The 2025 Gold Rush

Gold has been in the news of late, as fiscal and monetary policy uncertainty pervades markets.

Because gold is a currency, its price does not behave like other commodities. It’s also why gold equities do not behave like other mining shares. So far, 2025 has been a stellar year for the shiny metal and those companies that dig it from the ground.

We believe gold’s winning streak, and therefore its miners, is likely to continue.

Predictions of a gold price beyond US$4,000 are becoming more and more frequent.

Gold has been one of the best-performing asset classes so far in 2025. Its value rose over 30% since the beginning of the year (1 January 2025 to 16 September 2025).

It hit a record high of US$3,695 this week.

A higher gold price largely correlates with investors’ increasing unease about a weakening global financial system. Currently, investors are worried about government indebtedness, geopolitical risks, tariffs and central bank mismanagement.

Gold miners, which tend to outperform gold bullion when the gold price rises and underperform when the gold price falls, have also benefited from this uncertainty. VanEck’s Gold Miners ETF (GDX) has returned over 85% since the beginning of the year (1 January 2025 to 16 September 2025). Noting that past performance is not an indicator of future performance.

The historical outperformance and underperformance of miners, relative to the gold price, has led many investors to refer to miners as providing ‘leverage’ to the gold price. The rise this year has taken many by surprise.

What is behind the rise of gold miners?

There are two key reasons why gold miners have performed so well in 2025 (and why we think it could continue).

1 – Gold miners were undervalued.

In November last year, our gold Portfolio Manager for Gold and Precious Metals, Imaru Casanova, lamented that the gold miners’ leverage to gold had only been significant during downturns since 2020, not during price rises – you can read that analysis here.

What this meant is that the gold miners were falling by much more than the gold price when the gold price was falling. But when the gold price was rising, the performance of miners barely matched the positive performance of the price of gold.

As a result, gold miners, relative to the price of gold bullion, started the year undervalued.

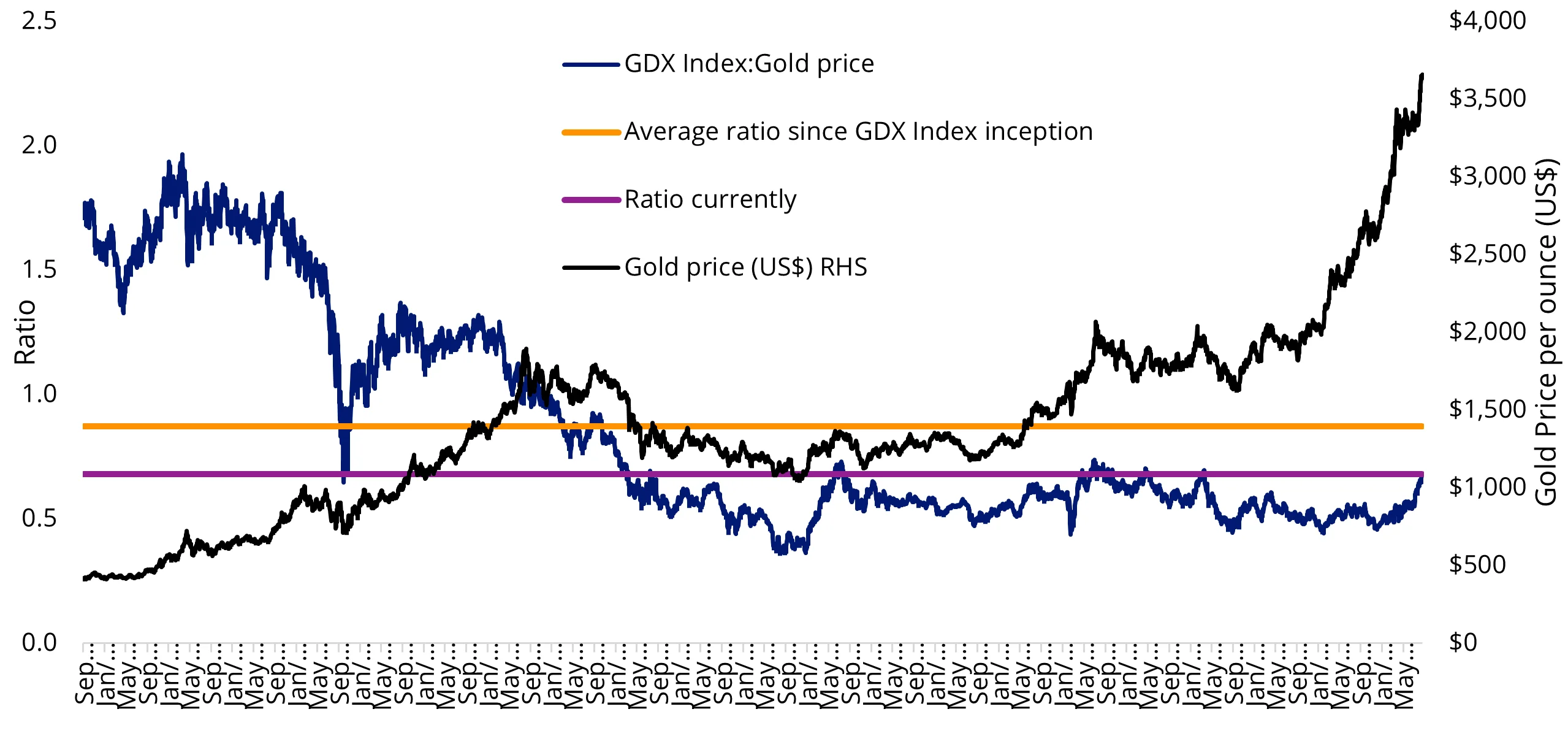

You may have seen us present this chart before. Not only does it show the rally since the beginning of the year, it also highlights that there could still be room for gold miners to continue their momentum. Especially if the price of gold continues to rise.

The black line in the chart below shows the price of gold bullion per ounce, and the blue line shows the ratio of NYSE Arca Gold Miners Index (GDX Index) to the price of gold bullion, that is the index divided by the gold price. When this blue line is falling, gold miners are becoming cheaper relative to the gold price and vice versa. The average of this ratio over the 21 years (how long the GDX Index has been around) is approximately 0.90. This average was last achieved when gold was around US$1,700 in 2012. You can see the sharp rise of the blue line in 2025, but it is still not near the long-term average.

Source: VanEck, LBMA. Bloomberg, as at 15 September 2025. All figures in US dollars. Past performance is not a reliable indicator of future performance. There is no guarantee that gold miners, as represented by the GDX Index, will return to the long-term average ratio. You cannot invest in an index.

From current levels, a return to the long-term average of 0.90 would need gold miners to rise by approximately 30% (and that assumes that the gold price doesn’t increase).

2 – Gold miners have been reporting strong results

During the recent earnings season, here and abroad, gold mining companies generally reported financial and operating results that met or exceeded expectations, with many companies reporting record revenues and free cash flow. Most companies in GDX’s universe maintained their yearly guidance, and many larger players reiterated their commitment to higher shareholder returns via dividend payments and share buybacks.

Investors were reassured that higher gold prices are indeed translating into higher margins, higher profitability, lower debt and enhanced growth prospects for the industry.

Our most recent gold commentary includes this analysis. You can read it here. According to our portfolio manager, Imaru, “While it is too early to tell if a new valuation trend is forming, August data is encouraging and may signal the beginning of a new bull cycle for gold mining stocks.”

Accessing gold with the specialists

Gold miners could be a potential consideration when contemplating an allocation to gold and there are ETFs that include gold miners such as VanEck’s GDX. You can also consider gold bullion ETFs, such as VanEck’s NUGG, to access the benefit of an allocation to the precious metal. An ETF means that you do not have to store and insure the gold yourself; the fund manager takes care of that for you.

VanEck’s global leadership in gold investing stretches more than 50 years, encompassing gold equities and bullion across ETFs and active funds.

Two ETFs for portfolio considerations:

- NUGG – accessing physical gold, that ‘delivers’

- GDX – investing in a diversified portfolio of gold mining companies

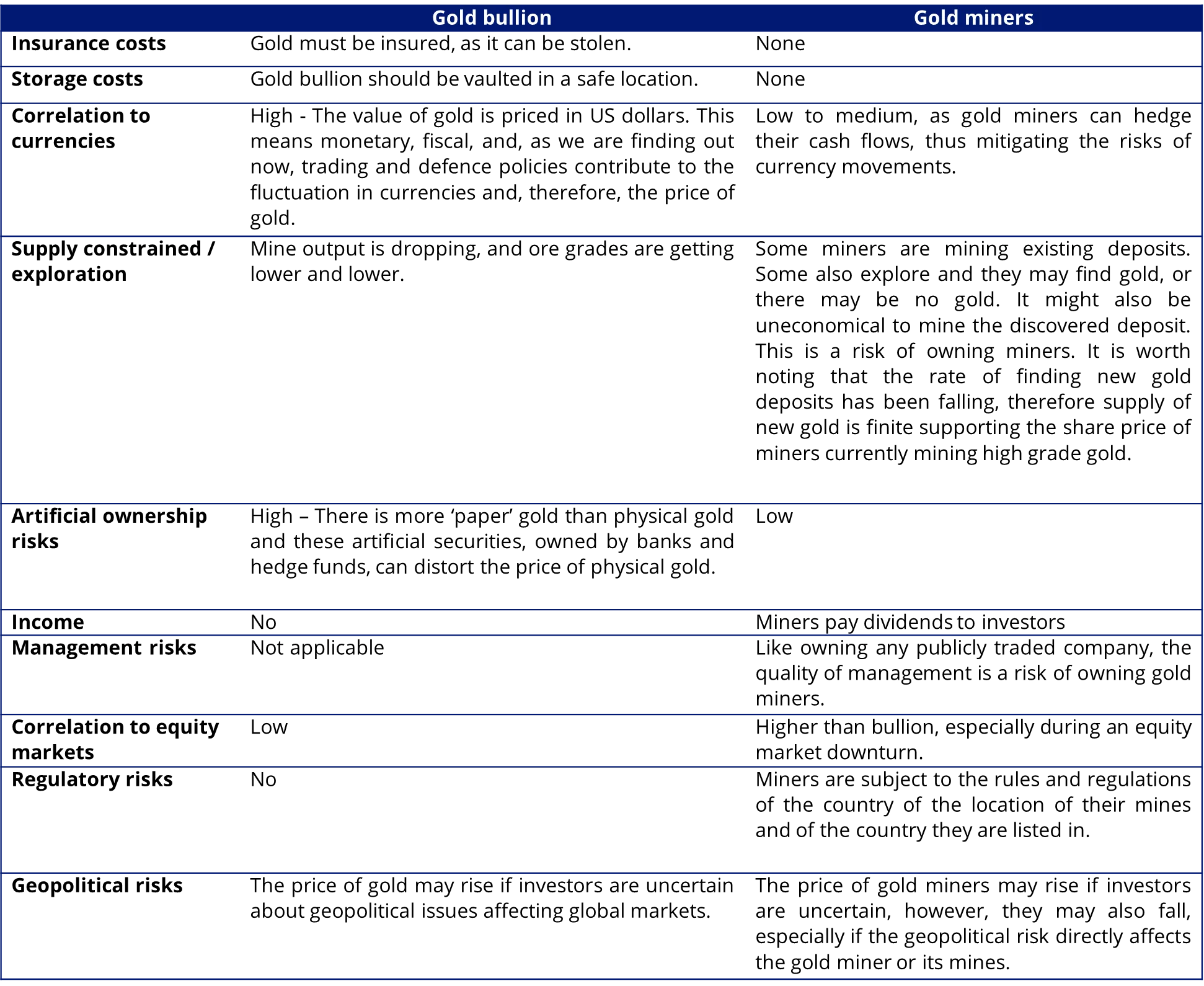

Below we outline the risks of each type of exposure to gold, owning gold bullion and owning gold miners:

Differences between gold miners and bullion

While each gold strategy has its merit for portfolio inclusion, you should assess all the risks and consider your investment objectives.

Past performance is no guarantee of future performance. The above is not a recommendation. Please speak to your financial adviser or stock broker.

For further information you can contact us via email or on +61 2 8038 3300.

Key risks

An investment in NUGG or GDX carries investment risk. These risks vary depending on the fund and may include gold pricing risk, currency risk, custody risk, Australian sourced gold bullion risk, ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDSs and TMDs for details on risks.

Published: 18 September 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

NYSE® Arca Gold Miners Index® is a trademark of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by VanEck in connection with the US Fund. Neither the Trust nor the Fund is sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding the Trust or the Fund or the ability of the NYSE Arca Gold Miners Index to track general stock market performance.

ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.