A stellar start to 2023 for global capital securities: Why it could be time to diversify your hybrid strategy

In 2022 Australian investors continued to buy ASX listed hybrids however as yield increased elsewhere, prudent investors started to realise there was better value elsewhere.

Turning to 2023, global capital securities have started the year in stellar fashion, with the VanEck Bentham Global Capital Securities Active ETF (Managed Fund) (ASX: GCAP) returning around 2.75% for the first 20 days of the month.

At the same time, Australian bank hybrids have lagged the rises in globally comparable securities, posting small falls.

While this is only over a short time-period and we would always caution that past performance is not a reliable indicator of future performance, it does highlight the need for geographic diversification within this asset class.

We think this dynamic of gains in global securities outperforming ASX hybrids has scope to continue because of the higher yield offered in offshore markets versus the low spreads in the ASX securities. It could be time to consider diversifying your hybrid strategy.

GCAP primarily has an exposure to hybrids issued by globally systemically important banks (GSIBs), which to date are well capitalised and provisioned for a global downturn.

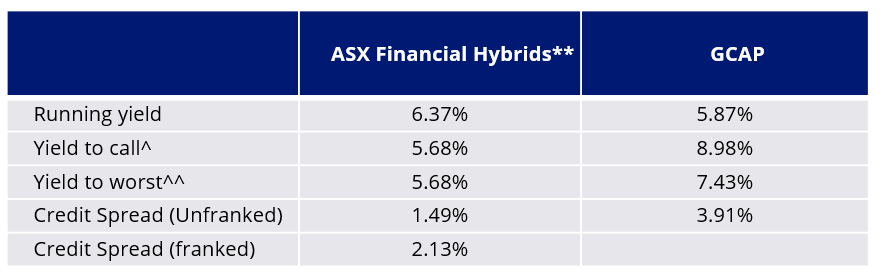

As at 19 January 2023, GCAP’s yield to call was 8.98%. This yield compares favourably to ASX Financial Hybrids which had a yield to call of 5.68% (including franking credits)1.

GCAP offers one trade access on the ASX to a portfolio of global capital securities selected based on a top-down and fundamental credit analysis by Bentham Asset Management who have a 19-year track record in managing this asset class.

Global capital securities start the year well

Global capital securities have been rallying in 2023, outperforming Australian hybrids that have fallen.

There are three key reasons for the rally:

- The economic and energy situation in Europe/UK has been better than originally feared.

- UK and European banks remain well positioned to benefit from higher rates and manage the headwinds.

- Investors are driving demand, with net flows into the space. Technical demand for the sector has improved with net inflows into the space.

In addition to the above, the yield on global capital securities is relatively high.

Favourable yield

In the table below, we compare the yield metrics for the VanEck Bentham Global Capital Securities Active ETF (Managed Fund) and ASX Financial Hybrids.

Table 1: Yield comparison

Source: VanEck, Bentham as at 19 January 2023. Past performance is not indicative of future performance.

^ Includes franking credit (assuming forward swap rate) for ASX Financial Hybrids

^^ Yield to Worst equals Yield to Call at present for ASX Financial Hybrids

** Market Cap weighted

Diversification benefits

Apart from the yield premium we believe global hybrids/bank capital securities have a role to play in adding diversification to existing fixed income portfolio allocations because:

-

- It is a more liquid market, facilitated by the depth and breadth of the global market relative to the Australian hybrid market which is dominated by retail investors;

- Underlying bank fundamentals in key exposures remain stable and will benefit from higher interest rates, whereas the Australian market is more leveraged to the property market (which is currently under pressure) and slower growth in China;

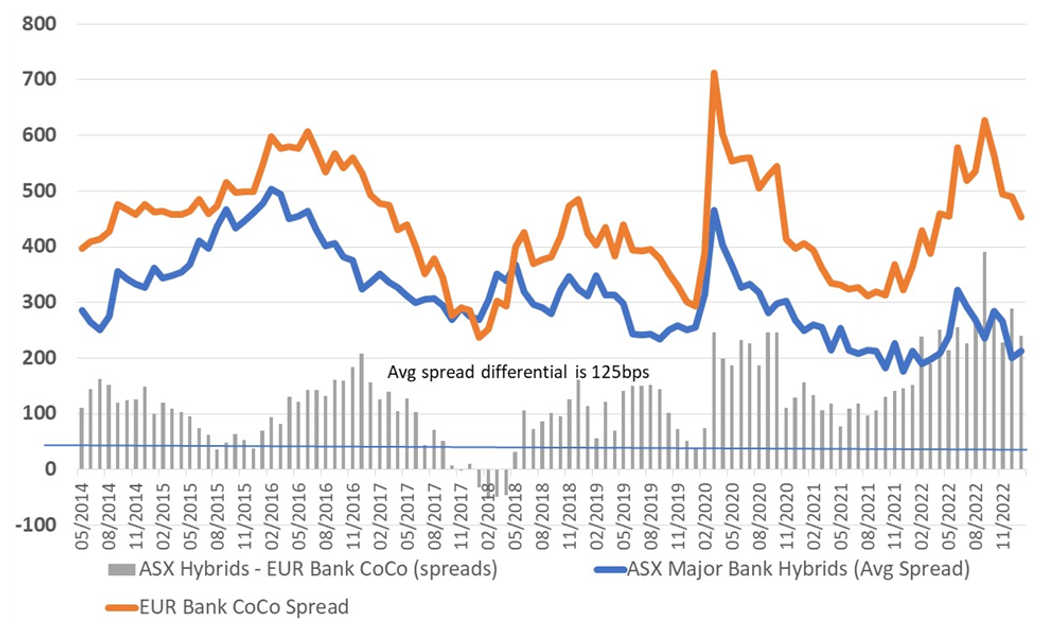

- Globally, spreads remain elevated, with the differential currently above long-term averages; and

- ASX hybrid spreads are near record lows despite concerns surrounding the health of the global economy.

In addition to providing diversification benefits, right now global capital securities look cheaper compared to ASX hybrids.

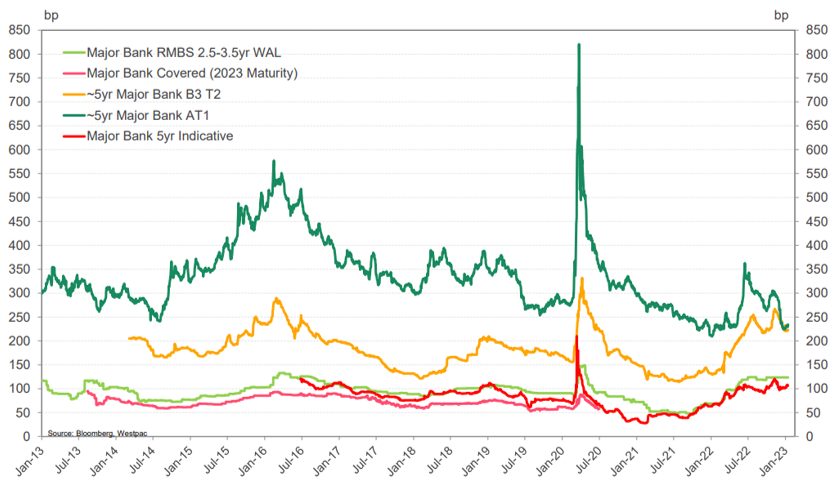

ASX hybrids look expensive

The chart below shows that Major Bank ASX Hybrids spreads are basically flat to Major Bank Tier 2 spreads.

Chart 1: Current Spreads to swap: ASX Hybrids vs AUD Capital stack

Source: Bloomberg, Westpac, as at 16 January 2023

Relative to global peers the spread remains well above long term averages. In the chart below, Relative to European Bank CoCo’s the differential has compressed to around 245 basis points but it is still wide relative to longer term averages. We view global bank capital securities as offering more attractive relative value.

Chart 2: Credit spreads: ASX Major bank hybrids versus EUR Additional Tier 1

Source: Bentham, Bloomberg, as at 19 January 2023

The current spreads offshore are attractive relative to the Australian alternatives. It is also worth noting the structural improvement in offshore banks’ balance sheets over the past few years.

The VanEck Bentham Global Capital Securities Active ETF (Managed Fund) (ASX: GCAP) is an ETF that gives Australian investors the ability to access this opportunity and to diversify their hybrids exposure internationally via a single trade on ASX.

VanEck Bentham Global Capital Securities Active ETF (Managed Fund) (ASX: GCAP)

GCAP is an actively managed high conviction portfolio of global capital securities selected based on a top-down and fundamental credit analysis by Bentham who have a 19-year track record in managing this asset class.

|

|

|

|

Australian first |

The first active global capital securities ETF on ASX. |

|

Global income opportunity

|

GCAP offers an opportunity for investors to diversify their income away from Australian exposures by harnessing a deep and sizeable global universe. GCAP is AUD hedged. |

|

Actively managed by Bentham Asset Management – a leading credit specialist with significant global experience |

The strategy is professionally managed by Bentham Asset Management, a leading and award-winning global credit specialist with a proven track-record and strong pedigree in credit investing. |

|

Fundamental high conviction exposure |

A high conviction portfolio selected on the basis of top-down and fundamental credit analysis. |

|

Dividend frequency |

Monthly. |

For more information on GCAP please contact me or visit our website here.

For large trade execution please contact our Capital Markets desk on 02 8038 3317.

Key risks

An investment in the Fund carries risks associated with: subordination in the capital structure, derivatives, bond markets generally, interest rate movements, currency hedging, below Investment Grade securities, country and issuer concentration, liquidity, and issuer default. See the PDS for details.

Published: 08 February 2023

1 – Market capitalisation weighted

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (‘VanEck’) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.