Infrastructure advances in a high-inflation environment

2022 has not been the best year for equity investors thus far. We are experiencing a rising rate environment which leads to company valuation re-rating, compounded by the uncertainty of debt serviceability. However, infrastructure assets, including transport, utilities and telecom towers have been resilient.

2022 has not been the best year for equity investors thus far. We are experiencing a rising rate environment which leads to company valuation re-rating, compounded by the uncertainty of debt serviceability.

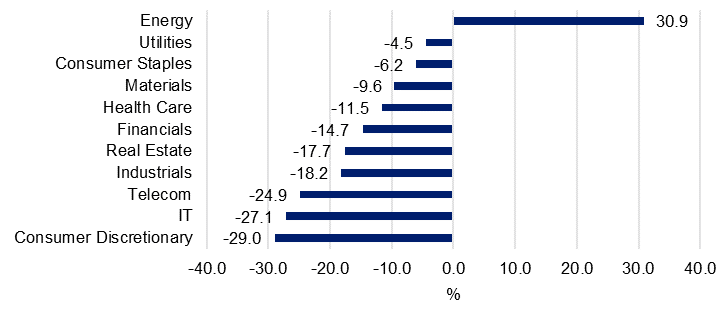

Chart 1: Broad sector returns YTD

Source: Bloomberg as at 13 May 2022. Sectors are represented by the MSCI World sector indices.

Infrastructure assets, including transport, utilities and telecom towers have been resilient in such climate. There are two perspectives to infrastructure, the ability to adjust prices based on inflation (i.e. inflation-linked revenue) and the capital expenditure which requires borrowing in a rising rate environment.

Utilities (including electric, multi, gas and water)

- Suppliers of electricity, gas and water have the greatest ability to pass through inflation costs as most of their pricing is locked up in regulation. These agreements set up a regulated charge that adjusts based on published CPI data. However, certain jurisdictions also have utility trading mechanisms which can allow the market to set the rate within set parameters, however there is no solid information to suggest that this would stop rising utility prices in an inflationary environment. This means that they can adjust for the rate of inflation but they cannot significantly increase prices.

- Utilities generally have long term capital expenditure in place with long term borrowing capacity which would be hedged on the currency front and on interest rates. The only companies that would need to refinance or seek new capital would be undertaking large scale new development. As a listed company they are all able to source equity capital if the current interest rate curve is not desirable.

Airport services

- Covid has changed the dynamic of the airport business as they earn revenue from management of airports like runways, taxiways, retail and also from passenger levies. The levies charged are generally part regulated and part negotiated contract with the airlines. The passenger levy side of the business operates similar to regulated utility in that it can raise prices if CPI increases.

- As airports recover from the hard hit they took during covid lockdowns across the world, anyreturn to previous pre-Covid passenger numbers would dramatically increase the profitability of the airports.

Railroads (toll roads)

- These privately owned toll roads have generally entered into a concession agreement with the local government to charge and collect a toll for a prescribed period of time. The contract will also spell out toll increases and a frequency schedule, such as quarterly or annually.

- They are all able to adjust prices based on CPI within a short window of time with minimal lag. As tolls roads become electronic payments there is evidence to suggest that prices have raised more quickly hence the ability to act more nimbly.

- Most of the capital expenditure on a toll road has been financed up front for the building phase and the tolls help pay back the financing and generate profit. Once again like utilities, much of the existing financing is hedged and any new capital expenditure has access to equity financing.

Pipelines

- Like the other industries listed here, the transport of oil and gas is a contracted service which will bake in CPI rises into the contract to transport the oil and gas. The pipelines are less likely to be heavily regulated like the above industries and therefore can have a greater ability to increase profits in this scenario. Many of the contracts also include a measure of the underlying oil or gas price, which currently has caused the largest growth area in the portfolio as they’re linked to the underlying energy price. This is both a good and bad thing as prices can fluctuate based on the underlying energy price.

- From a capital expenditure point of view, the ability to refinance and seek capital outside of equity raising will be somewhat more expensive than a regulated body and will be partly determined by the energy pricing. There is potential greater risk for this type of company’s performance as it is linked to external energy pricing mechanisms.

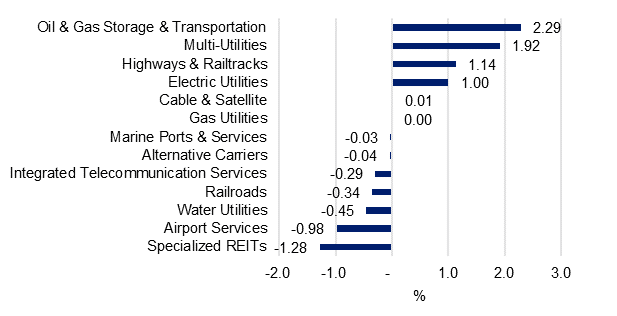

In the below graph we show how various infrastructure assets have performed this year in terms of contribution to the VanEck FTSE Global Infrastructure (Hedged) ETF (IFRA).

Chart 2: YTD contribution to returns

Source: Bloomberg as at 13 May 2022. Past performance is not indicative of future performance.

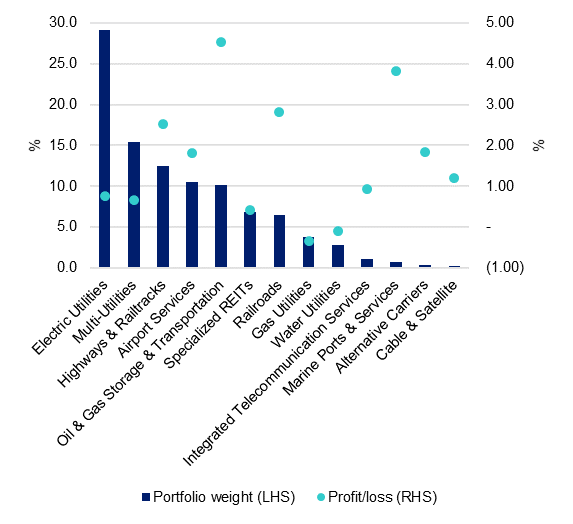

Due to the defensive nature of infrastructure assets, they are more likely to outperform other asset classes in an inflationary environment. The graph below shows the scenario of the portfolio performance with a 100bps rate hike, all subsectors in the IFRA portfolio would generate positive returns except water and gas utilities.

Chart 3: Scenario of +100bps Interest Rate Move

Source: Bloomberg, VanEck as at 13 May 2022

You can learn more about IFRA here.

Key risks

An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, currency hedging, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 20 May 2022