Much ado about hybrids

The yield for global capital securities has increased as both interest rates and credit spreads have increased over the past year. Meanwhile, Australian bank hybrids have been relatively stable resulting in their yields lagging the increases in globally comparable securities.

To date, the global capital securities market has received very little attention by Australian income investors with so much focus on ASX hybrids. This may be set to shift as the current spreads offshore are attractive relative to the Australian alternatives.

While Australia may not face an energy crisis like Europe, Australian banks are not immune from the increased economic risk posed by higher inflation and geopolitical risks. Australian banks are susceptible because Australia’s households are highly geared and leveraged to the property market.

The increased yield differential offers a timely opportunity to switch from ASX hybrids to global hybrids, or to start using global hybrids instead of ASX hybrids. Potentially, ASX hybrids, with less trade liquidity, could suffer a large jump or fall in valuations.

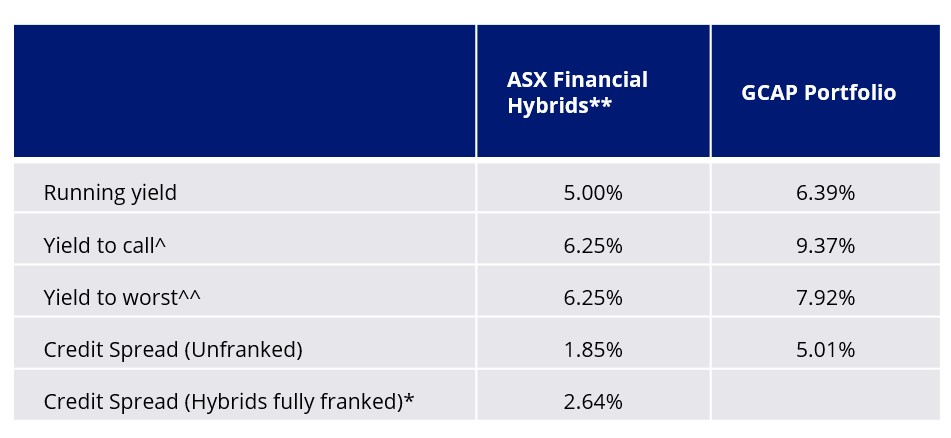

The VanEck Bentham Global Capital Securities Active ETF (Managed Fund) (ASX:GCAP) primarily has an exposure to hybrids issued by globally systemically important banks, which to date are well capitalised and provisioned for a downturn. GCAP’s yield to call (9.37%) is well over Australian bank hybrids including franking (6.25% YTC) despite its similar credit profile.

ASX hybrids look expensive

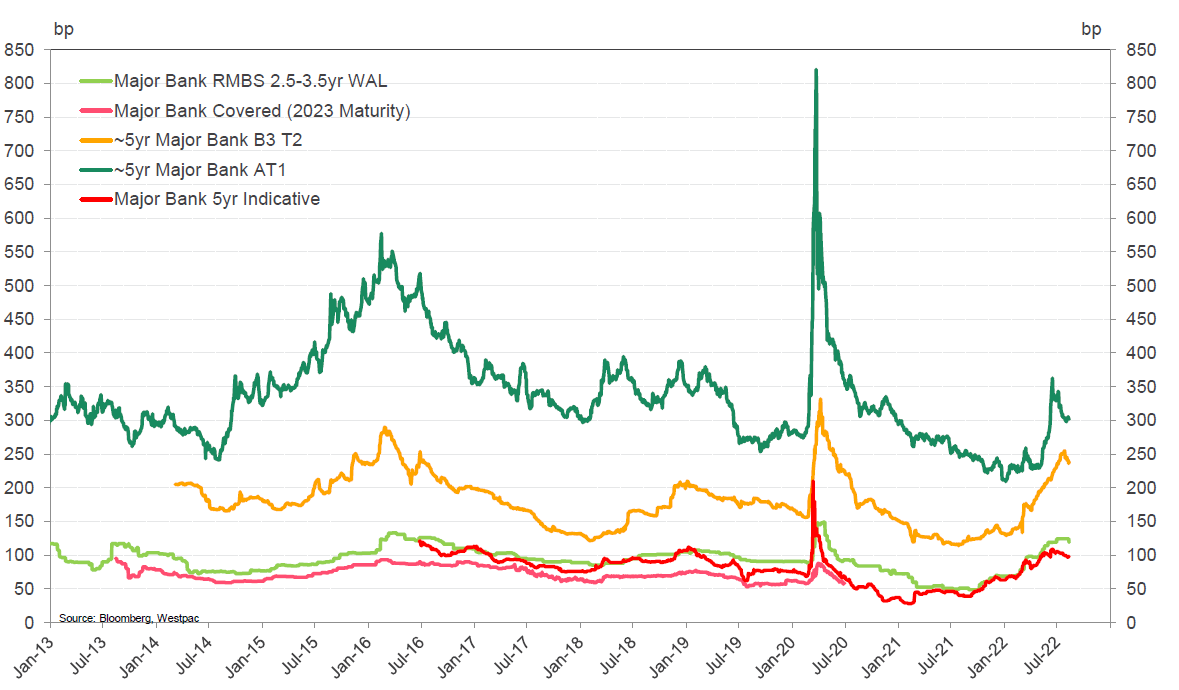

While ASX hybrid spreads have retraced, they remain expensive relative to Australian dollar tier 2 subordinated bank debt.

Chart 1: Current Spreads: ASX Hybrids vs AUD Capital stack

Source: Bloomberg, Westpac, as at 25 August 2022.

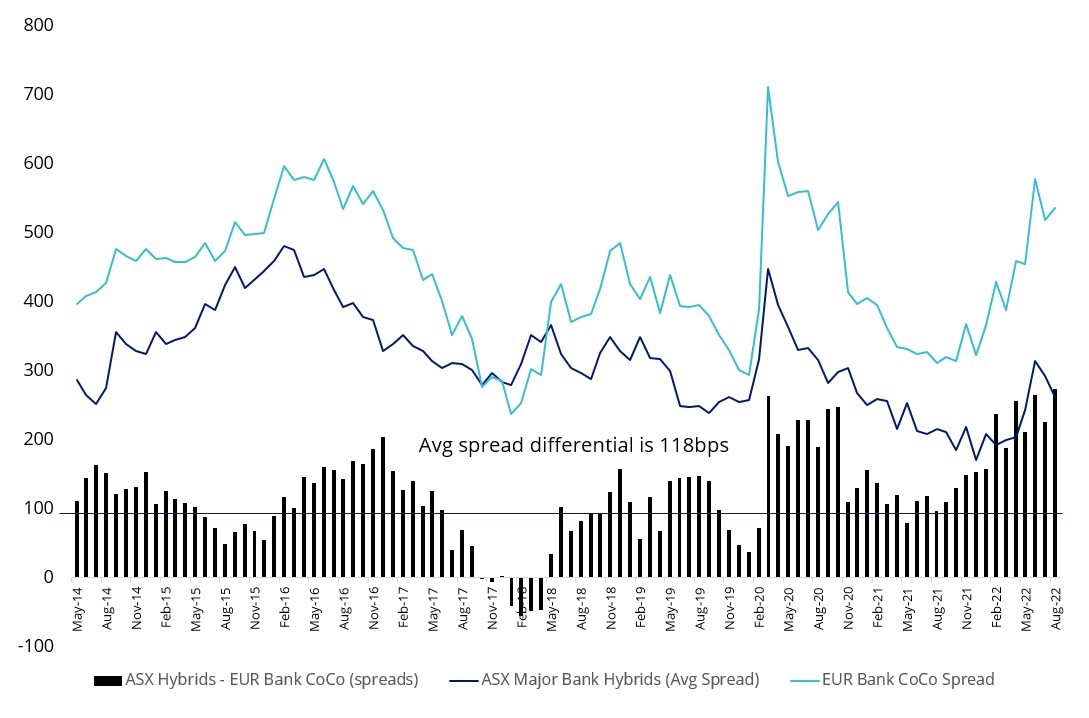

Relative to global peers the spread is well above long term averages. In the chart below, the European Bank CoCo spreads have remained elevated, and current differential with ASX major bank hybrids is well above the long term average.

Chart 2: Credit spreads: ASX Major bank hybrids versus EUR Additional Tier 1

Source: Bentham, Bloomberg

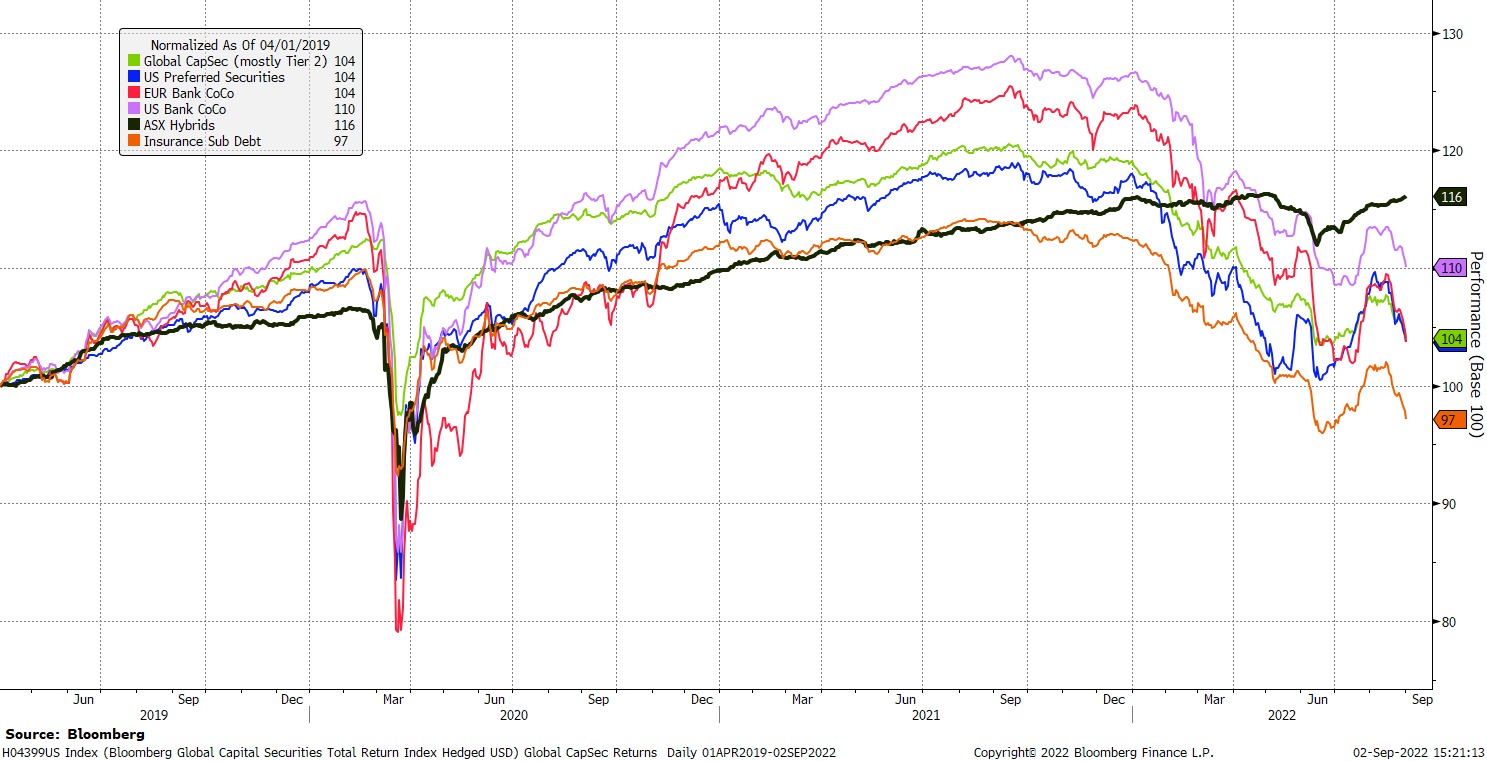

Despite headwinds ASX hybrids have performed well

If some commentators are to be believed, the Australian property market is facing significant headwinds. The impact of this would be detrimental to Australian banks that are heavily reliant on the Australian mortgage market. Many existing borrowers on ultra-low fixed rate mortgages, now approaching the end of their loan term, face sharp increases in repayments. Bad debts are expected to increase.

Chart 3: Up until now ASX hybrids have been immune to economic headwinds

Source: Bloomberg. All returns in Australian dollar. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

Indices used: Global Cap Sec is Bloomberg Global Capital Securities Total Return Index Hedged USD, US Preferred Securities is ICE BofA Fixed Rate Preferred Securities Index, EUR Bank CoCo is Bloomberg Contingent Capital EUR Total Return Index Value Unhedged EUR, US Bank CoCo is Bloomberg Contingent Capital USD Total Return Index Value Unhedged USD, ASX Hybrids is Solactive Australian Hybrid Securities Index (Gross), Insurance Sub Debt is Bloomberg Insurance Subordinate Total Return Index Value Unhedged EUR.

In the face of headwinds investors may look for opportunities elsewhere, and the deeper, more liquid global capital securities market represents a compelling alternative.

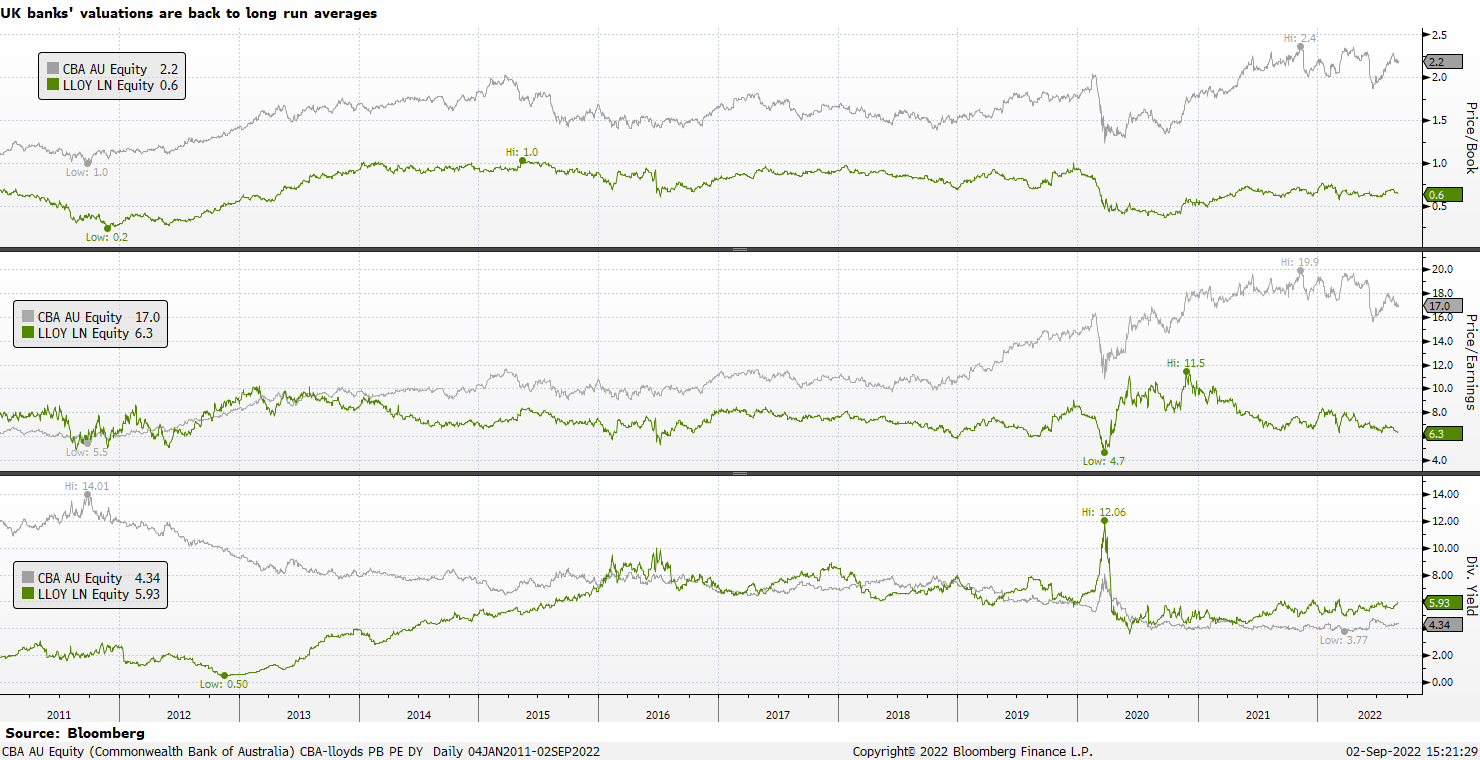

Example: Commonwealth Bank vs Lloyds Bank

Lloyds Bank PLC, which currently enjoys an A+ rating from S&P, compares favourably to Australia’s largest bank, the S&P AA- rated, Commonwealth Bank. You can see in the chart below, CBA’s equity valuation is more expensive and its dividend yield has become lower.

Lloyds Bank PLC, which currently enjoys an A+ rating from S&P, compares favourably to Australia’s largest bank, the S&P AA- rated, Commonwealth Bank. You can see in the chart below, CBA’s equity valuation is more expensive and its dividend yield has become lower.

Favourable yield

The current spreads offshore are attractive relative to the Australian alternatives. It is also worth noting the structural improvement in offshore banks’ balance sheets over the past few years.

In the table below, we compare the yield metrics for VanEck Bentham Global Capital Securities Active ETF (Managed Fund) to ASX Financial Hybrids.

Table 1: Yield comparison

^ Includes franking credit (assuming forward swap rate) for ASX Financial Hybrids

^^ Yield to Worst equals Yield to Call at present for ASX Financial Hybrids

** Market Cap weighted

Diversification benefits

Apart from the yield premium, we believe global hybrids/bank capital securities have a role to play in adding diversification to existing fixed income portfolio allocations because:

- It is a more liquid market, facilitated by the depth and breadth of the global market relative to the Australian hybrid market which is dominated by retail investors;

- Underlying bank fundamentals in key exposures remain stable and will benefit from higher interest rates, whereas the Australian market is more leveraged to the property market (which is currently under pressure) and slower growth in China; and

- Globally, spreads remain elevated, with the differential currently above long-term averages.

Key risks

An investment in the Fund carries risks associated with: subordination in the capital structure, derivatives, bond markets generally, interest rate movements, currency hedging, below Investment Grade securities, country and issuer concentration, liquidity, and issuer default. See the PDS for details.

Published: 06 September 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.