The bonds are back in town

With markets on edge about an economic slowdown and subsequent earnings revisions, those investors reliant on income are considering options beyond high-yielding shares.

The RBA Cash rate is sitting at 4.10%, more palatable for income investors than the 0.10% 16 months ago. At that time, income investors were being forced up the risk curve to achieve their investment objective. Now, with S&P/ASX 200’s indicative dividend yield being 4.46% (as at 31 July 2023, source S&PDJI), or 5.96% gross yield (inc franking), the increased income payoff, relative to the risks, gives income investors pause for caution.

We think, with less potential downside risks than equities, the highest yielding investment grade corporate bonds represent a compelling yield opportunity, with VanEck’s Australian Corporate Bond ETF’s average yield to maturity 5.88% (as at 31 July 2023. Yield figures quoted are not a forecast, and are not a guarantee of the future return of the fund that will vary from time to time).

We think, with less potential downside risks than equities, the highest yielding investment grade corporate bonds represent a compelling yield opportunity.

Bonds have traditionally been used by investors as a diversification tool to generate income and ‘cushion’ the losses for higher-risk equities.

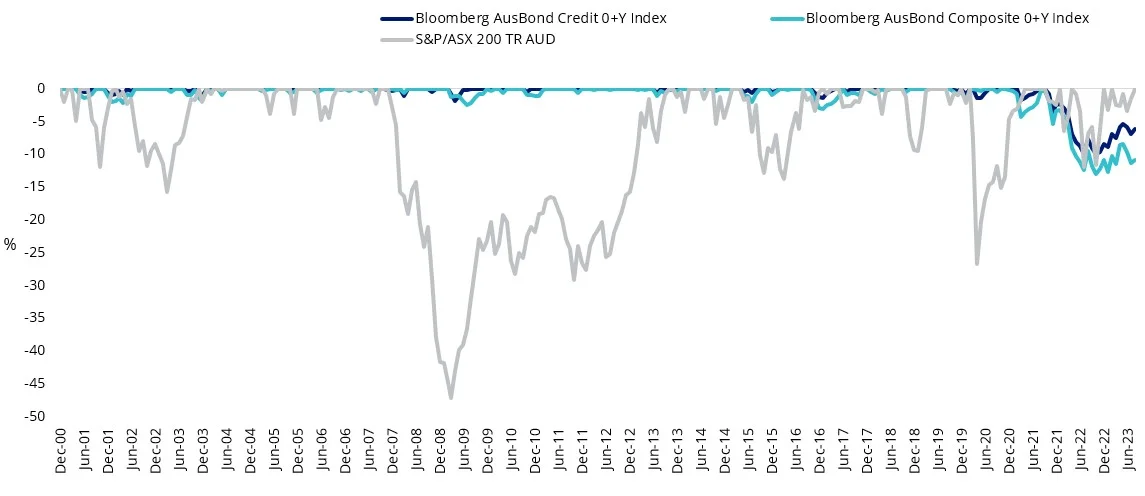

Chart 1: Drawdown: Equities and bonds

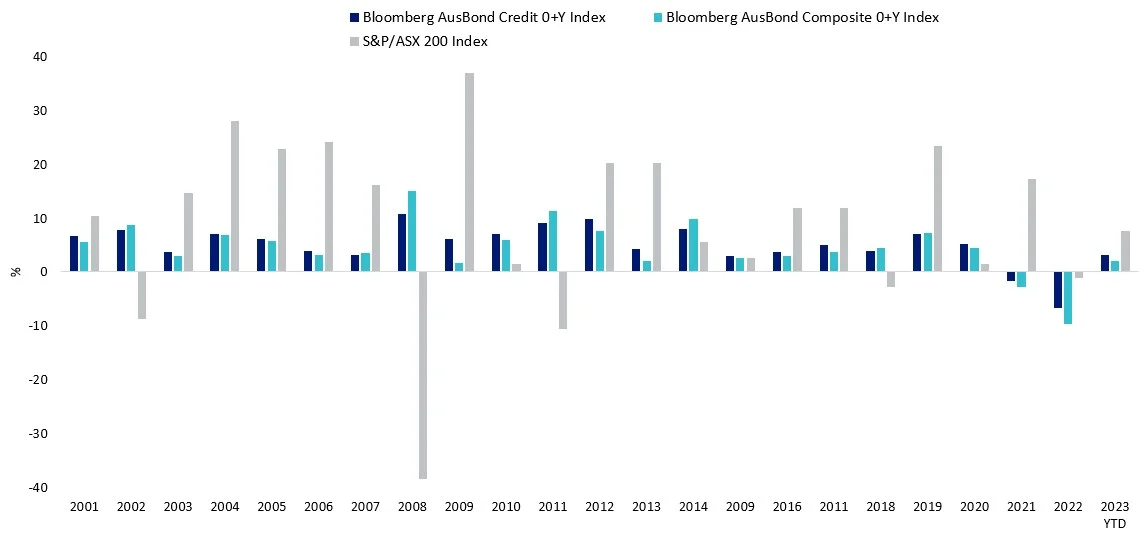

Chart 2: Calendar year returns for Australian equities and bonds

Chart 1 and 2 source: Morningstar Direct, to 31 July 2023. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

The exception, you can see, was 2022, which was the worst year for Australian bonds on record. Like so many asset classes, that were highly correlated on the way up remained highly correlated on the way down.

This was problematic for income investors, who a couple of decades ago could rely on reasonable current income to mitigate price losses when yields were rising, quickly discovered in this environment, yields could not mitigate the unprecedented price falls of the government heavy Bloomberg AusBond Composite Index.

The difference between the price losses and the income we call ‘carry’. Carry usually provides a cushion, at the start of 2022 it did not. We think it does now. In addition, we think, as rates have ‘normalised’ equities and bonds may have re-established their previous relationship, that led investors to use bonds as an income/capital-preservation sleeve while equities and other asset classes were used for growth.

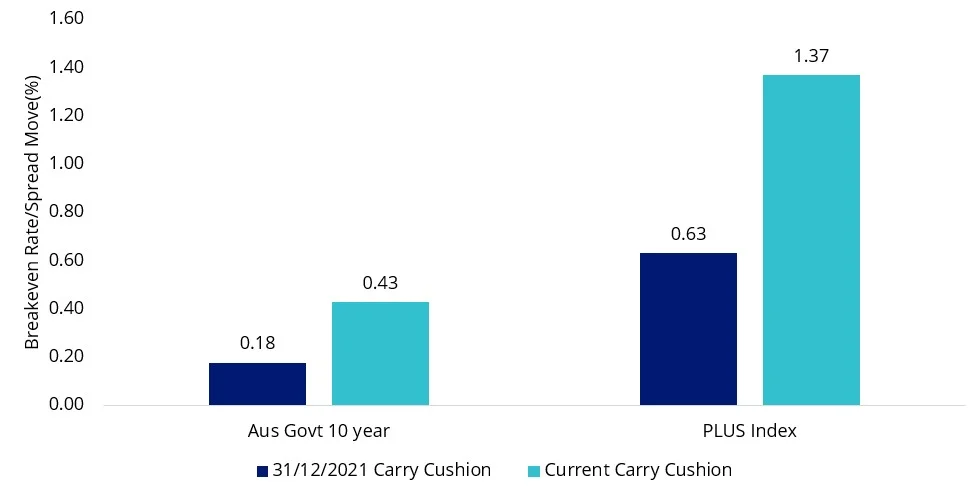

Remember, at the start of 2022 when Australian 10-year government bonds were yielding 1.60% (as of 31 December 2021), not only was the interest income negligible, but it was also only enough to absorb a 0.18% rise in yield over the next 12 months before an investor was underwater on a total return basis.

Chart 3: Australian Government Bond 10 Year Yield

Source: Bloomberg, 31 July 2023

The rises in yields and spreads over the past 18 months have been higher by several orders of magnitude, and capital losses, particularly in 2022 were severe, by bond standards. Now the Australian Government Bond 10 Year has risen beyond 3.98% and this was reflected in the returns of Australian bonds.

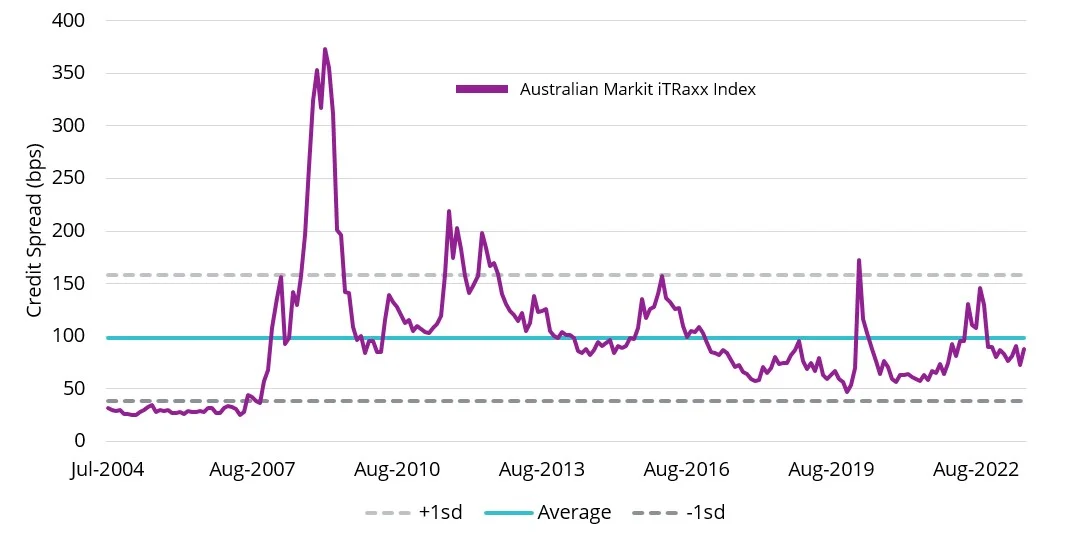

The silver lining is that now the yield on bonds is closer to, or in some instances higher, than the rates at the long end of the curve. Another positive is that the price of incremental risk of rate rises in fixed-income markets has de-compressed. More specifically, as credit spreads have also widened, there is a greater magnitude for income the further out the credit risk curve one goes. All without going way up the risk curve for income.

The spreads on corporate bonds, while they have come back, are still wide.

Chart 4: Credit spreads in the Australian market

Source: Bloomberg, 31 July 2023

The combination of wide spreads and the fallen prices means that ‘carry’ is once again providing fixed-income investors a cushion. The income earned on the current 10-year Australian Government bond note provides a return buffer that would allow investors to break even, even if the yield increases by 43 bps to 4.41% over the next year.

For high-yielding corporate bonds, the carry is higher

The yield at which investors in VanEck Australian Corporate Bond Plus ETF (PLUS) would break even in 12-months’ time is about 7.09%, or 137 basis points above where it stands today. In other words, rates would have to rise nearly 1.40% the next twelve months for the total return of PLUS to be below zero. The market is barely pricing in any more local rate rises.

Chart 5: The higher carry provides a greater cushion against higher yields

Source: Bloomberg, S&P, as at 8 August 2023. PLUS Index is represented by iBoxx AUD Corporates Yield Plus Mid Price Index. You cannot invest in an index.

With equity markets in a state of uncertainty, given fears of recession and earnings pressures, now could be the time for income-conscious investors to reallocate back to bonds. In particular, higher-yielding corporate bonds.

Bonds are back and one way to gain access to a portfolio of the highest-yielding investment-grade corporate bonds is via PLUS.

Investment-grade, short-dated over long-dated securities

The VanEck Australian Corporate Bond Plus ETF (PLUS) provides a diversified, investment-grade credit exposure but features a shorter duration than the AusBond Composite.

PLUS had an average modified duration of 4.01 as at 31 July 2023 compared to 5.12 years for the AusBond Composite.

Not only that, its average yield to maturity of 5.88% as at 31 July 2023, compared to 4.26% for the benchmark.

Currently, PLUS holds only investment-grade bonds and has an average credit rating of A-. You can learn more about PLUS here.

Key risks

An investment in the ETF carries risks associated with: bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 17 August 2023

IMPORTANT NOTICE

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.