold’s precious metals focus, and expand its long-term growth pipeline. It also improves investor appeal by increasing scale and liquidity, while unlocking value through the simplification of complex inter-company structures.

The compelling case for royalty and streaming companies

Royalty and streaming companies offer a unique and compelling investment profile within the gold mining sector. Unlike producers, they do not own or operate mines. Instead, they hold contractual rights to a portion of the production (either through royalties or streams) from mines operated by others. This model provides substantial benefits: reduced exposure to cost inflation, broad asset diversification, and limited operational risk.

Functioning as financiers to mine developers, these companies participate in the upside of mining operations without taking on many of the associated downside risks. Moreover, their business model offers the opportunity for "zero-cost growth" as they often benefit from mine life extensions or production expansions without needing to invest additional capital. This combination of growth potential and a lower-risk profile makes them a strategic “happy medium” between gold bullion and traditional producers, offering safety during downturns and exposure to upside in growth cycles.

Growth efficiency versus gold price leverage

The drawback is that royalty and streamers offer lower leverage to the gold price. This is a reason often offered to explain underweight positioning in this gold equity subsector during a gold bull market. However, this perceived limitation may be offset by their more attractive growth profiles and lower risk exposure. This dynamic explains why they tend to trade at premium valuations relative to producers.

The acquisition of Sandstorm Gold and Horizon Copper by Royal Gold exemplifies the value-adding potential of M&A within the streaming and royalty space. Unlike producer-led M&A, which often comes with integration challenges, geopolitical and operational risk, and the dilution of management focus, streaming companies can pursue acquisitions that are relatively risk-free from an execution standpoint.

In this case, the transaction is NAV accretive by most estimates, enhances Royal Gold’s growth pipeline, and expands its already diversified portfolio to 400 assets, 80 of which are in production. The deal also improves scale and liquidity, elevating Royal Gold’s profile among generalist investors and better positioning it to compete with the largest players in the sector. Notably, no single asset is expected to represent more than 13% of the company’s valuation post-transaction, reinforcing the company’s risk-mitigated structure.

Royal Gold’s proposed acquisition of Sandstorm gives the company one of the largest, most diversified mining asset portfolios. The proposed acquisition increases the company’s scale. However, it is still small enough to show growth potential.

Charts 2 and 3: Royal Gold’s post-acquisition portfolio and market capitalisation

Source: Royal Gold. Data as of June 30, 2025.

In sum, this acquisition not only strengthens Royal Gold’s organic growth trajectory but demonstrates the superior scalability and efficiency of the royalty and streaming model.

Positioning for a dynamic gold market

We believe royalty companies possess meaningful advantages, both in terms of organic growth and growth through acquisition. When combined with their lower-risk profile, they are positioned well to compete with gold producers, even in a rising gold price environment.

Published: 14 August 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.