Tapping into Australia's $45B & growing subordinated debt market

Understand a growing debt market in Australia and the added value from an exposure beyond the big banks.

Subordinated debt has seen strong investor interest over the past few years. Offering higher yields than traditional bonds and diversification benefits for equity investors, the market for subordinated debt has grown significantly following capital regulations introduced by APRA.

APRA requires Australia’s banks to hold “total loss absorbing capital” (TLAC) on their balance sheets as a safeguard against any future GFC-style financial crises. The buffer for Australia’s big 4 banks allocated to subordinated debt (also known as Tier 2 capital) was initially set at a minimum 2% of the bank’s risk-weighted assets (RWA) but was subsequently increased to 5% in 2019 and then 6.5% in 2021.

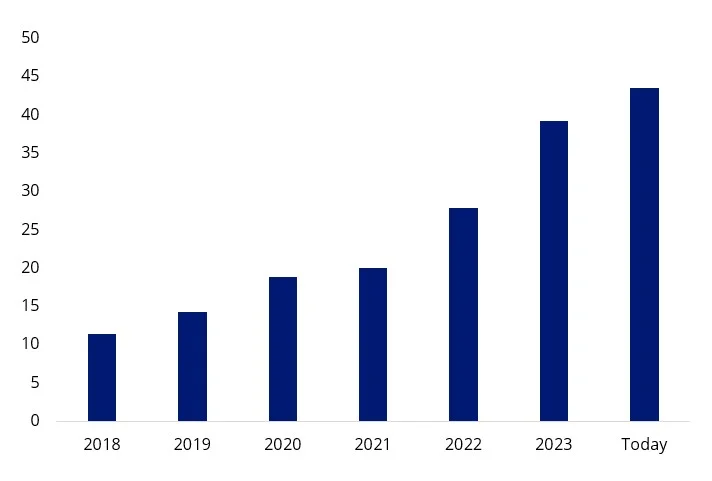

The banks had to dial up their subordinated debt issuance to meet the new buffer requirements. As of 30 April 2024, the market cap for subordinated debt was $45 billion - a four-fold increase since 2018.

Chart 1: AUD Tier 2 Market Capitalisation ($bn)

Source: Bloomberg, As at 30 April 2024.

Shortly after APRA’s interim TLAC announcement in July 2019, VanEck launched it’s Australian Subordinated Debt ETF (SUBD), Australia’s first pure play Tier 2 ETF on the ASX. This gave investors the opportunity to access a portfolio of investment-grade subordinated bonds – formerly only available to institutions – via a single trade on the ASX.

SUBD has become one of VanEck’s fastest-growing ETFs, amassing $1.47 billion in assets under management in less than five years.

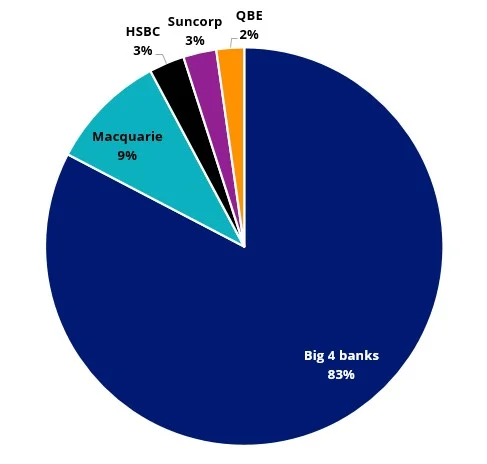

SUBD uses a passive strategy that tracks the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index (SUBD Index), which only includes investment-grade Australian currency floating rate bonds issued by financial institutions that qualify as Tier 2 Capital under APRA’s rules. The latest issuers included in the index are Australia’s big 4 banks, Macquarie Bank, HSBC, QBE and Suncorp.

Chart 2: SUBD holdings

Source: S&P, As at 20 May 2024.

Benefits beyond the big five

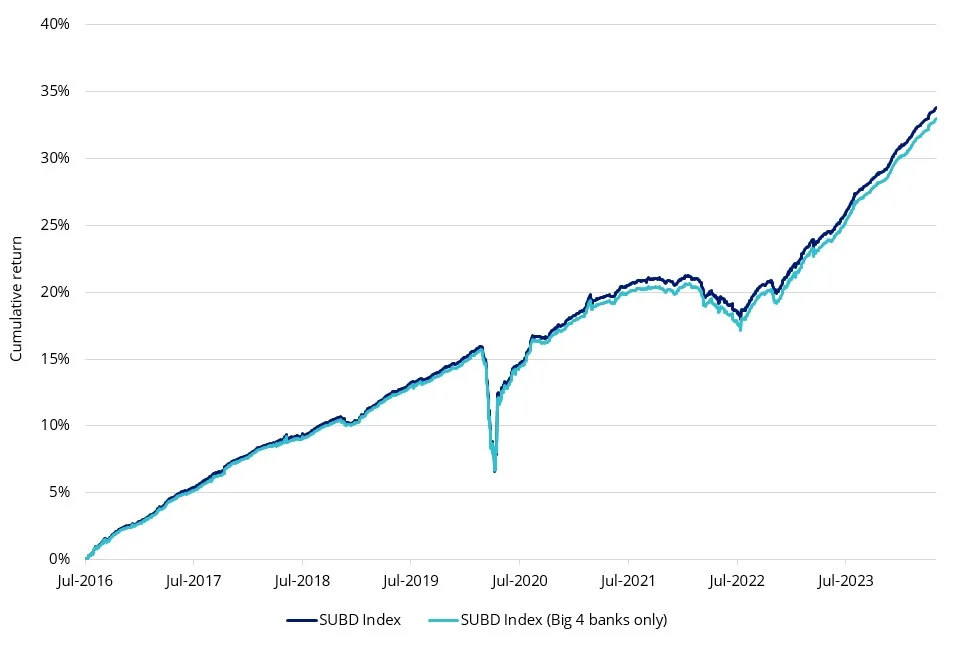

While exposure to banks and insurers outside of the big four and Macquarie is low (~8%), this allocation has benefits. They tend to be higher yielding, have historically outperformed, and have recorded similar drawdowns to Australia’s big 4 banks.

Historical performanceAllocation to the non-major banks in the SUBD index has historically seen it outperform the big 4 bank-only index by 8-11 basis points.

Table 1: Historical performance

Source: S&P, As at 30 April 2024.

Drawdown comparisonThe historical drawdown for the SUBD index is similar to the big 4 bank-only index.

Chart 3: Return comparison

Source: S&P, As at 30 April 2024.

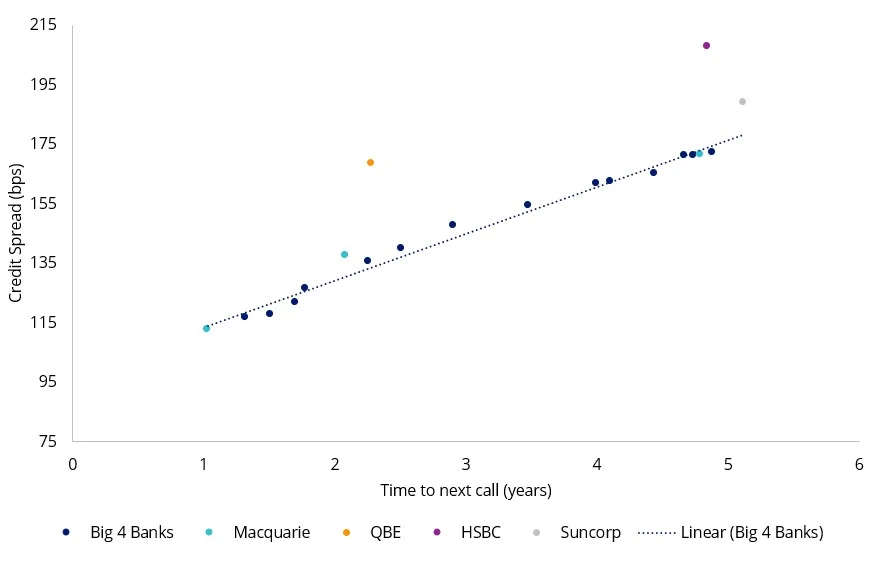

Yield pickupThe non-big 5 bank Tier 2 yield is between 15-45 basis points above that of Australia’s big 4 banks.

Chart 4: SUBD Index credit spread comparison

Source: Bloomberg, SUBD index constituents. As at 20 May 2024.

The role of subordinated bonds in a portfolio

For investors, subordinated bonds can serve two important roles in a portfolio:

- Increase return for a commensurate increase in risk – for investors with large holdings of traditional senior bonds, who are willing to take more credit risk, subordinated bonds issued by financial institutions can enhance income;

- Decrease risk – for investors with large holdings in hybrids or bank shares who are seeking to reduce their overall risk, subordinated bonds may perform a useful role. Now, for a variety of reasons, subordinated bonds are offering similar yields to bank shares and hybrids. While similar yields will not always be the case in the future, subordinated debt can potentially provide a reduction in price volatility relative to shares and hybrids.

As always, we recommend you speak to a financial adviser to determine if an investment in subordinated bonds is right for you. Past performance is by no means indicative of future performance.

Key risks

An investment in the ETF carries risks associated with: subordinated debt, bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 24 May 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.