Miners regain their shine as gold consolidates

- Gold prices were range-bound near the US$3,300/oz level, with catalysts such as Federal Reserve uncertainty and heightened global risks, which boosted safe-haven demand.

- Gold miners surged in August on strong earnings and capital discipline.

- Signs of a sector re-rating suggest gold equities may be entering a new bull cycle

Policy whiplash, golden calm

Gold continues to be supported by heightened uncertainty and volatility, stemming from persistent global geopolitical and trade tensions and mixed economic signals. In August, gold became entangled in the trade-tariff chaos when news reports suggested that the US had imposed tariffs on 1-kilogram and 100-ounce bars of gold. The White House and President Trump later reassured markets that gold will not be subject to tariffs. The gold tariff fiasco exemplifies the confusing policy environment in the US, with markets trying to re-interpret and price in rapidly changing and conflicting information daily.

Gold holds the line

The gold price has been range-bound around the US$3,300 per ounce level following its strong rally post “liberation” day in April. This sideways action does not surprise us. In recent years, after significant moves to new highs, the gold price tends to consolidate around a new, higher base before the next catalyst emerges which drives it to the next level. While there are plenty of potential catalysts at present, the timing is impossible to predict, but anything that threatens the stability of the global financial system would likely lead to a surge in safe-haven demand for gold.

From tariff talk to rally walk

We had a taste of what some of those catalysts may look like on August 20, when President Trump called for the resignation of, and days later announced he had fired, US Federal Reserve (“Fed”) Governor Lisa Cook. This escalation in assaults on the Fed by the current administration raised fears that the Fed could lose its independence, threatening the stability and credibility of the world’s most important central bank. Gold rallied in response, also supported by increased probabilities of a Fed cut in September and a weaker dollar, closing at US$3,447.95 per ounce on August 29, a US$158.02 (4.80%) gain for the month.

Calm metal, hot miners

The NYSE Arca Gold Miners Index (GDX Index) was up 19.70% during the month. The gold price increase led to an amplified gain for the gold equities, as expected, reflecting their leverage to the metal price. However, the substantial outperformance suggests other factors, beyond the gold price, supported gold mining shares in August. We believe a key driver was a strong Q2 2025 earnings season: companies reported financial and operating results that met or exceeded expectations, with many companies reporting record revenues and free cash flow. Most companies in our universe maintained their yearly guidance, and many larger players reiterated their commitment to higher shareholder returns via dividend payments and share buybacks. Investors were reassured that higher gold prices are indeed translating into higher margins, higher profitability, lower debt and enhanced growth prospects for the industry. And while August was not a bad month for broader equities, helped by mega-cap tech dominance and optimistic rate-cut speculation, monthly gains of approximately 2% for the S&P 500 Index paled in comparison to the gold miners’ advance. Richly valued US equities, concerns that growth of mega-cap stocks may be fading and high concentration in AI/tech stocks may also be driving portfolio diversification and rotation of capital that is benefitting gold stocks.

Miners regain their shine

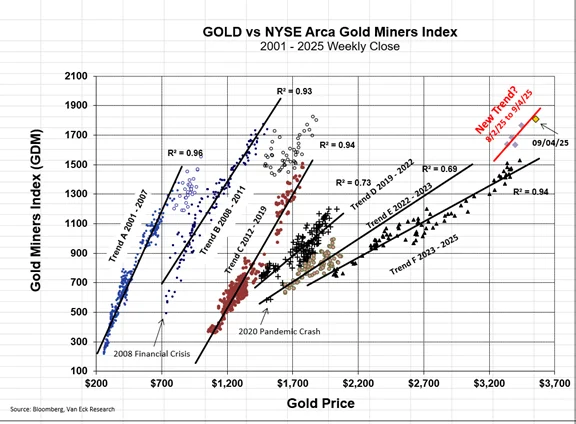

After almost two decades of persistent de-rating, data seems to suggest that gold equities are staging a comeback. We have been tracking the relationship between gold bullion and (gold equities as represented by the GDX Index) since 2001 (see chart below) and have identified six clear and strong trends, indicating a significant and prolonged de-rating of the gold mining sector since 2007. A de-rating occurs when a trendline shifts to the right and/or downward. De-ratings in the past were the result of companies disappointing investors. Examples include out-of-the-money hedge books in the 2000’s; over indebtedness and low returns on capital in the 2010’s; and missing production and cost targets in the early 2020’s. Now, investors are seeing expanding margins, low debt, capital-allocation discipline, and companies doing what they said they would do this year. While it is too early to tell if a new valuation trend is forming, August data is encouraging and may signal the beginning of a new bull cycle for gold mining stocks. For reference, the bull market trend of 2001-2007 would imply a GDX Index value of approximately 6,000 at today’s spot gold price, compared to its present value of around 1,800. A return of those historical sector multiples may seem unrealistic, and it is not part of our outlook, but a significant re-rating of the sector is in the cards, in our view.

As mentioned above, the chart below maps gold prices against the GDX Index since 2001, highlighting the six trends, and a potential re-rating with a steeper “new trend” emerging since mid-August 2025.

Data as of September 4, 2025. Past performance is no guarantee of future results.

Published: 16 September 2025

IMPORTANT NOTICE – FOR FINANCIAL SERVICES PROFESSIONALS ONLY. NOT TO BE DISTRIBUTED TO RETAIL INVESTORS.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

NYSE® Arca Gold Miners Index® is a trademark of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by VanEck in connection with the US Fund. Neither the Trust nor the Fund is sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding the Trust or the Fund or the ability of the NYSE Arca Gold Miners Index to track general stock market performance.

ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.