Bonds: Attractive yields (if you know where to look)

As expectations for the Reserve Bank of Australia to increase the cash rate have accelerated and credit spreads have widened, the yields on subordinated bonds have increased to potentially attractive levels.

As expectations for the Reserve Bank of Australia to increase the cash rate have accelerated and credit spreads have widened, the yields on subordinated bonds have increased to potentially attractive levels.

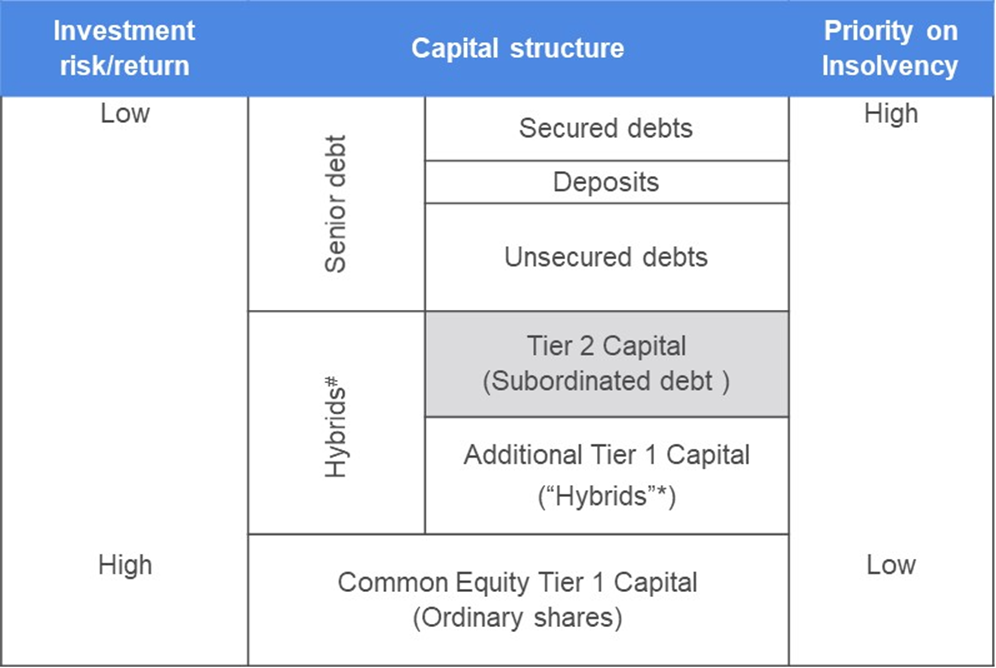

Subordinated bonds rank below traditional bonds and are therefore considered more risky. As a result, financial institutions, which largely issue subordinated bonds, typically pay a higher interest rate compared to traditional corporate bonds.

Bank dominated debt

Subordinated bonds in Australia consists mainly of Tier 2 Capital securities issued by banks and insurers. The debt ranks above ordinary shares and Additional Tier 1 Capital (commonly known as hybrids), but they sit below senior debt, as mentioned. The majority of subordinated debt is issued by the big four banks which have been designated as domestic systemically important banks (D-SIBs) by the Australian Prudential Regulation Authority (APRA).

APRA determines how much capital financial institutions must hold. In July 2019, APRA finalised its ‘total loss-absorbing capacity’ or ‘bail in’ requirements for the major banks in order to reduce the prospect of a taxpayer funded bail-out. APRA decided that the major banks should increase the amount of Tier 2 Capital they hold.

D-SIBs have now issued more than $50 billion in subordinated bonds[1]. Late in 2021, APRA updated its requirements for Tier 2 Capital securities and anticipates that D-SIBs may issue around a further $20 billion of Tier 2 capital, in aggregate, to meet their final requirement by January 2026.

#Per ASIC Report 365. *Per market convention.

The lure of higher yields

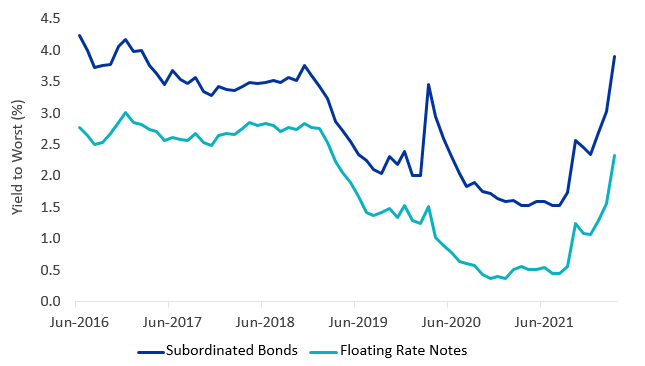

Subordinated bonds are now paying potentially attractive yields. As at 31 March 2022, the yield-to-worst (the common measure of returns on subordinated debt), as measured by the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index (SUBD Index), was 3.90%. THE SUBD Index includes Australian dollar investment-grade floating-rate subordinated bonds. This rate is 1.57% above the yield to maturity on the Bloomberg AusBond Credit FRN 0+ Yr Index (FLOT Index) which measures the performance of Australian dollar investment-grade floating-rate notes which are part of the senior debt of banks and other companies.

The average credit rating for the SUB Index is BBB+ compared to the FLOT index which is A+. By taking on some additional risk and investing in subordinated bonds, investors can enhance their overall yield towards 4.0%. The chart below highlights the upward tick in yields since 2021.

Yield to Worst: Subordinated Bonds vs Floating Rate Notes

Source: IHS Markit and Bloomberg; data from 30 June 2016 to 31 March 2022. Subordinated bonds is the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index; Floating Rate Notes is the Bloomberg AusBond Credit FRN 0+ Yr Index. Past performance is not indicative of future performance.

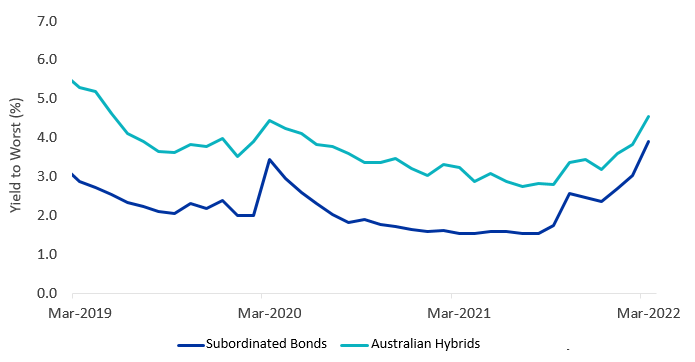

The yield offered by Subordinated bonds is also closing in on the yield offered by the higher risk Additional Tier 1 Capital Securities. The chart below compares the yield on a basket of four equally weighted (one from each of the big four banks) Additional Tier 1 Capital Securities (typically known as Australian Hybrids) to the SUBD Index.

Yield to Worst: Subordinated Bonds vs Australian Hybrids

Source: IHS Markit, Bloomberg and VanEck; data 31 March 2019 to 31 March 2022. Subordinated bonds is the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index; Australian Hybrids is a basket of four equally weighted (one from each of the big four banks) Additional Tier 1 Capital Securities. Past performance is not indicative of future performance.

Subordinated bonds have traditionally only been available to wholesale investors, but they can now be accessed on ASX via the VanEck Australian Subordinated Debt ETF (ASX code: SUBD). Subordinated bonds can be used to enhance the return on the fixed income portion of an investor’s portfolio or as an alternative to Additional Tier 1 Capital securities.

[1] Based on APRA’s interim requirements updated on 9 July 2019.

Published: 08 April 2022

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

The Fund is based on the Markit iBoxx Investment Grade Subordinated Debt Index (‘the Index’). The Index is the property of Markit Indices Limited (‘Markit’) and iBoxx® and Markit® are trademarks of Markit or its affiliates. The Index and trademarks have been licensed for use by VanEck. The Fund is not sponsored, endorsed, or promoted by Markit

Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) are not affiliated with VanEck and do not approve, endorse, review, or recommend the Fund. BLOOMBERG and the Bloomberg Ausbond Credit FRN 0+ Yr Index (“the Index”) are trademarks or service marks of Bloomberg licensed to VanEck. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the Index.