Expert’s choice: Hybrids

Like Australian hybrids? Try global hybrids.

Global fixed income and credit markets have had a historically weak 12 months of performance as surging inflation has seen global central banks make fast paced globally coordinated rate hikes. The performance of global bank hybrids has also been negatively impacted.

This underperformance of global bank hybrids has opened up an opportunity for active investors to capture much higher yields, particularly when compared with ASX hybrids.

Currently the Yield1(AUD hedged) on hybrids issued by highly rated European and U.S. banks ranges from 7.2% to 11.2%, which is 2-3% higher than Australian Major bank hybrids2.

The total return for the 12 months to October 2022 for the Global Contingent Convertible securities index (CoCos) (AUD hedged) was -15.6%. The average price for the securities in the index has fallen to $85. In contrast, ASX listed bank hybrids have been relatively stable, returning 1.7% over the same time period and are trading at an average price of $102.

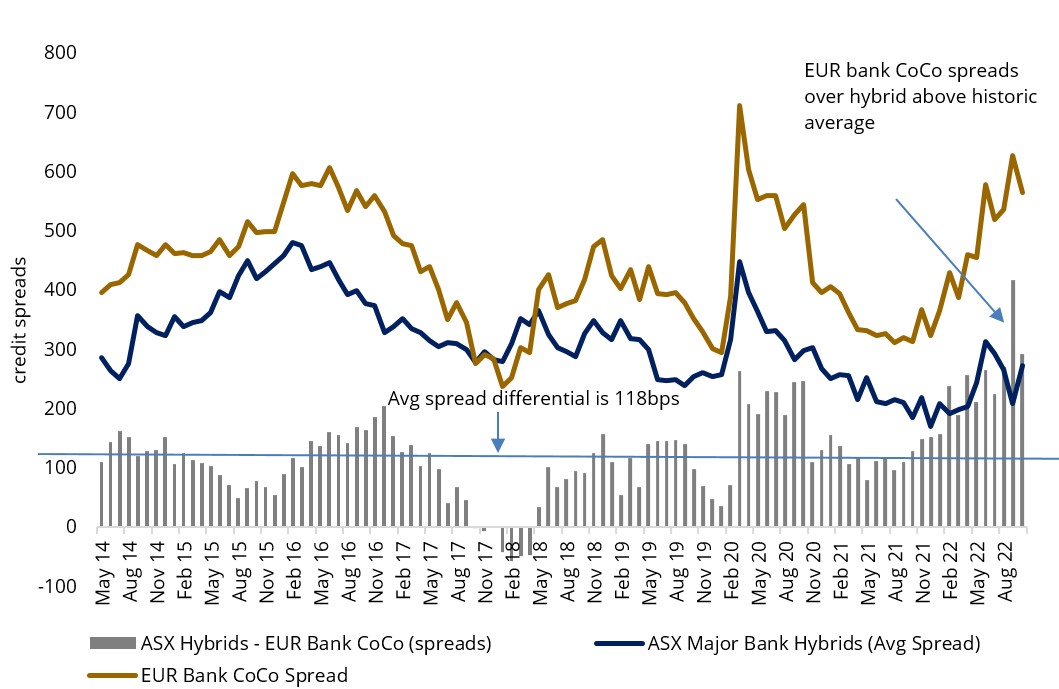

The relative value of offshore hybrids has increased

ASX Major Bank Hybrids vs EUR Additional Tier 1: Credit Spreads

Sources: Bloomberg, Bentham up until 31 Oct 2022. ASX Major Hybrids represented as an equal weight index.

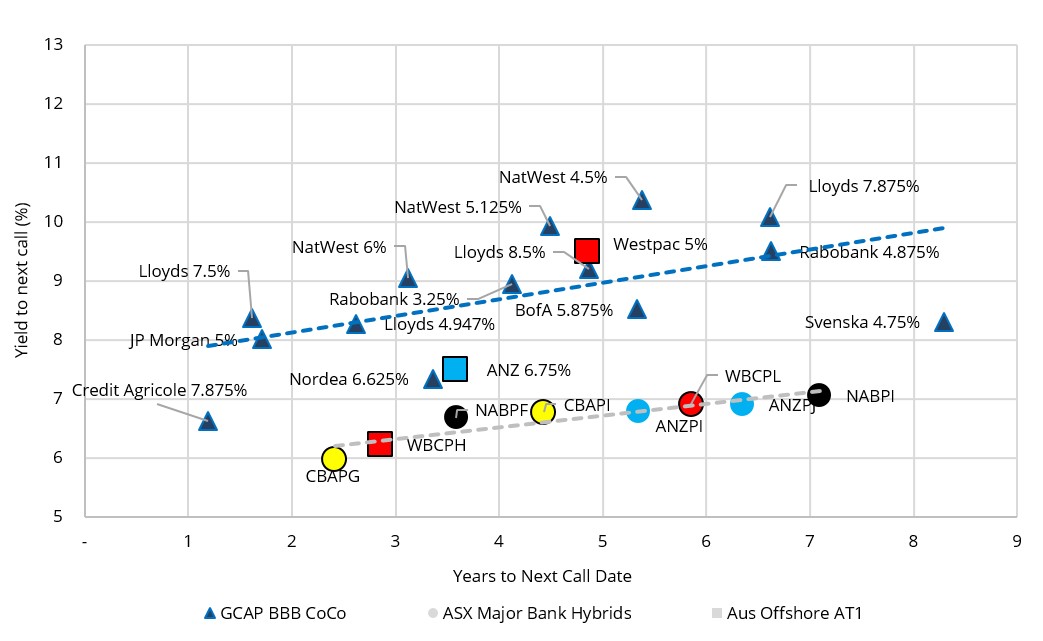

Similar credit risk2, but higher yields

The financial strength of Australian banks is well known by Australian investors who are comfortable in retaining an exposure to ASX hybrids. We believe that this comfort has driven Australian Major Bank ASX hybrids to currently trade at low Credit Margins by global standards. Reflective of this relative mispricing, Australia’s major banks also issue non-AUD hybrids to global institutional investors, which are currently trading at higher yields than the comparable ASX securities.

These non-AUD securities trade in credit markets alongside hybrids issued by other highly rated global banks such as; BNP Paribas, JP Morgan and Rabobank. These securities have a comparable credit risk2to ASX major bank hybrids but provide higher credit spreads or risk premia over benchmark yields.

As with all hybrids, security terms are important to security selection. There are some modest structural differences between the ASX Hybrids and the global hybrids. The impact primarily revolves around greater uncertainty of when the notes will be repaid. Even after taking this into account, we believe the additional yield from global securities more than compensates for this extra risk.

More yield in global hybrids for comparable credit risk

Yield to Call: GCAP BBB Securities vs ASX Major Bank Hybrids

Source: ASX, Bloomberg, Bentham as at 16-Nov-22.

Extension risk arrives down-under

A key investment risk in all bank hybrids is that they do not have a fixed maturity date and may not be redeemed at the next relevant call date. This risk is referred to as ‘extension risk’, and factors that contribute to this risk include the strength of the issuer, regulatory rules, and financial market conditions at the call date. Analysis of individual security terms are also important as to whether investors are compensated for this risk.

Until now, investors in Australian Major bank capital securities were largely immune to this risk because Australian Major banks routinely repaid capital securities at the first call date. These repayments have occurred even when the newly issued security was more expensive than keeping the existing securities outstanding. This expectation “of always calling” is partly the reason why Australian bank capital securities often trade at lower credit spreads than securities from some similarly rated European and U.S banks, who have on occasion deferred repaying a hybrid if it is the bank’s short-term interest to do so.

The local regulator, APRA, has recently reminded issuers of the existing prudential standards (APS 111), regarding “expectation on capital calls” (1st Nov 2022). These guidelines indicate that Australian banks “should not call an Additional Tier 1 Capital or Tier 2 Capital instrument and replace it with an instrument with a higher credit spread or that is otherwise more expensive” unless certain conditions are satisfied.

We believe extension risk is currently not adequately priced for ASX hybrids, particularly for securities with low reset spreads (margins). These guidelines, if followed, are also poised to increase the price volatility of ASX bank hybrids overtime.

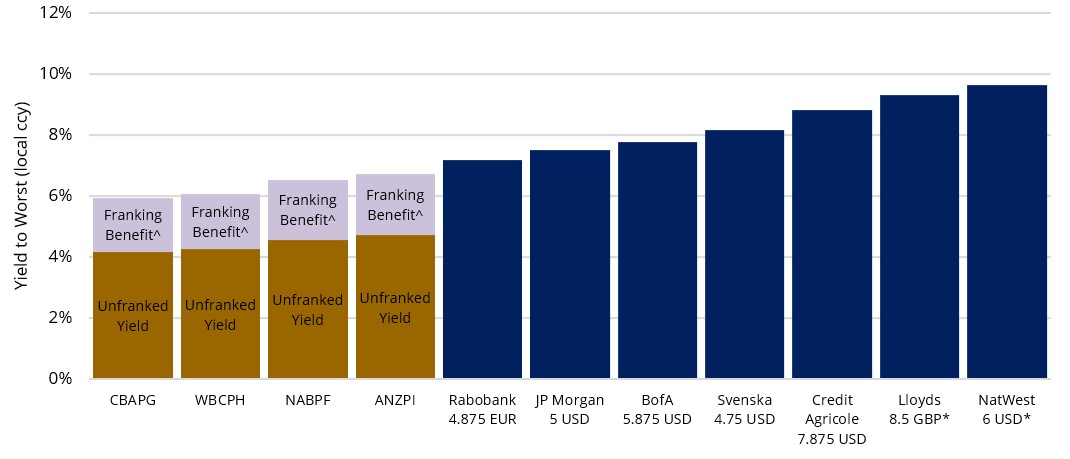

Below we compare yield to worst3on a selection of securities. This provides a guide to the worst-case scenario of yields on a selection of securities with a call date. Again, when comparing the lowest yield – either to maturity or the call date, the ASX listed securities often have far lower yields.

Yield Comparison of Select BBB rated Global CoCos vs Selected ASX Major Bank Hybrids

Source: ASX, Bloomberg, Bentham as at 16-Nov-22.*These issues have investment grade ratings from Moody's and Fitch but sub investment grade ratings from S&P.^Assumes full franking credit benefit.

How to access the global hybrid market

VanEck Bentham Global Capital Securities Active ETF (Managed Fund) (GCAP) is an ASX listed ETF that provides exposure to primarily domestically and globally systemically important banks4. It is managed by Bentham who has 19 years’ experience in this market, and invests actively in this segment via their multi-sector credit funds.

To access the Australian bank hybrid market retail investors can either buy the securities on the ASX or get exposure through a managed fund. The securities GCAP generally buys are only available via the over the counter to the institutional market. GCAP fund is available on the ASX providing local investors access to international capital markets. The securities are also in a foreign currency. GCAP hedges these investments back into AUD.

What are capital securities? They are commonly called hybrid securities in Australia.

Purpose – Banks issue capital securities to meet regulatory capital standards. These are issued in addition to common equity to help ensure a bank has sufficient capital to absorb losses and protect senior creditors

Issuers - Banks and insurers issue for the purpose of satisfying their regulatory capital requirements

Income – Typically capital securities have greater stability in coupon payments than ordinary bank dividends

Capital repayment - Repayment of principal at a future call or maturity date, subject to regulatory approval. The maturity risk is they are never redeemed or are converted into equity

Risk - Designed to absorb losses in periods of severe financial stress

Liquidity – Capital securities are mostly traded globally by institutional investors in generally liquid markets

Credit ratings - Vast majority of capital securities market is rated by major credit rating agencies e.g. S&P, Moody’s or Fitch

Regulatory status – Bank capital is classified as either tier one or tier two capital:

- Tier one securities are referred to Additional Tier 1 capital or AT1. Issues from European and Asian Banks are often referred to as “CoCos” – short for contingent capital securities. In the U.S they are often referred to as “prefs” – short for preference shares. These securities rank ahead of common equity in liquidations but behind other creditors

- Tier two securities are often referred to as subordinated debt. These rank senior to preference shares of a bank (tier one) but are subordinated to senior creditors

Key risks

An investment in the Fund carries risks associated with: subordination in the capital structure, derivatives, bond markets generally, interest rate movements, currency hedging, below Investment Grade securities, country and issuer concentration, liquidity, and issuer default. See the PDS for details.

1yield to worse in local currency terms

2Similar credit risk: The stand-alone credit ratings of the major Australian banks and the major international banks in the chart on page 2 are within 0-2 notches of each other depending on the rating agency. There are differences in the terms of the capital securities but they sit in the same part of the capital structure as going concern capital. Most of the ASX Major Bank hybrids are not externally rated. Our assumption is that ASX Major Bank hybrids would be rated BBB-, which is in line with their USD issuance rated Baa2/BBB-.

3Yield to worst or YTW. Is the lowest possible yield on a callable security without defaulting. For example, the yield to maturity or even perpetuity may be lower than the yield to the next call date and vice versa

4Note some securities in the portfolio will carry sub-investment grade ratings and a moderate amount of securities held are issued by corporations rather than financial institutions

Published: 29 November 2022

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.