Gold Stocks vs. Bullion in a Gold Bull Market

Gold’s current price level hints at a potentially longer, sustained rally. We believe this, along with the steps gold miners have taken to reduce costs and capital expenditures, make gold stocks an attractive opportunity.

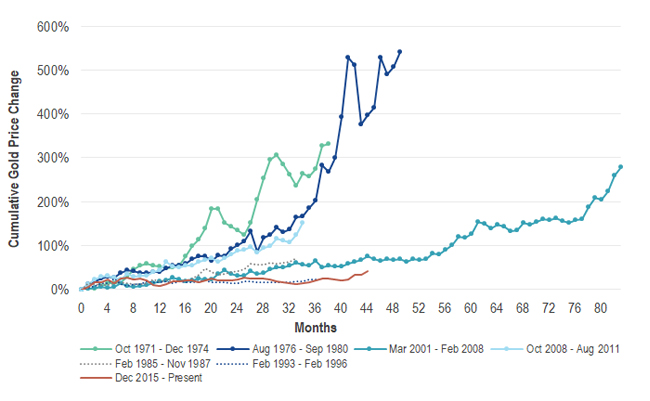

Bull markets can be classified as either secular (long term) or cyclical (bull phases within an overall bear market). Before its US$1,400 per ounce breakout in June, gold appeared to be tracking, on a technical basis, similar to its 36-month cyclical bull market from 1993 to 1996. However, its current US$1,500 price level hints at a potentially longer, sustained rally—perhaps more similar to the secular gold bull market of 2001 to 2008.

Historical Gold Bull Market Rallies Have Come in All Shapes and Sizes

Source: VanEck, Bloomberg. Data as of August 2019. “Gold” represented by Gold Spot ($/oz). Past performance is not indicative of future results.

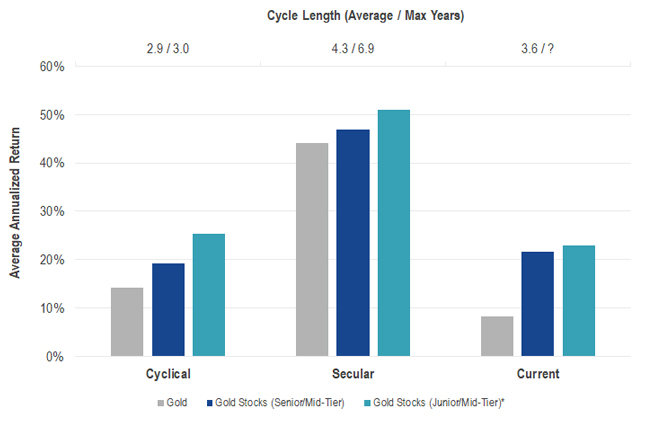

Gold stocks, on average, have historically outperformed gold during gold bull market cycles in the past—including through both cyclical and secular periods. This typically occurs because of their optionality to gold through earnings and resource leverage.

Gold Stocks Have Outperformed Gold in Past Bull Market Cycles1

*Data first available beginning in February 1992.

Source: VanEck, Bloomberg, FactSet, Barron’s. Data as of August 2019. Past performance is not indicative of future results.

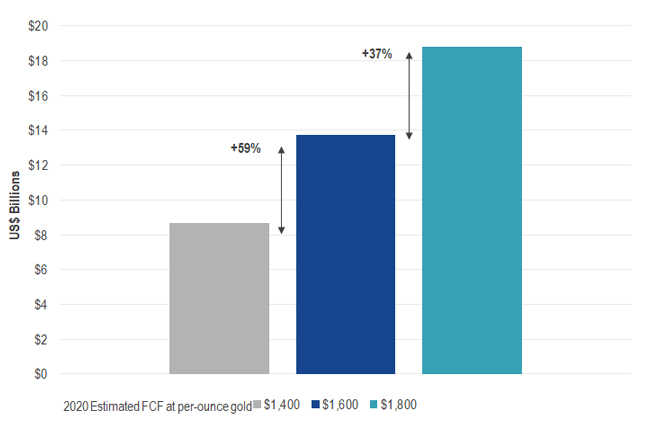

However, the greatest difference between the last bull market cycle (2008 to 2011) and the current cycle is the lengths to which these companies have gone to reduce costs and capital expenditures and to avoid mistakes of the past (such as “hedging” their production—i.e., buying futures contracts to ensure delivery of their gold at a fixed price at a later date in time—in a rising gold price environment). For senior or mid-tier miners, these efforts could translate to nearly 60% increases in free cash flow, on average, for a gold price move from $1,400 to $1,600. We believe that this makes a compelling case for gold stocks at the moment and, in particular, given their attractive valuation on both an absolute and relative basis.

Some Gold Senior and Mid-tier Miners Exhibit Favorable Leverage to Higher Gold Prices

Source: VanEck, Bloomberg. Data as of August 2019. “Senior” miners defined by production levels of approximately 1.5-6.0 million ounces of gold per year (“Mid-Tier” approximately 0.3-1.5 million ounces per year).

DISCLOSURE

1“Cyclical” bull markets include: February 1985 to November 1987; and February 1993 to February 1996. “Secular” bull markets include: October 1971 to December 1974; August 1997 to September 1980; March 2001 to February 2008; and October 2008 to August 2011. “Current” bull market includes December 2015 through most-recent month-end (August 2019). “Gold” represented by Gold Spot ($/oz). “Gold Stocks (Senior/Mid-Tier)” represented by Barron’s Gold Mining Index (BGMI) from October 1971 to inception date of the Philadelphia Gold and Silver Index (XAUTR) in January 1984 and XAU to the inception of the NYSE Arca Gold Miners Index (GDMNTR) in October 1993. “Gold Stocks (Junior/Mid-Tier)” represented by the world small-cap gold subgroup index of the Dow Jones Global Index (DJGI) from February 1992 to inception of the MVIS Global Junior Gold Mining Index (MVGDXJTR) in January 2004. “Senior” miners are defined by production levels of approximately 1.5-6.0 million ounces of gold per year (“Mid-Tier” miners approximately 0.3-1.5 million ounces per year; “Junior” miners approximately <0.3 million ounces per year). Indices are not securities in which an investment can be made.

Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’). VanEck is a wholly owned subsidiary of Van Eck Associates Corporation based in New York, United States. VanEck Vectors ETF Trust ARBN 604 339 808 (the ‘Trust’) is the issuer of shares in the VanEck Vectors Gold Miners ETF (‘US Fund’). The Trust and the US Fund are regulated by US laws which differ from Australian laws. Trading in the US Fund’s shares on ASX will be settled by CHESS Depositary Interests (‘CDIs’) which are also issued by the Trust. The Trust is organised in the State of Delaware, US. Liability of investors is limited. VanEck Associates serves as the investment adviser to the US Fund. VanEck, on behalf of the Trust, is the authorised intermediary for the offering of CDIs over the US Fund’s shares and issuer in respect of the CDIs and corresponding Fund’s shares traded on ASX.

Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This is general financial product information only and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Investing in international markets has specific risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign laws and tax regulations. Before making an investment decision in relation to the US Fund you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37.

Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies or the Trust gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance or any particular rate of return from the US Fund.

An investment in the US Fund may be subject to risks that include, among others, competitive pressures, dependency on the price of gold and silver bullion that may fluctuate substantially over short periods of time, periods of outperformance and underperformance of traditional investments such as bonds and stocks, and natural disasters, all of which may adversely affect the US Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates that may negatively impact the US Fund’s return. Small- and medium- capitalisation companies may be subject to elevated risks. The US Fund’s assets may be concentrated in a particular sector and may be subject to more risk than investments in a diverse group of sectors.

©2019 VanEck

Published: 27 August 2019